Polygon is a layer-two scaling solution that runs alongside Ethereum blockchain. Last month Polygon provided a good return to its investors, but overall, MATIC’s price has been under a downtrend.

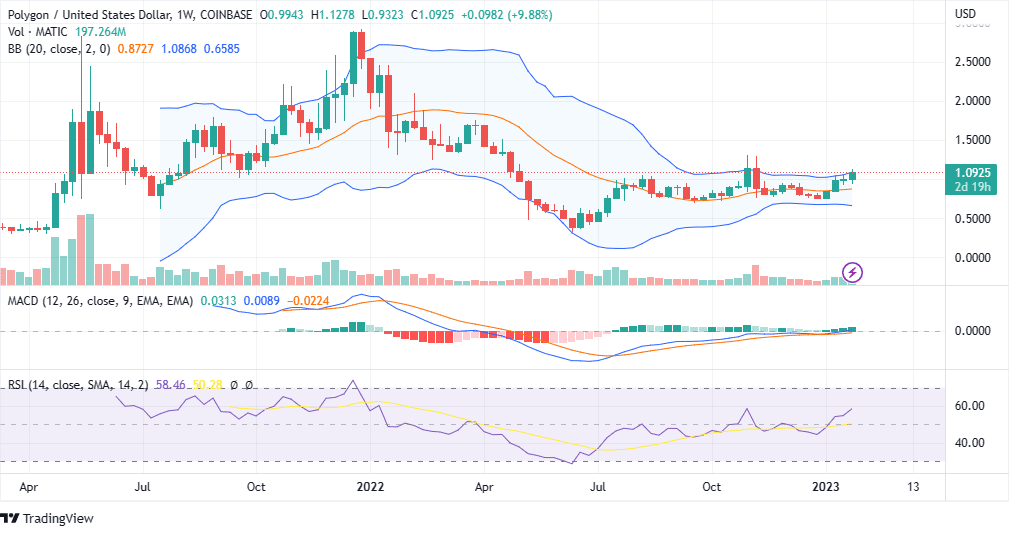

At the time of writing this analysis, MATIC/USD is trading around $1.1, suggesting a resistance zone. $0.95 is strong support over the last six months, so we do not think MATIC price will break the support in the upcoming few weeks. However, it is risky to invest because the price is around the recent high.

Based on the technical indicators, candle sticks are forming in the upper Bollinger Band with positive MACD and RSI, which suggests a continuation of this trend. We have to analyze the weekly chart to get a long-term view.

Advertisement

Advertisement

Indeed, Polygon has a wide range of use cases. Marketing and development teams are working hard to make it more user-friendly. So, MATIC must be a part of your crypto portfolio. Still, you have to keep an eye on the price action. You can buy Polygon (MATIC) for long-term if you have a broader view, like 5-10 years, because $1.1 is still a lower price based on its future potential.