XRP price for today is $0.4386 with a 24-hour trading volume of $3,109,498,828 USD. Price is up 6.9% in the last 24 hours. It has a circulating supply of 42.1 Billion coins and a max supply of 100 Billion coins. ROI on XRP is 7,367.24%. XRP/USD hit $0.4470 during early Asian hours amid strong rally supported by positive fundamentals., it is still nearly 5% higher than this time on Monday.

Ripple’s technical Analysis:

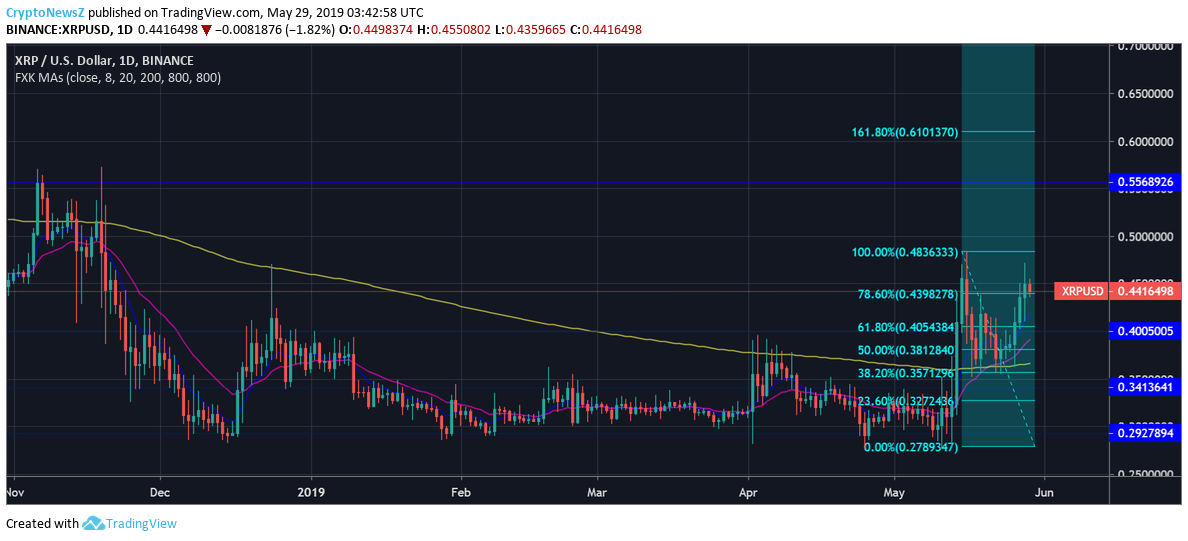

XRP / USD Mid-term price analysis (1Day)

The strong support for the coin lies with the psychological level $0.35, strengthened by 38.2% Fibonacci level. The price has already rebounded twice on that level and its acting as strong support. Moreover its also above 200 MA (yellow line). Also, a significant barrier is created by $0.3600 area that stopped the decline twice since the middle of May.

On the upside, a sustainable move above $0.4400 (78.6% fib level) will open up the way to high $0.48. A move below this handle will open up the road towards 8 Day MA (blue line) daily at $0.42 and then the bounce will lead to next bullish aim $0.60 (161.8% fib extension), not seen since November 2018.

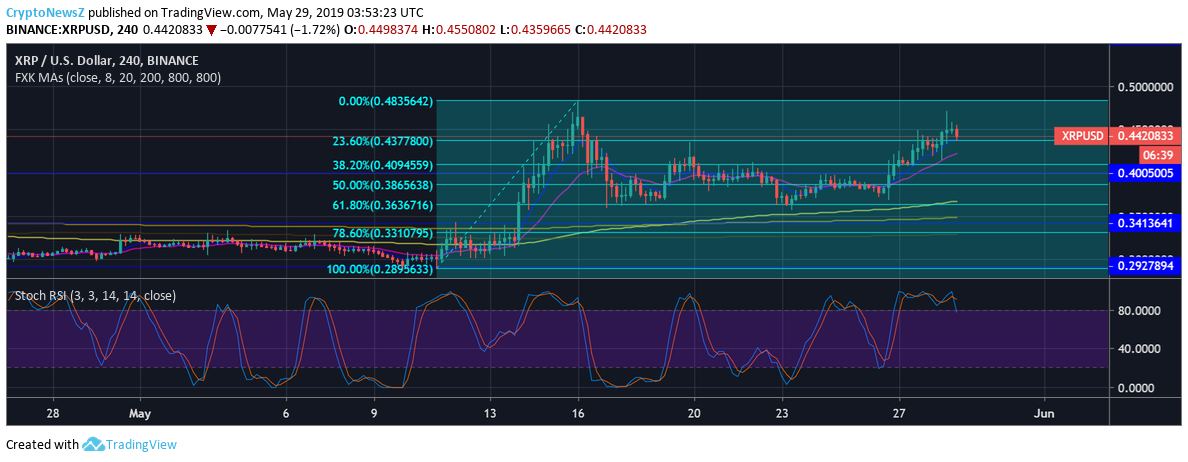

XRP / USD Short-term price analysis (4 hr)

Advertisement

Ripple has a bearish short-term trade bias, with the XRP / USD pair tumbling on the four-hour time frame below its 200-period moving average. The four-hour time frame is showing a good rebound to 61.8% fib level, and price is also above 200 MA and 800 MA.

Technical indicators across the four-hour time frame have turned heavily bullish and continue to signal further. Although the RSI indicator is bearish on the four-hour time frame, it looks like the indicator is attempting to correct from overbought territory.

Fundamental Analysis:

Several negative catalysts have hampered XRP over the past few weeks. CTO David Schwartz sold a share of his tokens, and the company also announced a 31 percent increase in the share of XRP sold compared to the previous quarter. The increased supply of tokens has probably created additional downward pressure on the token price with the current sell-off for altcoins.

Conclusion:

Advertisement

Although Ripple continues to expand its partner network, little information is still available on how the company is progressing with the adoption of xRapid, which directly uses XRP for cross-border payments. The lack of positive news and development in this direction could hurt the project’s value. The XRP / USD pair could see significant medium-term uptrend if the daily time frame confirms the recent bounce on fib levels.