- Former President Donald Trump is set to announce the creation of a ‘Bitcoin Strategic Reserve’ in Nashville.

- Vice President Kamala Harris’s office contacted billionaire investor Mark Cuban to discuss Bitcoin.

- Independent Presidential Nominee RFK endorses Bitcoin.

Advertisement

As the American national debt continues to spiral upwards, exceeding 32 trillion dollars, America must look for solutions to tackle the rising inflation and debt. The financial pressure has pushed politicians to explore avenues and desperately seek alternatives. In lieu of this, the outspoken and bold former President Donald Trump is rumored to have announced the establishment of a ‘Bitcoin Strategic Reserve’ in Nashville, according to recent reports from prominent cable networks Fox News and CNBC. Should this declaration come to fruition, it could symbolize a monumental transformation in American fiscal policy that leverages Bitcoin as a counterbalance against instability.

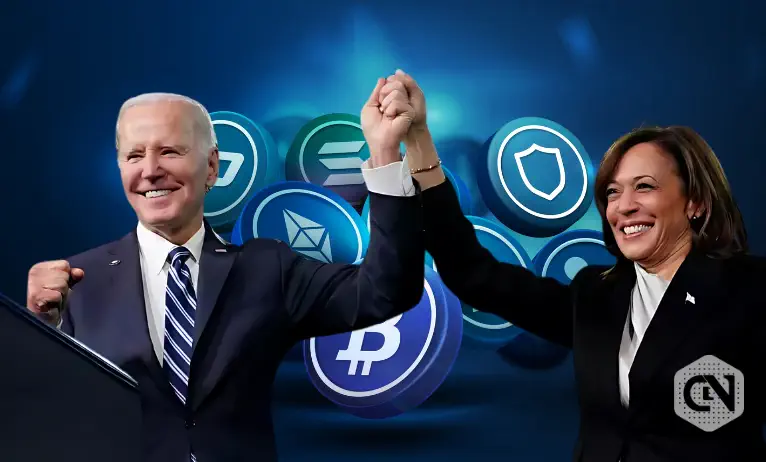

Trump and Harris Spark a Crypto Showdown

If Trump intends to announce a ‘Bitcoin Strategic Reserve’ in Nashville, his commitment to positioning the digital asset as core to America’s economic strategy is a massive step for the crypto industry. Due to its finite availability and decentralized framework, Bitcoin maintains the potential to function as a reserve holding capable of hedging inflation and unpredictability, as mentioned earlier.

Now, rumor has it that Vice President Kamala Harris’ staff recently reached out to billionaire tech magnate and Bitcoin proponent Mark Cuban to discuss cryptocurrency privately. Cuban hinted that Harris’ stance seems more amenable and that the Democratic administration is ‘far more open to business’—implying that a Harris-led Presidency may soften its grip on cryptocurrencies. This potential policy pivot has ignited controversy and comparisons to Trump’s crypto-friendly initiatives during his latest campaign for the upcoming presidential term. Historically, Harris has maintained a stoic silence on cryptographic monetary forms, accentuating administrative oversight and shopper insurance amid her efforts.

Big Whales Rally Behind Trump, Can Harris Catch Up?

Adding to his previous endorsement of digital currencies, Trump has accumulated backing from notable figures like Elon Musk and Robert Kiyosaki. Though Musk has not directly approved of Trump’s strategy, he continues to advocate his pro-cryptocurrencies stance in the political domain. Now that Trump has actively supported cryptocurrencies, it is a calculated guess that Musk will favor a pro-crypto government.

Musk verbalized his concern on Tuesday, writing, “America is going bankrupt btw..‘. His disapproval of Democrats is evident in his myriad of tweets on X. Correspondingly, Robert Kiyosaki, revered author of the personal finance book “Rich Dad Poor Dad,” praised Trump’s strategic vision for Bitcoin, accentuating its potential to reinvent the American economy. These validations meaningfully bolster Trump’s stance, amplifying his message and potentially swaying public views in favor of his cryptocurrency initiatives. The author has publicly supported Trump various times and has, in the past, favored Bitcoin’s position to make an impact in U.S. finance.

Why GOLD, SILVER, BITCOIN will rise in price when TRUMP becomes President again.

Trump wants a weaker dollar so America will begin export more than import. With a weaker dollar jobs will come back and assets will go up in price.

Trump is going to drill, drill, drill for oil…

— Robert Kiyosaki (@theRealKiyosaki) July 23, 2024

Gary Cardone, CEO & Co-Founder of Chargebacks911 and a well-acclaimed investor, also entered the conversation, upholding the notion of leveraging Bitcoin to change the U.S. financial landscape as he tweets the possibility of Bitcoin reaching the price of $1 Billion by 2038. He has been an ardent supporter of Bitcoin, comparing the asset to gold. He has ratified Bitcoin’s position as a ‘risk-off’ asset, claiming new investors prefer Bitcoin as an asset for ‘hedge against inflation’ than gold.

In contrast, Vice President Kamala Harris appears late to recognize cryptocurrency’s growing importance. As her office contacted billionaire investor Mark Cuban to discuss Bitcoin, Cuban indicated that Harris seemed “far more open to business,” signaling a potential policy shift regarding cryptocurrencies. This move has sparked controversy and comparisons to Trump’s proactive approach to crypto-friendly legislation. This late joining with Cuban has put Kamala Harris at the heart of speculation in the crypto industry. Further, the Bitcoin Magazine CEO has now confirmed that Kamala Harris, who was supposed to share the spotlight with Trump at the Bitcoin Conference 2024 in Nashville, has stepped down. This incident has brought much scrutiny to Harri’s take on cryptocurrency.

Many investors and on-lookers believe her pro-crypto move (if any) may synchronize with Trump’s pro-business and crypto-zealous discourse. As the political scene advances, these events raise questions about the potential outcome of the U.S. elections and the direction and reception of the cryptocurrency industry in the United States. The apparent contrast between the anti-crypto stance in the past and the ongoing pro-crypto stance of both Democrats and Republicans provides a fresh look at how rapidly the crypto space has evolved.

RFK Jr. Wants The Feds To Acquire Bitcoin

While engaging in a spirited discussion on TheStreet Roundtable, independent presidential candidate and longtime advocate for the environment Robert F. Kennedy Jr. passionately promoted the notion of the federal government acquiring bitcoin reserves. RFK Jr. contended that incorporating cryptocurrency holdings into America’s financial bulwarks could function as a stabilizing counterweight against inflationary forces. He insisted that such an unprecedented yet pragmatic strategy had the potential to safeguard citizens against economic turbulence and maintain confidence in the dollar’s spending power on both national and international stages. Read more here.

Win-Win For America, Crypto In the Leads

As the 2024 elections draw near, the differing crypto strategies espoused by Trump and Harris highlight a pivotal moment for digital assets in America. For Trump, cryptocurrency is viewed as a firebreak against inflation and has been included in strategic reserves; for Harris, influenced by crypto advocates such as Mark Cuban, the digital currency has tended to be accepted readily, becoming a standard financial instrument.

RFK Jr plans to give Bitcoin in the future and emphasizes that cryptocurrency is increasingly essential. Regardless of who wins, America might have to incorporate Bitcoin and crypto into its financial system to make a dent in the global economic structure regarding this new asset class. However, the question remains: Will this crypto battle end in a regulatory embrace for the sector or widen an already gaping hole between proponents and opponents?