SALT Lending was established in 2016 and has become one of the major players in the crypto lending space. SALT has become one of a kind in the cryptocurrency sector; this platform includes several additional benefits and makes it easy for users to maintain a healthy crypto portfolio and ensure that their funds are safe. Based on the available SALT Lending reviews, SALT is an automated lending platform that permits users to get cash loans using their cryptocurrencies as collateral. Using SALT, the user need not fill out loan agreement forms or wait for long hours to get their loan approved.

| Very Good Reputation | Visit Website | |

| Very Good Reputation | Visit Website | |

| Very Good Reputation | Visit Website |

SALT Lending Summary

| Official Website | https://saltlending.com/ |

| Headquarters | Denver, Colorado |

| Found in | 2016 |

| Native Token | Yes |

| Listed Cryptocurrencies | BTC, BCH, ETH, DASH, LTC, DOGE, XRP, USDC, TUSD, PAX, PAX Gold, and SALT Token |

| Supported Fiat Currencies | USD |

| Minimum Deposit | SALT Minimum loan amount – $5,000 |

| Deposit Fees | Depends on Currency |

| Trading Pairs | N/A |

| Trading Fees | Depends on Network and Currency |

| Withdrawal Limit | N/A |

| Withdrawal Fees | 0% |

| APY | There is MAX 17.95% APR |

| App | Yes |

| Customer Support | Live chat, Mail, Phone, & Form Support |

What is SALT Lending?

SALT lending provides centralized solutions and plays an important role in the digital currency ecosystem. It offers services to users who are looking to borrow loans in USD and also with crypto holdings. SALT lending started its journey as an innovative platform by offering its native token as a SALT token in crypto finance. SALT smart contracts run on the ethereum blockchain, and its token’s utility is applicable only for members. The token can be used to pay for memberships and gain benefits on the SALT lending platform. It is established in Denver, Colorado, with a mission to offer a solution to the crypto holders by maintaining their long-term speculation and investments without selling their cryptocurrency holdings for the short term.

In this way, the company has developed its brand by offering businesses and individual loans globally. Compared to other platforms, SALT challenges the traditional way of lending and borrowing by offering a new system in the cryptocurrency world that users prefer.

How Does SALT Work?

If the user wants to secure a loan using their blockchain assets through the SALT lending platform, they should offer collateral in the form of different crypto assets.

Following are the steps about how the SALT platform works:-

Creating an Account

The first step as a borrower is to create a SALT membership account with SALT. After this step, the digital currency can be moved to the account and used as collateral using the SALT oracle wallet. A SALT oracle wallet is a multi-signature wallet that helps store the collateral and manages the lending terms automatically.

Transferring Funds

After completing the first step, the SALT loan will be processed and approved. The funds are transferred to the user’s bank account.

Periodic Payments

After borrowing the money from the SALT lending platform, the user must repay the amount on time. The repayment has been structured as periodic payments and offered to the borrowers. This is necessary because SALT does not conduct any background checks and provides loans without any guarantees except asking for digital currency as collateral.

Collateral

If the borrower repays the entire amount that has been received as a loan, they can take back their collateral and keep them in their account.

Key Features of SALT

Here are the few key features of SALT:-

- SALT Blockchain Inc is a lending platform that provides an entire crypto portfolio management tool that makes it easy for users to manage their cryptocurrency holdings in one place.

- According to our SALT Lending review, the SALT Lending platform covers its digital assets through extensive insurance used for loans as collateral. Further, the crypto collaterals are held in cold storage, and the crypto holdings are insured against theft and crimes.

- SALT has few resources for their customers to learn about the SALT lending platform by explaining how their services are carried out. For beginners, it provides a newsroom page that provides featured articles and press releases from SALT.

- SALT also provides videos known as “Worth Your SALT,” which offers insights from industry leaders by providing their perspectives on various cryptocurrency topics. It also offers an extensive FAQ section to its customers by answering several common questions when the customers use SALT lending services.

- SALT provides a mobile app available to the users and permits them to monitor their loans and the status of their deposits, withdrawals, and several more. The push notifications of SALT are also available in the mobile app of SALT lending, which is available for both IOS and Android devices.

- This platform provides email alerts, SMS alerts, push notifications, and phone calls for notifying the customers about their pending actions and reminders. This is one of the advantages that help customers to be aware and in full control of their investment portfolio.

- SALT sends real-time notifications through their platform, and the users are notified immediately about a situation like where they should add more collateral to their outstanding loans.

