This content has been archived. It may no longer be relevant.

IMPORTANT UPDATE: BlockFi, a crypto lending platform, emerged from bankruptcy in October 2023. Users are advised to withdraw digital assets from their BlockFi Wallet by December 31, 2023, and complete Identity Verification by January 12, 2024. Visit BlockFi’s website for detailed instructions and FAQs regarding the withdrawal process.

Accordingly, we have marked the platform as “closed.”

Looking for a trustworthy crypto lending platform? Explore our curated list of top crypto lending platforms and discover the ideal platform for your trading needs.

The crypto market is ever-evolving, and many investors worldwide are interested in cryptocurrency investments. Now that Bitcoin’s supremacy over other altcoins has ended, lesser-known cryptocurrencies like the Binance Coin, ATOM, Cardano, etc., offer users a better entry point for long-term financial gains.

| Very Good Reputation | Visit Website | |

| Very Good Reputation | Visit Website | |

| Very Good Reputation | Visit Website |

Consequently, the rising demand for these altcoins is creating demand for more cryptocurrency accounts capable of providing more interest payments for interest-bearing bank account holders. This is where BlockFi’s platform becomes inevitable in the crypto industry. Follow this BlockFi review for getting a thorough idea about the platform’s details.

BlockFi Overview

| Official Website | Business is closed |

| Headquarters | US |

| Found in | 2017 |

| Native Token | None |

| Minimum Deposit | $0 |

| Withdrawal Limit | 100 BTC per 7-day period |

| Withdrawal Fees | 0.00075 BTC |

| APY | Max 8.6% |

| App | iOS and Android |

| Customer Support | Chat Bot, Phone Support, Raise a Ticket |

Summary of BlockFi

- BlockFi allows its registered users to earn compound interest on digital assets or crypto assets, like BTC, LTC, ETH, USDT, USDC, GUSD, and PAXG.

- It keeps crypto deposits secure.

- The platform is available in most countries.

- Allows users to withdraw money anytime but is limited to one free withdrawal (it also allows one free crypto withdrawal) per month.

- BlockFi provides an attractive platform for both beginners and professional traders.

What is BlockFi?

Prior to starting BlockFi, it is a private New Jersey-based crypto assets custodian founded in August 2017 by Flori Marquez and Zac Prince. The platform allows its registered customers to take USD loans against their crypto holdings. Thus, it is a bank-like platform for cryptocurrency traders. By depositing crypto assets into their BlockFi account, traders can easily earn interest rate @8.6%, spend their cryptos, and trade cryptocurrencies (buy or sell crypto) without paying any cost for minimum balance or hidden fees (the platform no longer has a minimum account balance required to earn interest).

The company has raised $158.7 million so far in Series C funding. BlockFi is considered one of the world’s best high-interest crypto savings accounts. BlockFi interest rates are quite competitive in the industry.

How Does BlockFi Work?

BlockFi is a cryptocurrency exchange platform and the best crypto wallet (digital wallet), which serves both individual traders and businesses as a whole. It allows traders to fund their savings account with crypto or stablecoins and USD.

The platform is more like a spread business that makes money by borrowing capital at a specific interest rate (interest rate varies by currency type and fluctuates with market values) that it pays to its registered users and lending capital at a high rate that it offers for various loans backed by cryptocurrencies like BTC or ETH.

BlockFi Product and Services

The platform offers the following BlockFi product and/or services to its users:-

BlockFi Interest Accounts: This is the highlighted feature that BlockFi advertised when it first came into existence. The BlockFi interest account or BIA works much like a traditional investment scheme, or savings account on which the account holders earn interest on their investments or savings. With the BlockFi Interest accounts, you can earn interest on crypto deposits and fund your account with crypto or fiat currencies. As of February 2021, BlockFi pays 6% APY on BTC deposits, 8.6% APY on GUSD and USDT deposits, borrow cash, and 4.5% APY on ETH deposits.

The exchange pays interest to its customers by lending assets to corporate and institutional borrowers with high collateral. It also stores reserves with New York trust company Gemini to easily fund its customers’ withdrawals. However, traders are limited to one stablecoin and one digital currency withdrawal from the BlockFi interest account, after which each withdraw will be charged.

