Senator Elizabeth Warren has secured a win in her Massachusetts Senate race against Republican challenger and crypto friendly lawyer, John Deaton.

Associated Press has confirmed Warren’s win on Tuesday night, and the news has come as a shock to the crypto industry. With her victory, Senator Warren could become the next ranking member of the Senate Banking Committee, that oversees SEC and FDIC, if Sen. Sherrod Brown loses to Bernie Moreno.

Now we focus on Ohio. If @SenSherrodBrown loses to @berniemoreno, there’s a possibility that @SenWarren could become the next ranking member of the Senate Banking Committee (if GOP takes Senate) or Chair (if Dems retain it).

Senate Banking oversees the @SECGov and the @FDICgov. https://t.co/ijq29e4MKQ

— Eleanor Terrett (@EleanorTerrett) November 6, 2024

This win marks Warren’s fourth term in the U.S. Senate. Warren is a prominent member of both the Senate Finance Committee and the Senate Banking Committee, and plays a significant role in controlling the financial regulation of the country, including the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Advertisement

Warren has long been a vocal critic of the cryptocurrency sector. She has also led the legislative efforts of regulatory bodies with an anti-money laundering bill aimed at extending the Bank Secrecy Act’s know-your-customer (KYC) requirements to miners, validators, and wallet providers.

John Deaton’s loss has come as a huge blow to the crypto industry as he attracted support from notable figures in the crypto industry, including Ripple CEO Brad Garlinghouse, who publicly announced a donation to Deaton during DC Fintech Week last month. Deaton had received around $2.6M of crypto industry money as a donation. Deaton has been a persistent critic of SEC Chair Gary Gensler and previously filed a 2021 petition challenging the SEC’s designation of Ripple(XRP) as a security. Deaton even stepped up to appear as an amicus counsel for XRP holders. Deaton also took a dig at Senator Warren’s anti-bitcoin sentiment as he drew a parallel to Massachusetts’ decision to prevent retail investors from purchasing Apple stock during its initial public offering back in 1980 with that of Warren’s actions. The attack was in response to the news that Bitcoin had become the six largest assets in the world, and Warren’s discouragement to Bitcoin investments.

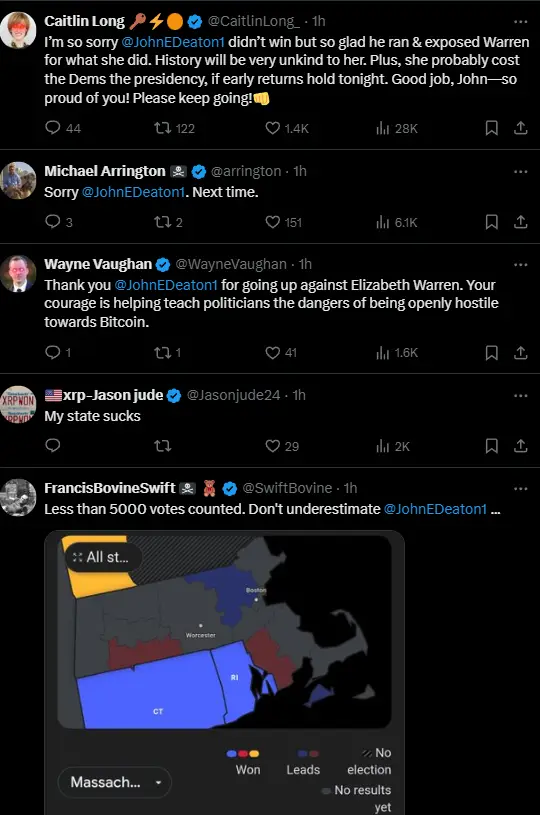

Crypto industry has expressed disappointment at Warren’s prevailing win. Here’s how some of the twitter users took the news:

Advertisement

Also Read: Bitcoin Crosses $71,000 as Early Vote Count Shows Donald Trump Leads Kamala Harris