VeChain was created to solve the biggest challenge in the logistic industry. It helps to keep track of all the goods and finances on a single platform. It was created by Sunny Lu, who was a technology officer in a corporate house in China.

VeChain platform combines a number of modern technologies such as NFC, radio frequency identification, and QR codes. It attached a sensor in every stage of the supply chain to track the system.

Blockchain and smart contract technology observe every stage of the process and notify when something goes wrong. Moreover, no user can change the record. In this way, VeChain adds an extra layer of security, which is necessary for the logistic industry.

The software of VeChain is known as VeThor, which uses Proof of Authority consensus as a primary governance mechanism. It is different from Proof of Work and Proof of Stake consensus because it needs to be authorized by every node in order to access the platform.

Advertisement

It is used by many leading companies in China and Singapore, and some of them are notable companies such as Walmart and BMW.

Interestingly, VeChain has two coins- the primary coin is VET, which is used as a payment currency on the platform. The other coin is VeThor, which can be generated by using VET.

In the last couple of months, the VET price has not performed well for different reasons, but now crypto markets have seen an inflow. Thus, the price may turn bullish.

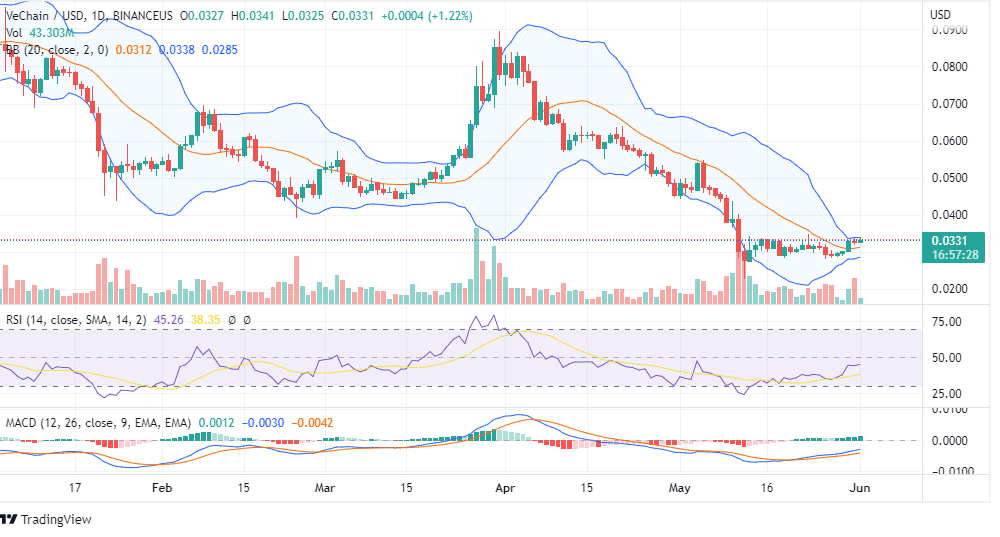

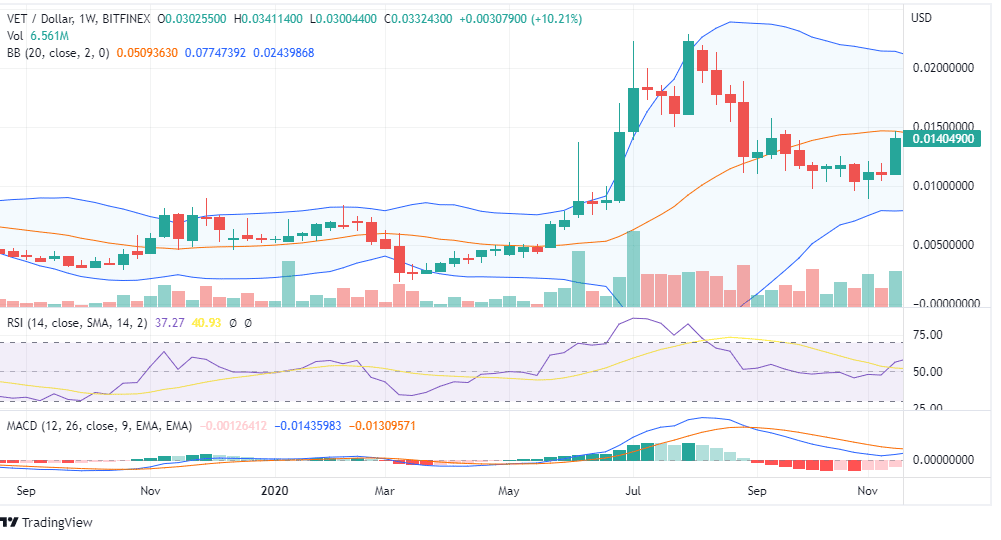

At the time of writing, VET was trading around $0.033. It has been consolidating between a range of $0.045 and $0.085, but it has broken the trend in the second week of May this year. After that, VET is in a downtrend and finds support around $0.027.

On the daily chart, candlesticks are in the upper half of Bollinger Bands but lack volatility. MACD indicator and RSI are also showing positive momentum for the short term.

Is it the right time to invest? Visit here to understand the historical performance and VET price prediction!

Advertisement

VET may break the support of $0.027 in the next couple of weeks due to the current downfall. But, if it turns bullish, it will face resistance at around $0.06.

Most of the technical indicators are neutral, while candlesticks are forming in the lower range of the BB. This means it is not the ideal time to buy VET for the long term. Traders may wait for a few months to get momentum for VeChain. After that, they can invest for the long term.