What is Bitcoin up to in the near future?

Bitcoin lovers and loyalists have been bullish than ever on their investments in BTC. Additionally, the technical have been a little complex to understand the bullish nature and an uptrend that the coin exhibits.

As per the recent update, the Bitcoin Hash rate is nearing to hit All-Time High, which means that the miners are diligently acing to complete an operation in the Bitcoin code. It was just over the bygone weekend when the network’s protocol had hit over 110 terahashes per second, which was just 10 terahashes below its All-Time High that was hit in the previous month on May 12, 2020. This embraced the weak miners to retort the network again as the level of mining difficulty has been reduced by over 9%.

Now, why a high value of hash rate is preferred? The high worth of hash rate leads to more security on the network, quick and speedy transactions, and fastened confirmation of the block. The difficulty which has just been eased by a certain percentage is an inherit attribute to secure and retain the total worth of Bitcoin mining reward.

#Bitcoin mining difficulty just dropped -9.29%.

It is the fourth downwards adjustment this year and so far the second largest decrease in 2020.

Feb 25: -0.3%

March 26: -15.9%

May 20: -6%

June 4: -9.3%Live chart: https://t.co/qtmuDmTfGS pic.twitter.com/W8e4WJ3xJi

— glassnode (@glassnode) June 4, 2020

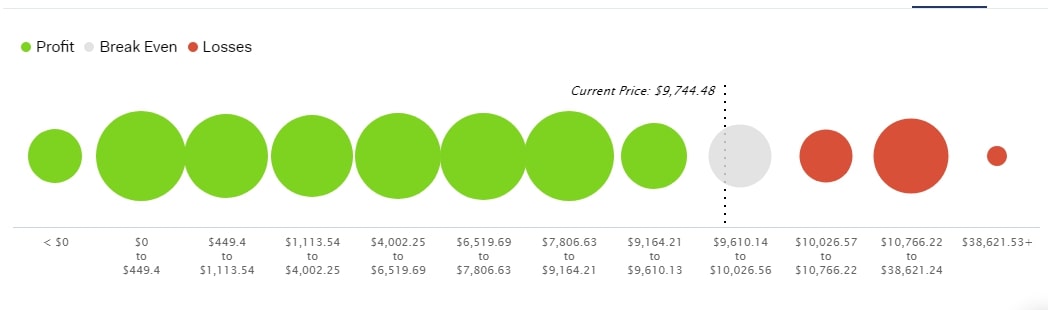

If we look into the on-chain fundamentals of Bitcoin, we see that the networkers or the investors are particularly bullish for the In the Money, with the current trading price being $9,744.48. In common parlance, if I understand the exceeding amount of networkers for possession of ITM option is that according to the BTC price prediction, holder addresses believe that Bitcoin price is likely to rise above the current market price and are thereby holding an option to sell at a strike price above CMP.

Advertisement

The demarcation in percentage is clear about the addresses believing with an optimistic approach towards the BTC current price, and a future hit, wherein a persistent trade above $10k happens to be the foremost target.

Alongside, a particular price range has been quite persuading for In the Money and At the Money option, i.e., $8,265.04 to $9,751.96. With this, we see that the current trading price constitutes under the mere portion of At the Money Option or option’s moneyness, which is not a figure to esteem and only holds 0.07% of the addresses between the prescribed range.

After an unstable transition, the compass has moved deeper into the bullish Regime 1 in Week 23.

With on-chain fundamentals rising and $BTC holding over $9k, the present outlook for #Bitcoin seems to be optimistic.

Read more in The Week On–Chain 👇https://t.co/2dCwJrNt78 pic.twitter.com/z8JT4Ox3bi

— glassnode (@glassnode) June 8, 2020

Now, when we talk about the complexity that the security is holding is about the diminishing supply on all the centralized exchanges has been nearing to hit a 1-year low. Moreover, the previous and the nearest 1-year low was observed in the previous week when the market crashed, and BTC lost over 8% in just minutes after breaching above $10k.

$BTC supply held on centralized exchanges drops to the lowest level since a year.#Bitcoin https://t.co/VkZi57n5cn

— glassnode (@glassnode) June 7, 2020

However, just with the plummeting supply, we cannot ignore the strong fundamentals of the security and the analysts who believe in a positive breakout soon. The assumptions supported by technical and historical trends based on the previous halving’s have been drawing a positive sentiment of hitting a fresh ATH and a new target soon.

Former Goldman Sachs hedge fund mgr, Raoul Pal predicts a $1 million trading price for #Bitcoin @RaoulGMI.

Pomp is at $100,000 buy the end of 2021. @APompliano.

IMHO we hit a new ATH by the end of October 2020.

If you can't wait a few months or years for this potential GTFO.

— Jason A. Williams (@GoingParabolic) June 8, 2020

Moreover, the profits have been startling enough for any potential investor to disregard and not join the network.

Advertisement

Profit has been the driving motive for any probable investment, and Bitcoin is rightly serving the need to lure the right amounts. One is never late to invest in Bitcoin with the possible minimum amount.