- Monero (XMR) continues with the fall in the price chart.

- The day holds not much expectation from the coin.

- The price of the coin is at $16.

- The coin is at the 11th rank in the crypto market.

- The ROI (Return on Investment) is marked as 3140.35%.

- The market cap is noted as $1,376,533,798.

- The circulating supply of the coin is at 17,172,954 XMR.

- The 24hr volume is marked as $92,961,596.

Monero is going through a rough phase. The entire week has been quite a disappointment for the coin. The traders were holding high hopes from the coin, which now seems be ruined. Well, the coin is anticipated to recover in some time. Till then, the traders are recommended to stay put. The coin is likely to remain the same.

Advertisement

The intraday trading in the coin wouldn’t be a great choice. The immense drop in price is scaring many traders. Let’s have a look at the price chart of Monero.

Monero Current Statistics:

Advertisement

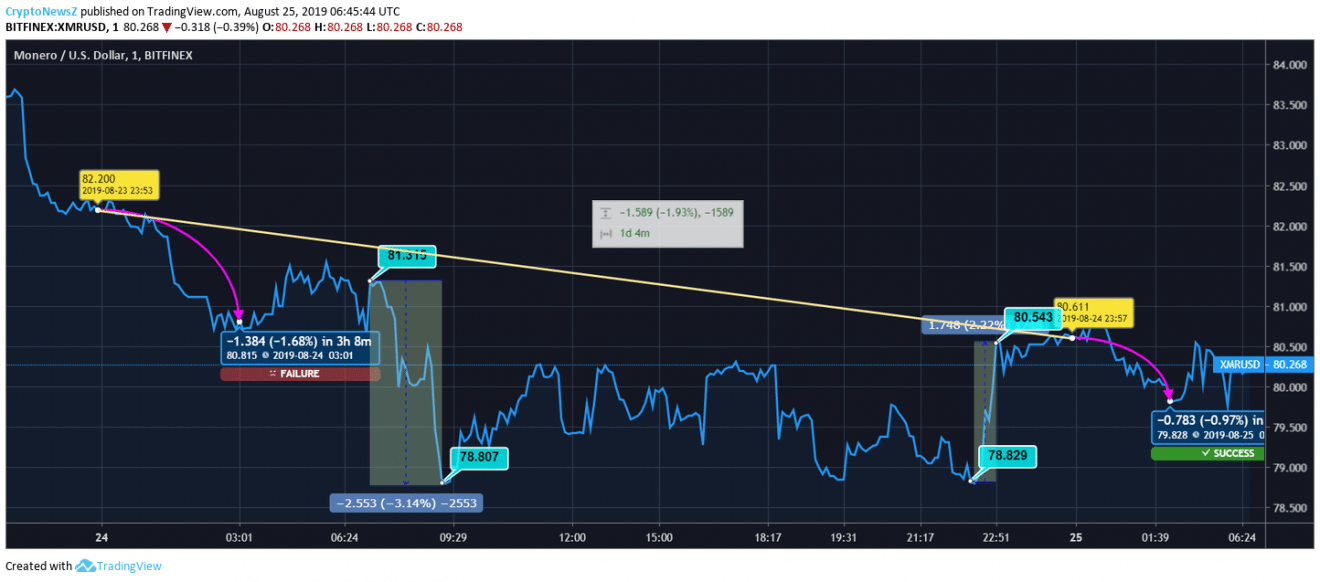

The chart is taken from Trading View on 25th August 2019 at 06:45:44 UTC for price analysis.

Looking at the chart, we can observe that the coin has experienced a steep move. Yesterday, the coin opened with a fall of 1.68%. The price counters changed from $82.2 to $80.8 by 1.68%. Later, the coin again took another drop of 3.14% from $81 to $78. Towards the end of the day, there was a slight escalation marked in the price of the coin by 2.22%. The price changed from $78 to $80. The coin closed at $80.6. The intraday fall in price was of 1.91%. Today, there is again a drop. The coin has shifted from $80 to $79 by 0.97%.

Summary of XMR to USD:

Monero Price Prediction and Conclusion:

Monero (XMR) was spotted trading with the bulls during the beginning of the month. The coin got caught in the fall and is unable to come out of it. Based on Monero forecast, we were hopeful that the end of the month would reflect some improvement, but that also looks like on hold.

In such a scenario, we recommend holding the investment. It would be best to jump in the pool when the rally has embarked. This would help the investors to cut short the risk involved.