Uniswap is the Ethereum-based decentralized crypto exchange that controls a vast majority of daily trading along with Coinbase and Binance. Users add funds and get trading facilities using a traditional order book system.

The orders of buyers and sellers are known as market depth. To make successful transactions, a buyer needs to match the price of a seller or vice versa. UNI has an automated liquidity control protocol.

Uniswap is an open-source platform that means anyone can copy code and create a new decentralized exchange. It offers to list a token on the exchange free of cost. On the other hand, centralized exchanges charge high fees to list a token in the exchange and are profit-driven businesses.

Uniswap is the 4th largest decentralized finance platform with $3 billion worth of crypto assets. It runs on two smart contracts: Exchange and Factory, which are designed to run specific functions on the platform.

It solves the problem of most decentralized exchanges with an automated liquidity protocol. Uniswap incentivizes the people trading on the exchange to become the liquidity providers, and it pulls their money to create a fund used to execute the trades.

Advertisement

In this way, each of the tokens listed on the platform has its own pool that contributes to maintaining the liquidity on the platform. The prices of the token are matched using an algorithm.

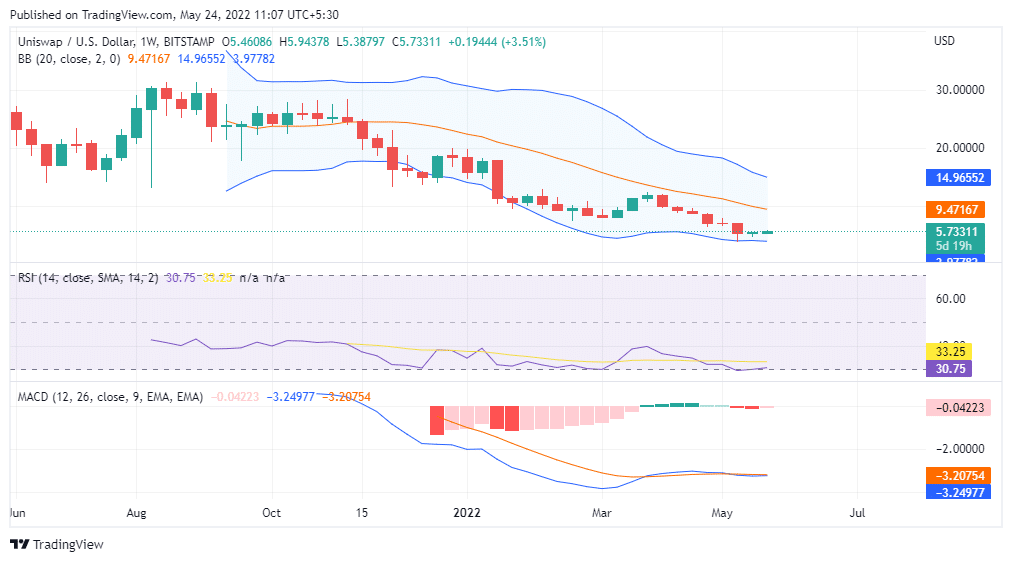

After the US Fed rate hike, crypto markets tumbled. UNI was no different, and it has broken its strong support level of $8 and is trading around $5.7.

Although UNI shows a short-term recovery, it is difficult to predict how long it will sustain. Click here for UNI price predictions to know if the prices pump or dump!

The MACD indicator forms four consecutive green histograms with bullish signs on the daily chart. RSI is also stable at around 44. Daily candles are forming around the middle line of the Bollinger Bands, which suggests short-term bullish momentum in the market.

On the weekly chart, Uniswap has broken the support level of $14 and $7. Now, it may even reach the level of $2.86. So, it will not be the right time to start investing for the long term.

Advertisement

Traders must wait until UNI shows vital signs of recovery and cross the immediate resistance level. Currently, UNI can take the momentum on either side. So you must wait until it shows a clear direction.

However, the crypto market will be volatile this year due to various reasons. Thus, investors must be more careful than before!