TRON emerged from an ERC-20 blockchain to develop its network working on a delegated Proof of Stake. Initially, it was developed to address the ownership issue with digital content wherein creators were required to share their data with centralized organizations to ensure its connectivity.

Bypassing the intermediaries such as YouTube, Meta, Google, and other organizations would allow creators to enjoy better economic benefits. Fast forward to 2022, TRON has its token named TRX and is currently working on Smart Contracts, Algorithm Stable Coins, and supports multiple Decentralized applications.

With a market capitalization of $6,070,330,435, this token hasn’t mentioned its total circulation supply but has more than 92.45 billion tokens in existing circulation. The TRON blockchain pegged with USDD stablecoin pair seems like a decent ratio as the USDD market capitalization remains limited to just $720,304,984. Currently, TRX tokens are being burned to mint the USDD tokens, and this is being done backing with a combination of USDT, BTC, and TRX tokens to prevent the LUNA UST-like issue.

Advertisement

TRON blockchain and its native cryptocurrency are trading at a minor decline in 2022, with peaks touched in May and June 2022. As of now, we are witnessing a notable decline from its 2022 peaks. Visit here to know when TRX will begin its recovery.

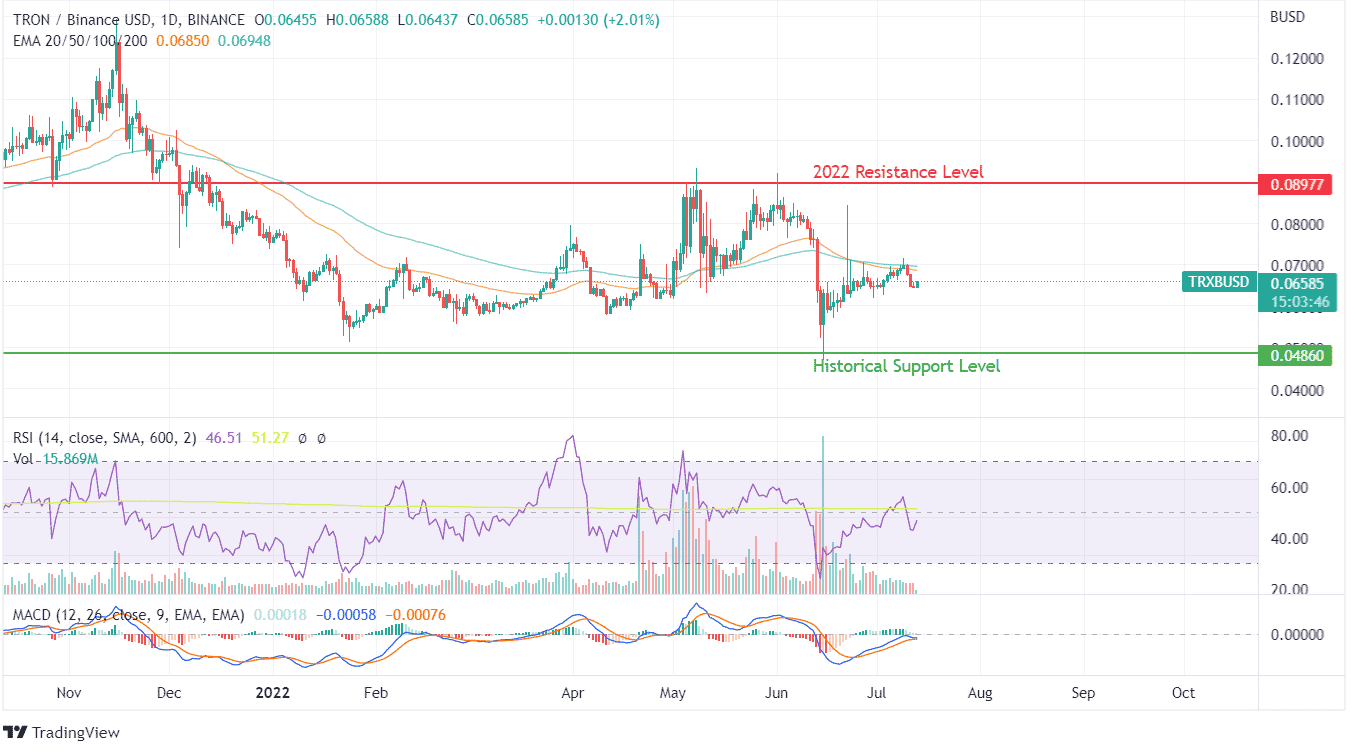

Drafting the resistance and support lines for TRX tokens marks $0.08977 as the resistance level, and $0.04860 as a support level has remained untouched since June 2021 dip. Compared to the last one-year price trend, the outlook seems strong and positive in the short term.

However, the price trend is even stronger in the long-term perspective since gains have been tremendous since March 2020. This price jump provides much-needed clarity on the fundamental acceptance and growth of the TRX blockchain.

Since its emergence in late 2017, TRON has delivered a gain of close to 3100%. In the upcoming possibilities, the TRX token has resistances tied with the 50 and 100 EMA curves, which have become a challenge for the token to overcome. With MACD declaring a bearish crossover and RSI dipping back to a near-neutral zone of 46, the signs are more biased towards negative movement but with a stronger stance than leading altcoins.

Advertisement

In 2022, the TRX token has delivered multiple double-digit gains and profit bookings, which have incited buyers to take advantage of its current values in hopes of gaining a higher return. Technicals indicate a decent level for buying and acquiring.