Polkadot operates on the novel idea of connecting multiple blockchains to facilitate cross-chain transactions, which could later be upscaled as a web 3.0 technology, decentralized internet. Learning from the challenges of leading blockchains, Polkadot created its code, allowing it to be capable of autonomously updating its code without needing a fork. It has been possible through the governance feature of its token DOT, which allowed holders to direct the change-making decisions by the token community.

Polkadot’s relay chain connects public and private chains alike with permissionless networks and future technologies to share information allowing more complex transactions to be undertaken with ease. DOT lost 80% of its market value on a yearly basis, while the negative trend continues to rock this blockchain with a decline of a further 22% monthly. DOT stands at the 11th spot with a market capitalization of $6.25 billion, as a majority of the token supply has been liquidated in the market.

Polkadot (DOT) Price Analysis

DOT’s subsequent decline to fresh lows has created a challenging scenario for the token. Reclaiming its previous high of $50 seems highly unlikely. Growing applications and its high volumes of 1 billion have disabled the supply crisis needed for the sudden rise in token value.

Advertisement

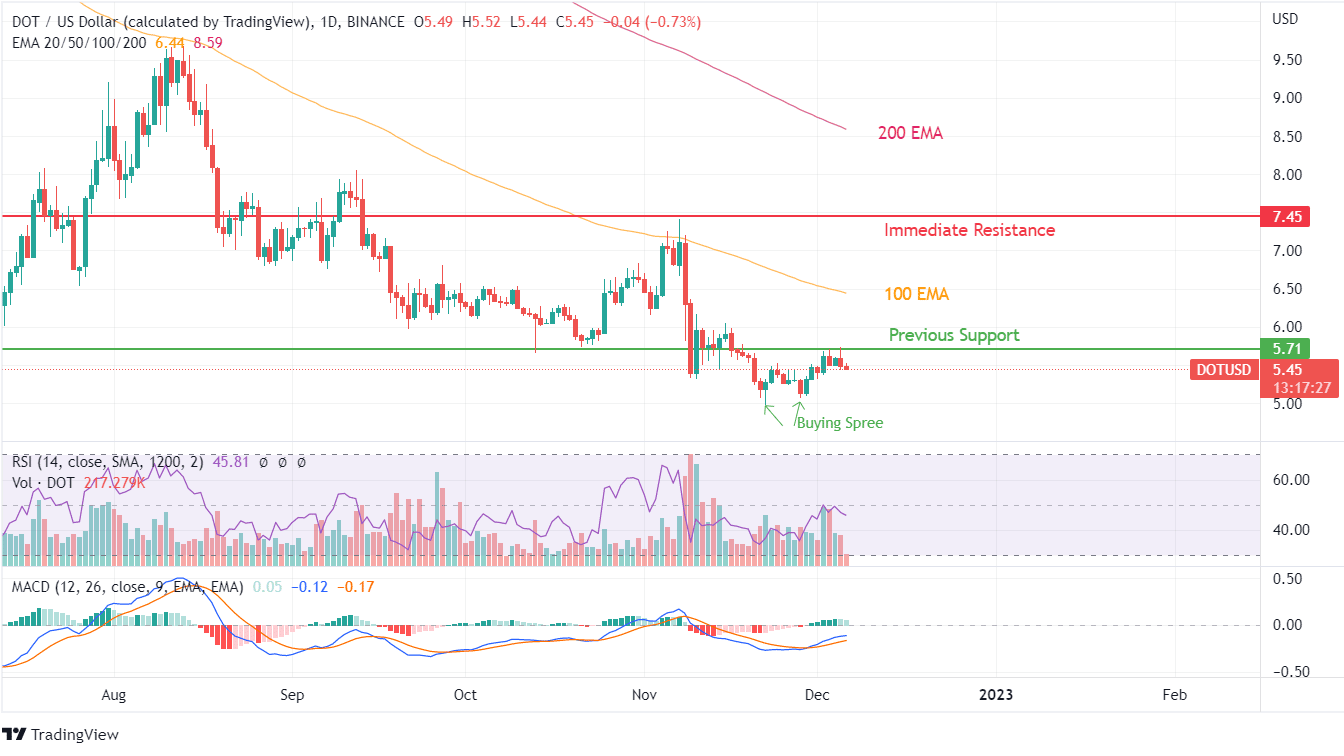

Polkadot’s price action has been consecutive resistance from the 100 and 200 EMA curves. The outlook for this token remained positive in the last year, but since hitting its all-time high of $51 in October 2021, the outlook for DOT has crashed to the low of $5. On close inspection of price reaction near moving averages, it has been found that 100 EMA remains one of the most controversial resistance for DOT.

Rejection can be seen in April 2022, August 2022, November 2022, and subsequently. To project itself as a trending token not buried in a pile of fundraising events, Polkadot would have to surpass the price action-based resistance level of $24.05. Currently, the 200 EMA for DOT has been trading slightly closer to the $8.5 mark, with a steady decline.

A positive movement or U-shaped recovery on DOT token value would be instrumental in identifying the positive outlook for the token in the short term. MACD has attempted to move up with a positive crossover, but the price has remained constrained with an 8% up-move.

RSI during this phase has tanked to below the 40 mark for the daily candlestick pattern, while weekly charts show RSI at 32. DOT’s retracement to December 2020 level is a huge negative indication based on price volumes and token demand. To know in-depth projections, visit our Polkadot predictions for the upcoming years.

Advertisement

On weekly charts, a corrective decline in transaction volumes can be witnessed since the beginning of 2021. Even the maximum decline in July 2021 was $10, which was 100% ahead of the current decline of $5. Buyers should consider the price action history and project application in the next two years before investing hard-earned money in Polkadot just because the token value has tanked. Buying on a dip is not fit for all cryptocurrencies.