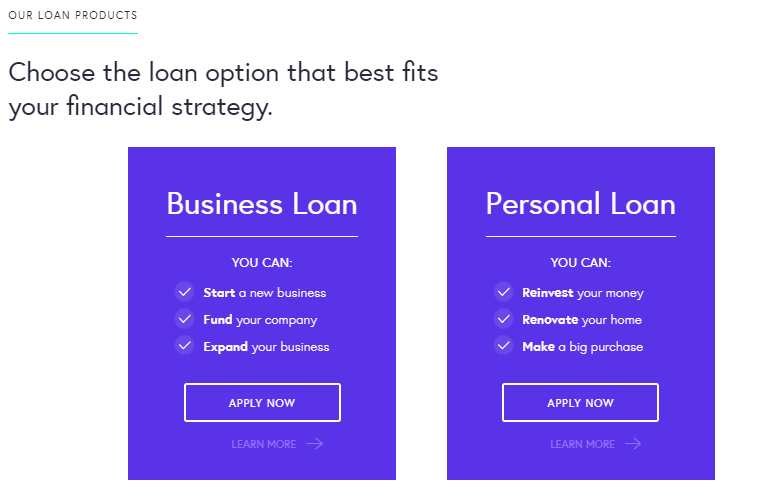

SALT Lending Products

- SALT provides individual and business loans to their customers, and they can open loans against their digital assets in exchange for USD and stablecoins like TUSD, PAX, and USDT.

- SALT provides loans from $5000 to $25,000,000 with 3 to 12 monthly payment windows and LTV (Loan-to-Value ratio) of 30 to 70%. A loan calculator is also found on the SALT website that helps users know about the exact rates.

- The users can provide the following cryptocurrencies as collateral like Bitcoin, Bitcoin Cash, Ethereum, Dash, Litecoin, Dogecoin, Ripple, USDC, TUSD, PAX, PAX Gold, and SALT Token.

Advertisement

SALT Lending Review: Pros and Cons

| Pros | Cons |

| SALT does not ask for credit checks. | Does not offer Interest accounts. |

| SALT lending provides comprehensive insurance coverage for its customers. | The window for repayment is small. |

| Provides cold storage and multi-signature security for the user funds. | SALT charges higher repayment rates when compared with traditional loans offered through bank accounts. |

| SALT provides real-time notifications. | The minimum loan amount is $5000. |

| The customer can use different cryptocurrencies as collateral for SALT loans. | Pledging crypto as collateral is highly risky, as it is prone to market fluctuations. |

| Customer support is knowledgeable and dedicated. | |

| Registering an account is simple and easy. |

Creating an Account with SALT Lending

- Creating an account with SALT lending is simple and easy. The user should go to the SALT website and register on the platform by providing details like full name and email address. SALT will send a verification email to the email address provided by the user. The email will provide a 6-digit code that needs to be entered in the box provided on the SALT lending platform.

- When the code is entered on the platform, SALT will ask the user to set up two-factor authentication to protect their account. Also, it will provide a QR code that needs to be scanned with an authenticated application like Google authenticator.

- The application will be linked to the user account that will generate a unique code every 30 seconds. Moreover, it is an important step in security that helps in verifying the user’s identity.

- When the two-factor authentication is done, the customer needs to provide their full name and the residing country to verify their identity. The user must submit any form of identification via a passport, driver’s license, or identity card.

- In the next step, the user should understand, read and affirm the agreement by clicking the checkbox and submit button.

- The user needs to verify whether their account is for business or personal use. Further, users can create up to 7 various accounts and only one personal account a user.

- When the user selects the appropriate account type, they will be taken to their account, and from then on, they can complete their profile and apply for the loan.

SALT Lending Fees

According to our SALT Lending review, SALT loan terms range from 3 months to 12 months. This platform does not charge any origination fee for getting a SALT loan. Further, borrowers are charged a loan interest, and the interest rate varies from 4.95 % to 22.95%. SALT charges a fee for converting the user’s digital assets, which might be up to 5% of the total value. The terms and rates are subject to change based on several factors like qualifications, loan amount, and additional collateral. Moreover, you can get more details on fees by clicking here.

Trading with SALT Lending

Since December 2017, the SALT Lending price has gone up steadily, and it had gone up to an all-time high of $17 when it announced that it had started a lending platform. To start trading with SALT, the user should visit the SALT lending website, or they can visit any exchange platform where SALT is listed on their platform. If the SALT’s native token is listed on any exchanges, they can follow the instructions to sell or trade it.

How Do I Request a Loan at SALT?

- As the user needs to use their crypto assets to secure a loan, SALT lending does not have risk as the digital assets can be liquidated anytime. If the borrower does not repay the loan, this process is called default. Consequently, no credit check involves the borrower’s credit history.

- Further, the loan approval is not entirely based on the borrower’s credit score, which is a numerical representation of the user’s ability to pay back their loans on time, in full amount.

