Since February this year, cryptocurrencies have been dominated by macroeconomics. Investors observed a lot of outflow from the crypto industry, and it is continuing even in September. Due to inflation and other macro factors, cryptocurrencies could be the worst victim in the next few months. Some of the large cryptocurrencies like Bitcoin, Ethereum, and Stellar are still in a downtrend for the long term.

Steller (XLM) was launched in 2014. After that, it became popular as a crypto asset and fiat currency. It is also used for financial transactions in different sectors. Steller (XLM) is the fork version of Stellar Consensus Protocol (SCP).

It has started a partnership with Moneygram and Flutterwave as well as large institutions like New York State Finance Department and IBM. The security and speed Stellar provides are the main factors of its popularity. Besides that, Steller also charges low gas fees for the transactions. Crypto traders find Stellar as one of the popular mediums for crypto transactions at lower costs.

Advertisement

That is why we think Steller is a dependable cryptocurrency to include in your portfolio. Find more details about the XLM token in our prediction and technical analysis.

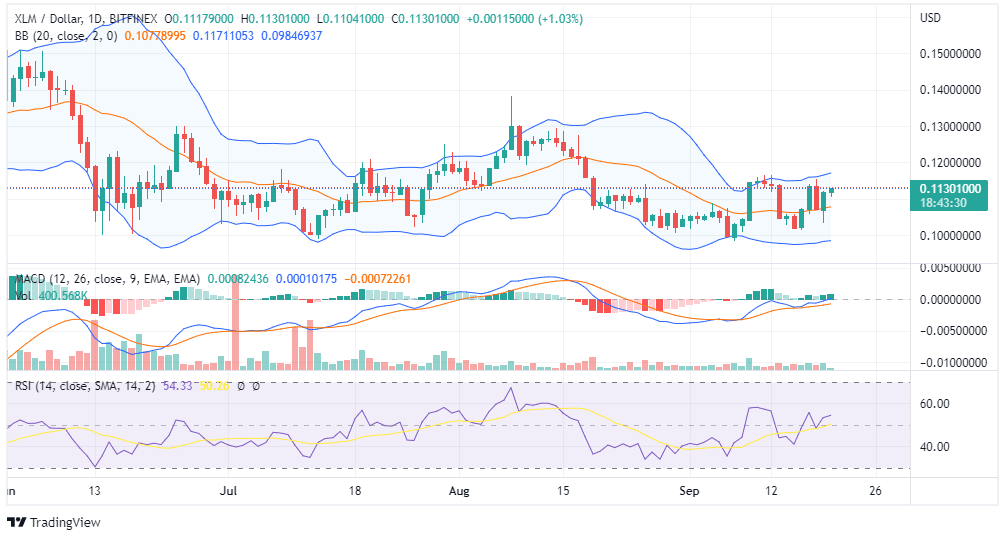

Most technical indicators are bullish; candlesticks are forming in the upper range of the Bollinger Bands with the RSI above 50, suggesting positive momentum in the market. We think it is the right time to invest in XLM for the short term.

Advertisement

However, if it breaks the support of $0.10, it will follow the downtrend. On the weekly chart, candlesticks are forming around the baseline of the Bollinger Bands with RSI around 39, so we think immediate support may be an ideal time to invest for the long term. However, you must also set a stop loss assuming the downtrend.