Funds Borrowing: BlockFi lets its registered users borrow funds against their crypto holdings, paying as low as 4.5% APR on them. Many crypto users like to hold their cryptocurrency holdings instead of selling them; for them, it provides an excellent platform to use those holdings as collateral to borrow funds. As of February 2021, the BlockFi requires traders to maintain a 50% LTV (loan to value) ratio for borrowing US Dollars.

However, the LTV ratio should not fall below 50% LTV as BTC prices fluctuate rapidly, and if the BTC prices suddenly drop, traders may need to deposit more BTC as collateral to secure their BlockFi loans. With BlockFi, traders can receive their loan on the same business day they deposit the collateral to BlockFi. The traders can readily access their consumer loans if the collateral is with the exchange.

Moreover, the platform allows the borrowers to pay back their cryptocurrency loans as they wish to as they can pay off a portion of the balance of the total amount at a time as per their convenience.

Trading Cryptocurrencies at BlockFi: BlockFi trading allows effective digital assets trading (BTC, LTC, ETH, PAXG, etc.) or stablecoins trading (USDC, USDT, GUSD, and PAX) at competitive prices. As soon as the traders execute a trade (buy or sell) and have cryptocurrencies in their accounts, they will start earning some interest. BlockFi emphasizes instant trade, at better pricing than its competitors, with immediate interest accrual.

Institutional Services: BlockFi links the cryptocurrency world with the institutional world by allowing its registered users to enjoy secure cryptocurrency trading, borrowing or lending crypto coins, earning returns on their holdings (HODL), etc. It is an amazing BlockFi offer that appeals to various other services offered by banks, brokerage firms, etc., with its robust regulatory compliances and lending inventories backed by leading institutions, thereby offering various traditional institutional services to the global cryptocurrency market.

Thus, institutions can access similar products and traditional financial services at BlockFi, which they access in the traditional finance industries like margin lending, shorting, and reporting. Thus, BlockFi offers its core services to the cryptocurrency market, investment funds, and market makers. Some of these institutions use BlockFi for borrowing money, while others use them to store or invest their holdings while earning huge interests therefrom.

BlockFi Bitcoin Rewards Card: BlockFi is planning to launch its first-ever BTC rewards credit card that will let clients earn 1.5% back in BTC as well as earn Bitcoin on every purchase they make. The ‘Bitcoin rewards credit card’ will be linked to the users’ BlockFi account (an annual fee of $200), which will let them spend money from their BlockFi account in BTC rewards card outlets.

Traders can sign up for the ‘BlockFi Bitcoin Rewards Credit Card’ account by signing up for a ‘BlockFi Interest Account’ after completing the registration procedure, funding their BlockFi accounts, and signing up for the BlockFi waitlist.

BlockFi Bitcoin Trust: After successfully launching its products and services and making a significant mark in the cryptocurrency industry, BlockFi has set its foot towards another milestone development in the future; as per current regulations, it is all set to launch a Bitcoin ETF (exchange-traded fund) called the ‘BlockFi Bitcoin Trust’ and has registered for the same with the SEC in January 2021 (as per company claims).

The ‘BlockFi Bitcoin Trust’ would hold (or invest) an equal number of Bitcoins as its holdings. Registered users would be able to buy crypto ETF shares in the future just like the way they purchase any ETF, and the value of the ETF would remain with the underlying Bitcoin assets. Nominal management (annual) fees would be charged from the ETF holders depending on the Bitcoin price as it rises or falls.

BlockFi Mobile App: BlockFi offers an excellent mobile app (alternative to desktop platform) compatible with iOS and Android devices. This makes it easier for tech-savvy mobile users to manage their BlockFi accounts from anywhere and everywhere. They can easily access account balance (to stay tuned into your cryptocurrency management), execute Bitcoin trades, borrow money, start investing, and even earn passive income (earn interest) just with a simple click.

BlockFi – Key Features & Benefits

Advertisement

BlockFi offers the following features and benefits to its crypto native clients.

- An easy-to-use platform where traders have full control over their accounts; a rather transparent platform without any hidden fees or minimum balances.

- iOS and Android compatible mobile app.

- Multiple options to earn profits by leveraging funds.

- Easy maintenance and quick access of account.

BlockFi Pros and Cons

| Pros | Cons |

| Easy-to-use platform | FDIC asset insurance not available |

| Regulated exchange | Not supported by some countries |

| Commission free | Crypto savings accounts are not protected in case of exchange failure |

| Automated trades | APY and loan rates are volatile |

| Easy withdrawal | |

| Up to 8.6% compound interest on holdings | |

| No monthly fees |

How to Create a BlockFi Interest Account?

