In December, liquidity token-swapping protocol Bancor will conduct a snapshot of the balances of all BNT holders, who will then be airdropped the equivalent of 10% of BNT’s market cap. As a result, millions of dollars will be shared with around 60,000 token-holders. While the value this brings to BNT holders will be easily measurable, the value it brings to the level of liquidity on the Bancor Network will prove even more precious. Virtually overnight, the number of liquidity providers will grow from around 200 to potentially tens of thousands.

Good for Bancor, Good for Defi

Bancor has been enjoying something of a resurgence in 2019 as the decentralized finance wave has latched onto many of the services that the smart token protocol was advancing all the way back in 2017. The defi community is committed to the principles of open finance, built on open source code, and close collaboration to foster a stronger ecosystem. That doesn’t mean that different protocols aren’t in competition with one another, however.

Around $5.8 million of assets are currently locked up in Bancor, according to Defipulse.com. Although rival token swapping protocol Uniswap has greater market share, the two projects are neck and neck in one of the most important metrics of all: number of liquidity providers. Both projects sport a couple of hundred liquidity providers, who earn fees for swaps conducted between ERC20 tokens.

Advertisement

The number of BNT Liquidity Pool providers will rocket upon completion of the airdrop from Bancor’s ETH reserve. This will revitalize the token-swapping protocol, providing an instant liquidity boost, while creating a broad community that is incentivized to facilitate the seamless exchange of digital assets. Should interest in the airdrop prove to be strong, there is reason to believe that Bancor’s model may be emulated by other projects seeking broader community involvement. If that comes to pass, it won’t be the first time Bancor has blazed a trail for the rest of the crypto community to follow.

More Than Just an Airdrop

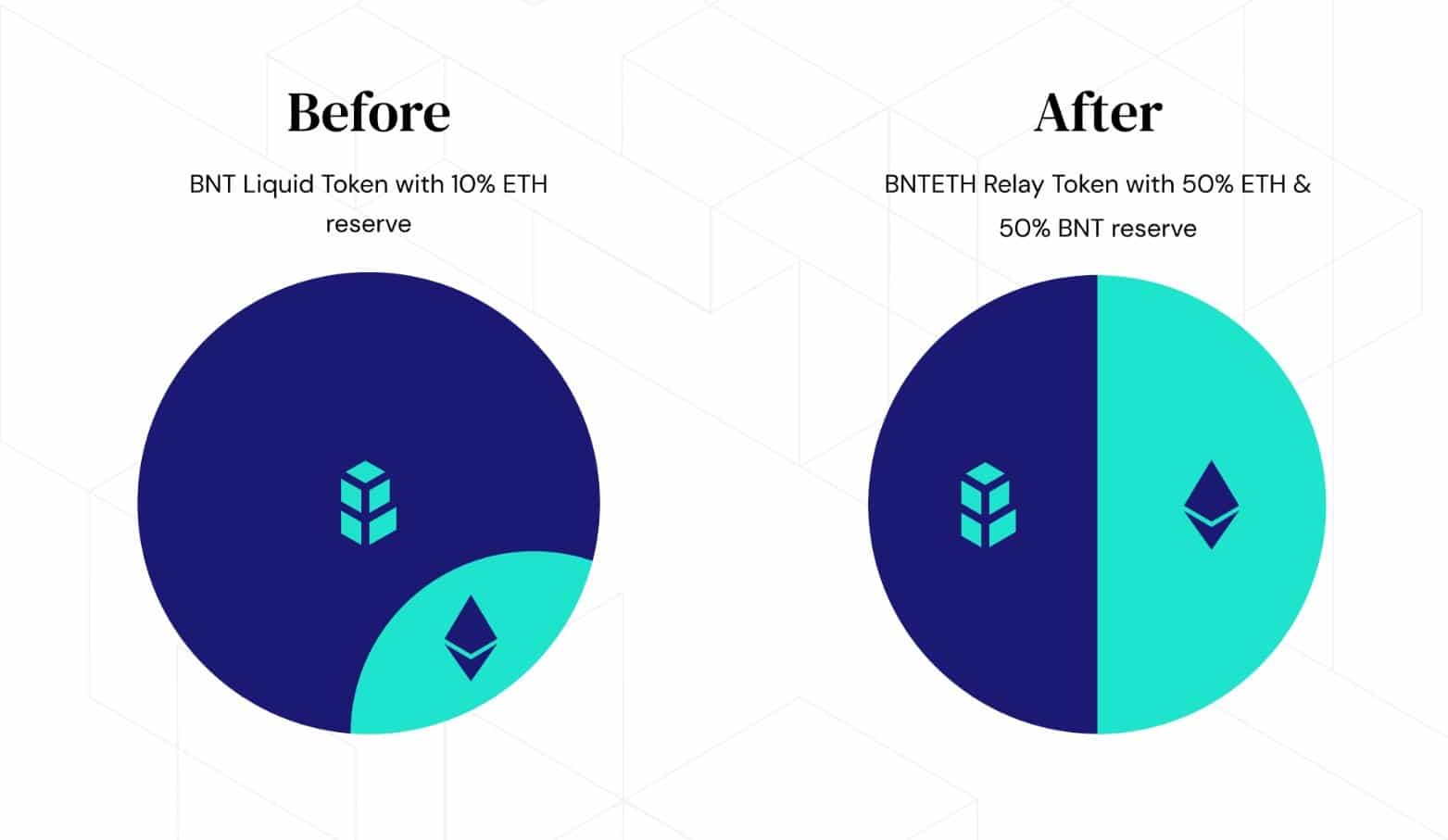

In December, a snapshot of all BNT holders across the EOS and Ethereum blockchains will be taken before a BNTETH relay token is issued, comprising equal parts ETH and BNT. In addition to becoming instant liquidity providers, recipients of the airdrop will be entitled to a share of all fees accrued from ETH conversions on Bancor. Unlike the passive airdrops granted to community members by other crypto projects, Bancor’s has been designed to benefit the project’s goals as much as those of the participants, who have little incentive to instantly dump their tokens on the market.

By way of comparison, Stellar’s XLM airdrop to Blockchain.com wallet owners resulted in the majority of recipients liquidating their free tokens on exchanges. Moreover, only 1.2M of Blockchain.com’s 30-30M addresses bothered to claim the tokens. Despite the total value of Bancor’s airdrop being smaller than Stellar’s, it has been designed with more care, in a bid to closely align incentives between all parties.

Advertisement

In a few weeks’ time, the defi community will be watching closely to see whether Bancor’s airdrop, coupled with its transition to a low inflationary token model, comes to define the future of decentralized lending protocols. You wouldn’t want to bet against it. One thing there’ll be no betting on is the exact date when the airdrop snapshot will occur. To mitigate the possibility of market manipulation, Bancor is remaining tight-lipped about the exact December date. BNT holders will be notified in the aftermath, before BNTETH tokens are deposited into non-custodial wallets, with major custodial wallets and exchanges also expected to support the airdrop.