Ethereum is one of the popular cryptocurrencies which allows the transaction of digital crypto assets, creation and development of smart contracts, decentralized finance apps, DApps, non-fungible tokens, and many others. Now analysts ask one question, Ethereum is facing an issue with scalability and slow transactions, so in the future, could any of the Ethereum killers replace Ethereum? In this article, you will get a comprehensive answer to this question.

Ethereum is a network that has been upgraded continuously to support its user experience and eco-friendliness. It is getting costlier, which is why investors and developers are looking for an alternative. Some alternatives to these coins, which are known as ETH killers, are Solana, Algorand, Cardano, Polkadot, AAVE, etc. However, we do not think these coins will ever replace the Ethereum mainnet.

ETH Killer: Solana (SOL)

Solana was launched in March 2020, and it offers a high transaction rate which is a drawback of Ethereum. It aims to enhance the compatibility with the Ethereum blockchain so that any ERC-20 token can move between Ethereum and Solana networks.

ETH Killer: DOT (Polkadot)

Polkadot is a decentralized network launched by Parity Labs. It works in a very similar way to Ethereum. It supports decentralized apps, non-fungicidal tokens, and many more. It aims to provide faster and more affordable transactions on the network. The data on the network can be transferred to several blockchains.

ETH Killer: Cardano (ADA)

Advertisement

Cardano runs on a proof of stake consensus like Ethereum 2.0 upgrade. Developers can create customized blockchains and altcoins. Cardano is one of the tough competitors of the Ethereum blockchain, but it does not support decentralized finance applications.

ETH Killer: ALGO (Algorand)

It is a decentralized cryptocurrency that serves various purposes. It is an expendable, safe network for developers. ALGO is the native coin of Algorand, but it is not popular as Ethereum’s other competitors.

ETH Killer: AAVE

It is an alternative to Ethereum for decentralized finance projects. AAVE is an open-source lending protocol that builds on the Ethereum blockchain. It does not have the main net, so it may not replace Ethereum in the future. Besides that, it does not have a wide range of use cases like Ethereum. This lending protocol allows users to borrow crypto from the pool in exchange for interest fees.

Most of the cryptocurrencies do not have strong use cases like Ethereum, and many of them do not have their own main networks. Cardano is a strong competitor of Ethereum, but it does not offer all the services.

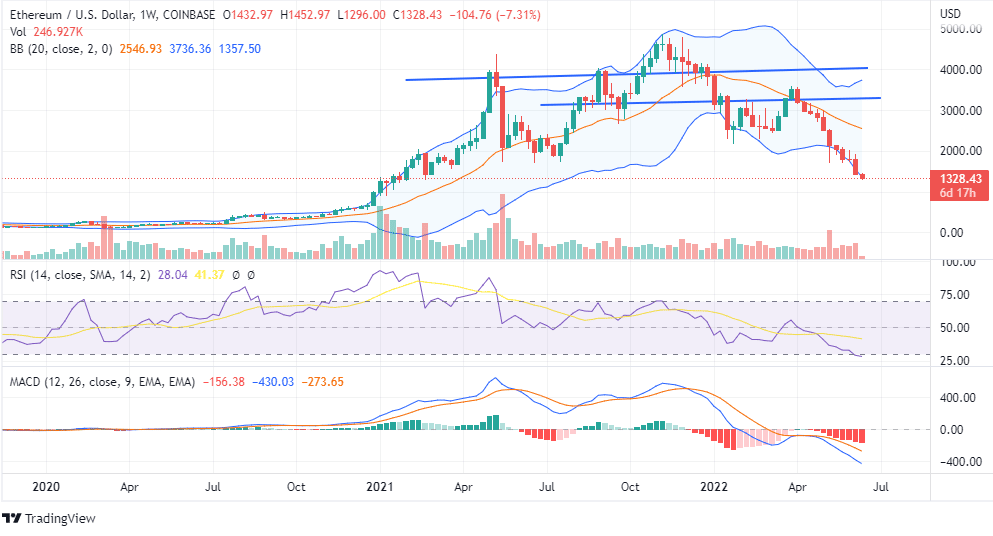

On the long-term chart, though ETH has been forming ten consecutive red candles, it is a crucial time for long-term investors as per our Ethereum projections.

Advertisement

The chart seems like a falling knife, but it is the time when big investors are accumulating for the long term, and after Ethereum 2.0 upgrade, it will skyrocket, and the investors will get the reward for long-term investment.

The Ethereum price chart may not break the level of $1200. It is time to accumulate more ETH coins and hold them for the next five years.