Creating a BlockFi interest account is simple; all that the users need to do is register on the Blockfi’s crypto asset platform and transfer their preferred cryptocurrencies into the account. As soon as there are crypto coins in the account, the traders will start earning interest rates compounded monthly. BlockFi clients can create an account.

Sign up for BlockFi Account

The Sign-up process for BlockFi account is quite easy and does not take hours to complete the steps. To get started on the BlockFi platform, users first need to create a crypto trading account on the platform, minimum deposit money into that account, and then they can automatically start trading. Here is a step-by-guide that helps traders to get started on the BlockFi exchange.

Create an Account: To create a user account, traders must visit the official website and click on the “Get Started” button on the top right-hand corner of the page. On clicking the button, a registration form will open up that has fields like full name, email address, and a strong password.

Once these fields are filled in, an auto-generated email will be sent from the BlockFi business development teams to the users’ given email address; this is a confirmation mail and need not be replied to; the traders only need to click on the link sent into their mail to confirm the email address.

The signup process ends here, and the user can now log in to his business account (or investment account) with these newly created credentials.

Verification: After the initial registration process is complete by entering your personal information, traders will now be asked to complete the KYC verification procedures, which require them to upload a clear government-issued ID like passport or driving license or any other suitable IDs.

Deposit Funds and Start Trading: After completing all the verification processes, traders can fund their accounts via a bank account transfer, stablecoin transfer, or cryptocurrency transfer. They can directly start trading without any restrictions. Moreover, if users have cryptocurrencies, they will start earning interest on them accordingly or may also use them as collateral to borrow money.

BlockFi Fees

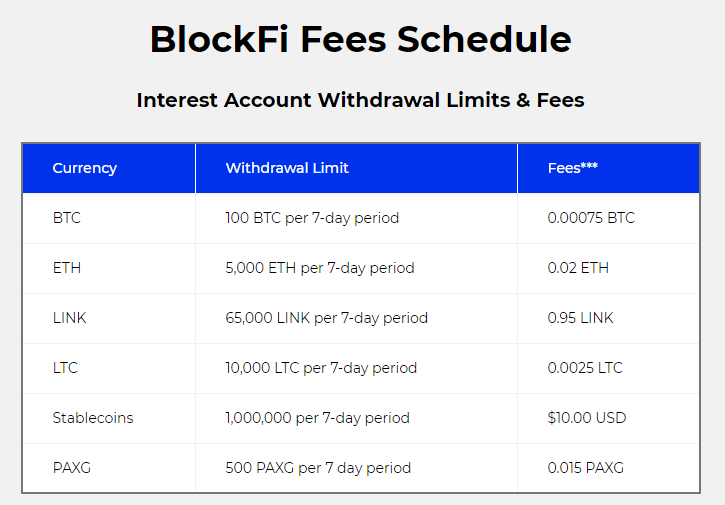

Though BlockFi crypto exchanges do not charge any fees for executing a trade on the platform, certain fees are charged for most withdrawals. However, every fee charged by the platform appears upfront on the platform’s website, and as such, there are no hidden BlockFi fees whatsoever. The first withdraw made in a month is free, but from the 2nd onwards, BlockFi charges a fee on every withdrawal as follows:

- For Bitcoin– a 0.0025 BTC fee is charged, and a 100 BTC withdrawal limit is allowed per 7 days.

- For Ethereum– 0.0015 ETH fee is charged, and a maximum of 5,000 ETH withdrawal limit is allowed per 7-day period.

- For Litecoin– a 0.0025 LTC fee is charged, and a maximum of 10,000 LTC withdrawal limit is allowed per 7-day period.

- For Stablecoins– a $0.25 fee is charged and the limit per 7-day period is $1,000,000.

- For PAXG– a 0.0025 PAXG fee is charged, and a maximum of 500 PAXG withdrawal limit is allowed per 7-day period.

BlockFi Interest Rates

As soon as traders register themselves on the BlockFi exchange and fund their accounts with cryptocurrencies, they start earning interest @8.6% compounded annually for the more crypto assets.

BlockFi Loan

As per reviews about BlockFi, the platform allows its registered users to apply for crypto-backed loans. Borrowers can use the assets held by them in their BlockFi company accounts as collateral for bitcoin loans (origination fees may also apply). There is no need to get their financial assets involved in this, which is the best part of the APR loans offered.

