TRON is a decentralized, open-source cryptocurrency founded in 2017 by the TRON Foundation. It is a platform that allows users to publish, store, and own data while allowing them to share content on a decentralized network. TRON uses a Delegated Proof of Stake (DPoS) consensus mechanism, allowing users to participate in the decision-making process of the TRON network by electing super representatives.

DPoS can potentially process transactions faster than other consensus mechanisms, such as Proof of Work (PoW), because the validation process is streamlined, and the network can achieve a higher degree of consensus more quickly.

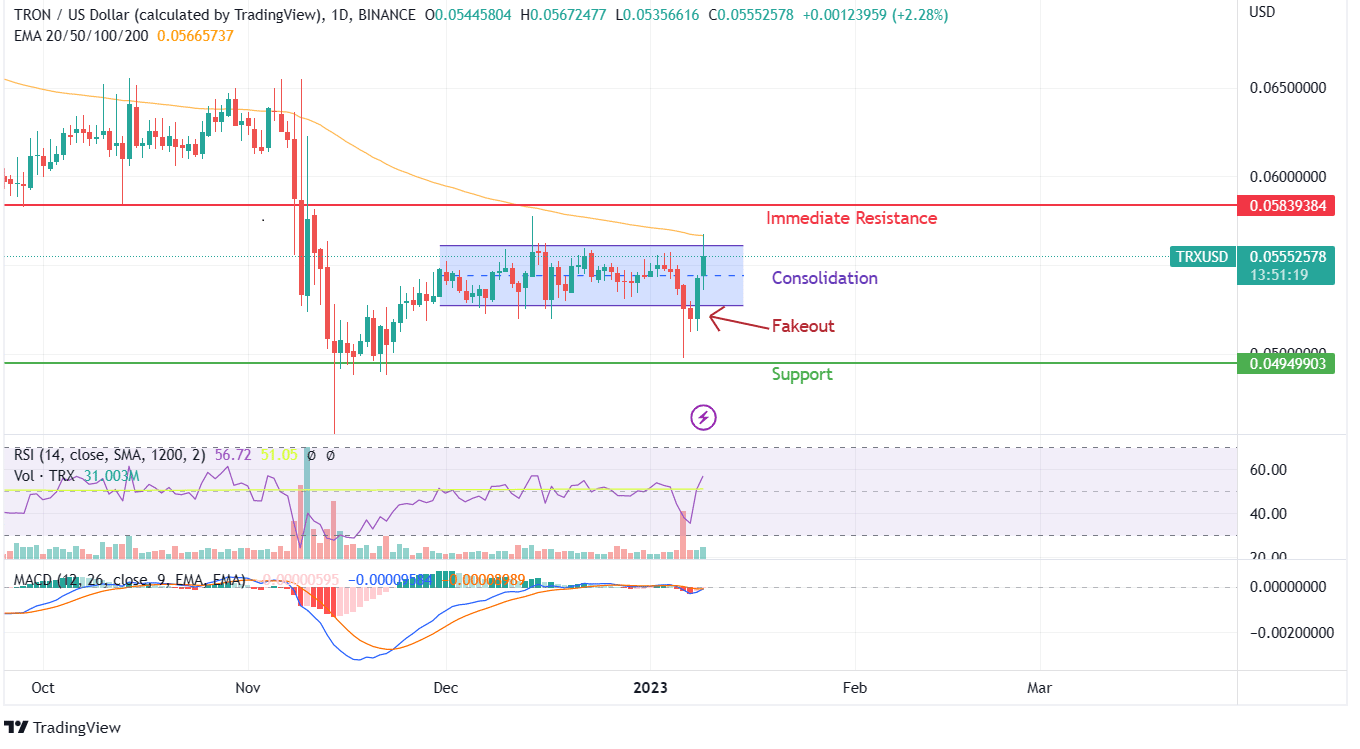

2023 has already begun on a positive note, but TRX managed to find a bearish trend even on a new beginning. However, buyers soon returned the token and took it from the lower band of its consolidation zone to the upper band in two days. With the token holding the 15th spot on the list, the good days for TRX are far from being over.

Advertisement

After witnessing the selling intensity in November 2022, TRX has gained some of its lost ground. With consistent breakouts and overreaching moving averages, TRX would soon test a new high compared to the peaks of 2022. Find more details about various levels TRON would face as resistance and support levels.

The technical indicators have found a new rally point on short-term price action from the intensive buying spree witnessed on Jan 6. The resulting high-wick candle prompted buyers to take command of this demand zone, and prices soon jumped significantly in the next three days.

While the following day was a neutral candle with a red body, the weekend created a newfound demand for TRX tokens in the market. A short profit booking stance has been created due to hitting the 100 EMA curve.

While price action-based resistance lies just a few percent above the 100 EMA curve, the time is ripe for a turning point event. As fakeout for TRX token subsided, the proper potential and strength of buying mode would be ascertained shortly.

Advertisement

The price jump has improved technicals such as MACD and RSI with a huge margin. Short-term support is around $0.049, and the resistance is visible at $0.0566 and $0.05839. Overcoming the 100 EMA curve would signify a bullish rally to continue. As a trader, it is vital to consider the potential risks and rewards of investing for going all in.