Donald Trump is back to making waves after his political rally alongside Elon Musk. DeFi market entities have witnessed net inflows into global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares. These entities recorded net inflows of $407M last week, following $147M worth of outflows the week before.

Trump takes the lead against Kamala

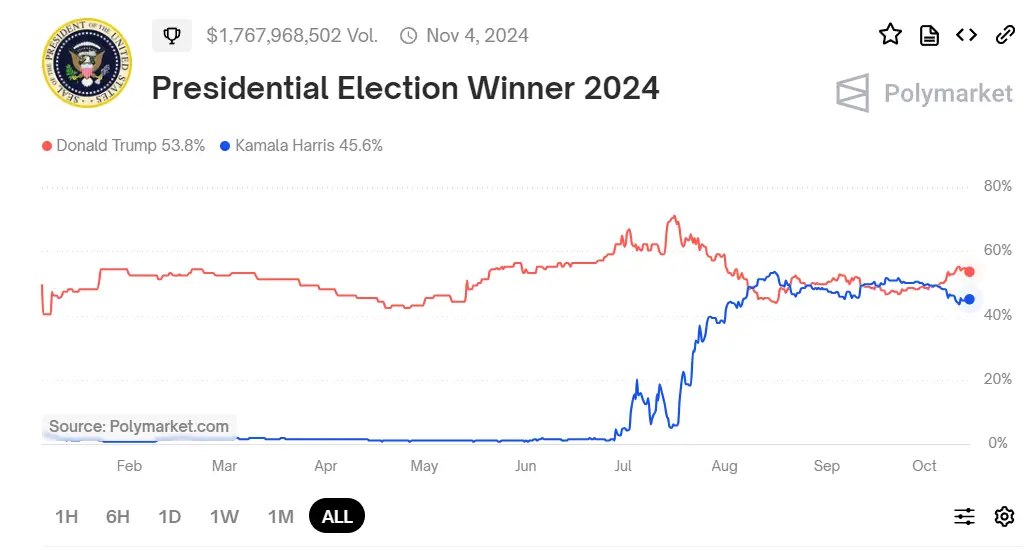

CoinShares Head of Research James Butterfill noted on Monday that the upcoming U.S. elections have likely influenced crypto investor decisions more than monetary policy outlooks, as seen in the fluctuating crypto betting odds on the US presidential election, which reflect the changing scenario of the political market.

He asserts, “This trend is evident in the fact that stronger-than-expected economic data had little impact on stemming outflows whereas the recent U.S. vice presidential debate and a subsequent shift in polling towards the Republicans, perceived as more supportive of digital assets, led to an immediate boost in inflows and prices.”

Advertisement

According to on-chain data from CoinGecko, Bitcoin is currently worth $65,836, up 5.3% in the last 24 hours and up 3.8% in the last 7 days.

In addition, Republican candidate Donald Trump currently leads Democrat Kamala Harris by odds of 54% to 46% to win the presidential election on Nov. 4, according to the decentralized predictions platform Polymarket. Trump is also taking the lead in five of six swing states.

Advertisement

In addition, Polymarket shows 78% odds of a Republican Senate, 56% odds of a Democrat House, and a 38% chance of a Republican sweep. This is compared to 17% for Democrats.