The APR or the annual percentage rate for these crypto loans can be as low as 4.5%, which is quite low compared to other traditional (loan-granting) platforms. You can check the most popular bitcoin loan platforms here for more details.

Is BlockFi Safe?

According to reviews of BlockFi, it is one of the few U.S.-based cryptocurrency exchanges that operate within the U.S. federal and state regulations, making the platform safe in all respects.

However, it is also true that the BlockFi client can store their funds or money deposited in the BlockFi account are not FDIC or SPIC insured, but that does not make it less safe because the platform employs several other security measures to protect the clients’ money, which make them BlockFi insured.

Apart from its state-regulated custodian, BlockFi is also backed by other companies like Valar Ventures, Coinbase Ventures, Morgan Creek Capital Management, etc., which makes it more reliable and trustworthy.

BlockFi Review for Security

The BlockFi team employs the following security measures to keep the platform safe from hackers.

- It keeps all its reserves with its third-party custodians, like Gemini, Coinbase, and BitGo for maximum security.

- The US government regulates all its investments; the BlockFi buys SEC-regulated equities only and CFTC-regulated futures with a risk management and credit analysis process.

- Before giving a loan, BlockFi makes it mandatory for borrowers to provide collateral of at least 50% of the assets.

- It offers a self-service security feature called ‘Allowlisting’ that allows the crypto-curious clients to ban withdrawals or restrict them to certain addresses. This measure prevents unauthorized intrusions into their BlockFi account.

Customer Support

The BlockFi customer service team is very prompt and responsive and is available 24/7. It readily answers the queries raised by the traders (online consumer lender) at any time during the day via email or phone calls.

There is a dedicated customer service number given on the platform’s official website for any investment advice that the traders might need (you can contact BlockFi anytime).

Our Verdict

All the indicators that we used for making this BlockFi review support our conclusion that the platform is legit, and there is very little evidence that can suggest otherwise. Whether BlockFi is worth investing in depends on the traders’ risk profiles and how they are handling their crypto coins. The BlockFi rates for interest that the platform offers are quite competitive, and so are the fees. Therefore there is no reason not to give BlockFi a ‘Thumbs Up.’

FAQs

Is BlockFi Legit?

As per our review on the BlockFi features like instant transactions, history, team, customer support, and business model, we found the platform to be an absolutely legit one.

How Much Can I Earn With BlockFi?

It depends on the amount of funds that you can risk to crypto trading. The more you risk the higher will be your chances of earning profits.

Can You Lose Money on BlockFi?

Like all other cryptocurrency exchanges, BlockFi also has inherent risks associated with it and so it is highly likely that you can lose money if you do not trade strategically. However, it prioritizes crypto fringe clients’ funds and makes sure that their client money is kept at the top of the capital stack even over employee capital or BockFi equity.

Does BlockFi Require KYC?

Yes, BlockFi requires KYC compliances after the initial registration is completed. It requires the traders to upload scanned documents of government-issued ID cards.

How to Open an Account With BlockFi?

Go to the BlockFi website and sign-up with personal information. The platform conducts a quick online verification process via email and phone numbers. After this process, the user can choose which account to open on BlockFi.

Who is Eligible to Use BlockFi’s Services?

Advertisement

A list of sanctioned and watchlist countries/US states have been provided on the website. This list gets updated periodically as people from more areas become eligible to use BlockFi services according to BlockFi review. Besides this, every owner of Bitcoin assets is suitable for BlockFi services.

What Types of Accounts Does BlockFi Offer?

BlockFi Trading Account and BlockFi Interest Account are the two types of user accounts offered by BlockFi.

Does BlockFi Offer Business Accounts?

Information on BlockFi Business Accounts is currently unavailable. However, the platform is expected to launch the business accounts soon.

How to Get in Touch With BlockFi Customer Service?

The Client Service Representative at BlockFi is available from 9.30 AM to 5 PM ET, from Monday through Friday. The best way to get in touch with BlockFi customer service is to call their toll-free number – 888-798-6139.

Which Countries Does BlockFi Support?

BlockFi supports leading economies where cryptocurrency markets are active and decently regulated.

What is BlockFi Withdrawal Time?

The maximum time taken by BlockFi for withdrawals is 1-5 business days.