As the broader cryptocurrency market grapples with consolidation, Solana (SOL) continues to experience sideways price movement, dampening the optimism of those hoping for a stronger October rally. Historically, the market has seen major price increases this month, a trend the crypto community calls “Uptober.”

However, this year has not mirrored the anticipated gains, and frequent price declines across various altcoins, including SOL, have led to some dubbing the current period “Rektober.” Despite this, there remains notable activity surrounding the token, with trading data signaling potential hope among investors.

According to CoinGlass, the cryptocurrency’s 24-hour trading volume spiked by 6.52%, reaching $4.84 billion. The token’s trading volume uptick highlights a continuing belief in the possibility of an upward trend as October progresses, even amid broader market stagnation.

Open Interest Gains Amid Growing Optimism

Solana’s Open Interest (OI), another key market indicator, has also surged. Recent figures show a 1.55% jump in OI, now at approximately $2.29 billion. This rise in OI suggests growing investor confidence, reinforcing a bullish sentiment despite the broader market’s lack of significant upward momentum.

Advertisement

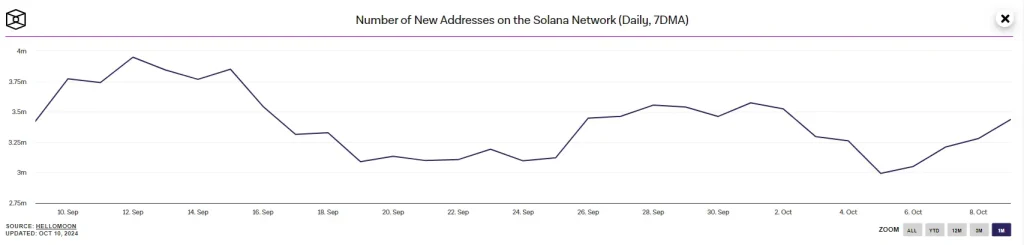

Moreover, several other factors are contributing to the surge in the cryptocurrency’s market activity. For instance, the number of new addresses interacting with the Solana blockchain has increased. Data from HelloMoon shows a rise in new wallet addresses, from a monthly low of 2.99 million on October 5 to a current count of 3.44 million. This uptick in network activity could signal a renewed interest in the altcoin, further supporting market optimism.

Technical Indicators Reflect Consolidation

Analyzing Solana’s price movement, it appears the token remains locked in a consolidation pattern. A TradingView chart analysis shows that the cryptocurrency has formed a symmetrical triangle pattern. This formation typically indicates a continuation of the existing price trend, suggesting that Solana may remain range-bound in the short term. Consequently, this situation leads to a more cautious Solana prediction for the time being.

While the current trend shows no immediate upward movement, the pattern hints at potential volatility once the token breaks out of this range. A closer look at technical indicators further supports the consolidation narrative. The Relative Strength Index, currently at 45.81, suggests that neither buyers nor sellers exert intense pressure on the market.

As a result, the token may continue trading within its current price range until more precise market signals emerge. The MACD also reflects a market in balance. While bears have maintained dominance over the SOL market, the MACD line is trending along the zero line, and the histogram bars are flattening.

This indicates that bearish momentum may be waning, opening the possibility for price stability. Yet, a market momentum shift could see the cryptocurrency test resistance at the $156.17 level, while support might be found around $125.68. As of press time, Solana is priced at $139.98, reflecting a slight 0.20% increase over the last 24 hours.

Advertisement

Also Read: Dogecoin Faces Critical Stress Test: Can DOGE Hold Above $0.10?