- If the user wants to secure a loan, the eligibility is based on the value of the borrower’s digital assets. SALT performs verification checks on every borrower and complies with AML and KYC regulations. After the verification, the member can secure a loan and have it processed further.

How Much Can I Borrow from SALT?

How much the user can borrow with SALT is based on the type of SALT membership the user purchases. A basic member can borrow up to $10,000, get loans in USD, and choose repayment terms between 3 to 24 months. If the user selects a higher membership tier like big organizations, they can access a $1 million loan. SALT allows more flexible terms, and also, the payout can be made through fiat currency.

SALT Supported Currencies and Countries

Few supported currencies that can be used as collateral in SALT lending are Bitcoin, Ethereum, Bitcoin Cash, Litecoin, PaxGold, USD coin, Paxos, and True USD. The user can combine with various collateral types to secure a loan. SALT provides its loan services in Brazil, the United States, New Zealand, Hong Kong, United Arab Emirates, Puerto Rico, Switzerland, Vietnam, and the United Kingdom. To know about bitcoin lending rates details click here.

SALT Token Details

- The smart contracts of SALT run on the ethereum blockchain, and the SALT network has an ERC20 token, SALT. The memberships for the SALT platform can be purchased through SALT tokens, and they can be used for paying loans or buying on the SALT platform.

- This token can also be used for purchases carried out in SALT online shops. All tokens are traded by the users available on some of the most popular exchanges like Binance, Bittrex, and Huobi; the price of SALT tokens on these exchanges differs.

- SALT tokens that are directly purchased from the SALT platform can be refunded while the tokens are brought from other exchanges or not.

SALT Mobile App

SALT offers a mobile app that allows the user’s wallet addresses and external accounts to track their cryptocurrency assets. Through the SALT app, the users can have a holistic view of their assets and manage their loans very efficiently. Also, they can turn on the notifications to get the latest updates on their account. They can also log in to their account via the mobile app and activate push notifications. This will help the users stay updated on their loans in real-time, and if there are any problems, they can take immediate action.

SALT Lending Security

One of the most advantageous features offered by SALT Lending is it provides full insurance for their customer funds. They offer both cyber liability insurance in the event of threat or breach, and crime insurance, in the event of infrastructure issues or theft. This ensures the customer’s funds are 100% safe and are held in cold wallets. The user’s funds are stored offline on level 3 validated hardware. Further, SALT complies with security standards and ensures the investor uses multi-signature wallets to store their funds.

SALT Customer Support

In any industry, customer support plays a vital role in clarifying the doubts of their customers. If the customer has any queries regarding the loan, they can always contact SALT’s loan manager through telephone or email. SALT’s global support professionals are available 24×7 for the benefit of their users. They attend to the customer’s general questions or any related technical queries immediately.

The customer support can be contacted through:-

- Live chat

- Email: [email protected]

- Phone: +1 (720) 575-2272

SALT Lending Review: Conclusion

In conclusion, SALT lending is one of the most popular blockchain lending platforms that has been created to help crypto holders by offering cash loans in return for their cryptocurrency as a form of collateral. SALT is the best option for users who do not want to sell their cryptocurrencies to pay for their bills. Simply put, SALT lending is one of the traditional crypto lending platforms, and it provides one of the key features like dedicated customer service. SALT is considered one of the best lending companies in the cryptocurrency financial markets.

FAQs

Is SALT Lending Legit?

Many associate it with the SALT Lending scam. According to our SALT lending reviews, SALT is a legit company, and it is registered globally. The company has a good reputation for offering crypto-backed loans since its inception. It offers the necessary security measures to secure the user keys through encrypted offline hardware, full insurance, and multi-sig wallets on its platform.

How Does SALT Lending Make Money?

Advertisement

SALT lending offers business and personal loans to their users who offer their cryptocurrencies as collateral assets. Also, SALT lending permits the borrowers to keep their ownership of their assets when they gain access to cash through a loan.

How Long Does SALT Take for a Loan to Get Approved?

When the user completes the steps in the application process, they can get their loans approved immediately. The average time required to get a loan approved is 48 hours.

Can One Use Multiple Cryptocurrencies to Secure Their Loan on SALT?

The user can use multiple assets as collateral like Bitcoin, Litecoin, Ethereum, and several more. They can combine different collateral types to secure their loan. SALT also accepts SALT tokens as a second form of collateral. In this way, the user can use 20% of SALT tokens as collateral in their portfolio and 80% or other supporting assets for collateral.

Investment Advice: Investing in cryptocurrency involves risk; people might lose 100% of their investment. Cryptocurrency trading involves high risk and is not suitable for all investors. Before deciding to trade cryptocurrencies, tokens, or any other digital asset, one should carefully research and consider their investment objectives, level of experience, and risk appetite.