VeChain was developed as a revolutionary product that met the new-age demand for enterprise-grade smart contracts. VeChain network combines the strengths of distributed networks and IOT to resolve the hurdles posed by globalized industries. The features offered by VeChain make this blockchain capable of handling the higher volumes and complex smart contract requirements for the fourth industrial revolution.

The supply chain is the biggest hurdle of growth in the 21st century, and the outlook cannot be improved without incorporating smart contracts and modern technologies. Its expansion has seen major success in adding high-profile business firms and government bodies for its services.

VET token carries a market capitalization of $1.65 billion, with 72 billion or 84% of the token supply already existing in circulation, creating a sense of higher decentralization on its network. Launching cross-chain NFT platforms and developing strategic partnerships will ease the growth charts for the VET token.

VeChain (VET) Price Analysis

VeChain price action has moved negatively, more so in 2022 than before. The price movement has seen a decline of 72% in just nine months of 2022, which is showing no signs of halting anytime soon.

Advertisement

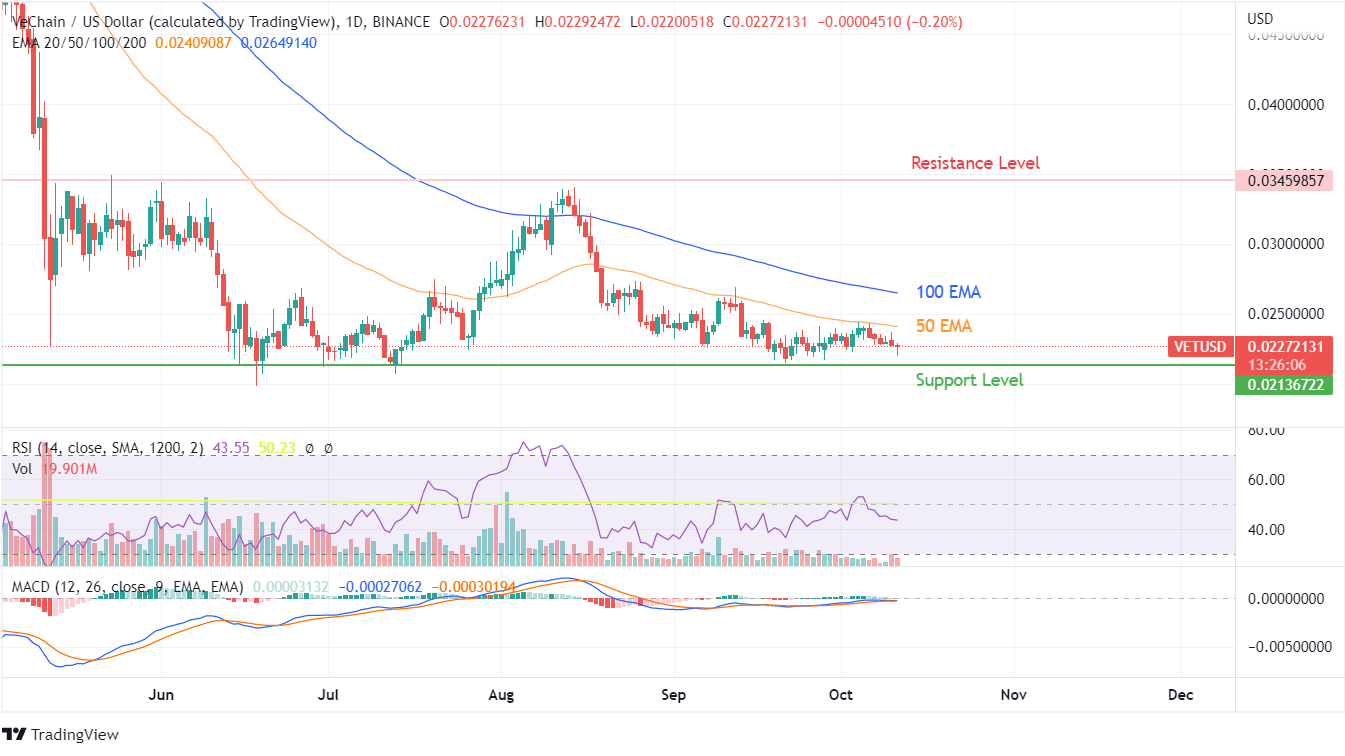

VeChain has found strong support at $0.02 levels, but the buying rallies face just as strong resistances from the $0.035 levels. While the MACD indicator has declined to showcase the suppression of strong buying action, the RSI candle also indicates weakness on short-term resistance from its 50 EMA curve.

Failing to clear such a minor resistance would add more intense pressure on the buyers. A resistance level of $0.035 created stiff profit booking not seen since the decline of May 2022.

The short-term outlook for VeChain is filled with consolidation rejection as per the VET coin price prediction. Considering the global outage in the supply chain industry, the token offers a promising outlook, but it is meant to generate VTHO, which is used for paying gas fees. Despite this minor difference, the price action for VET and VTHO carry a strong resemblance.

The price action of VeChain is undergoing a major transformation as the token is headed toward the pre-2021 breakout levels at $0.0072. Such a decline would bring the VET token a fresh 60% downside.

The technical charts, trendlines, and indicators all project toward a minor consolidation on weekly charts. To turn things around, the token needs to consolidate and break out to trade above $0.035 from its last traded value of $0.022, a 60% upside movement.

Advertisement

The weekly candles have failed to bring the transition excitement seen during the first half of 2021. VeChain transaction volumes are barely a percentage of its glorious highs. Long-term resistance for the VET token is situated at 300% above the LTP, creating intense selling pressure as previous buyers are losing their patience holding this token.