Imagine a digital goldmine wherein the amount of gold you can dig up is reduced by half every four years. Similarly, Bitcoin halving is an integrated function designed to affect Bitcoin’s circulation within the ecosystem. This revolutionary cryptocurrency has a built-in mechanism that throws a curveball at miners every four years by cutting the mining rewards to 50%.

This deliberate reduction aims to regulate the supply of Bitcoin and counteract inflation by maintaining scarcity. But why would anyone do this? The answer lies in the heart of Bitcoin’s design – to create a crypto with a limited supply, similar to precious metals like gold.

This concept of halving might sound complex, but understanding its impact is crucial for anyone interested in the future of Bitcoin. It affects not only miners who secure the network but also investors who hold Bitcoin. So, buckle up and get ready to explore the fascinating world of Bitcoin halving and its potential consequences!

Understanding the Basics

Let’s try to simplify and break down the mechanics behind Bitcoin halving to understand how this process works.

The Mechanism: How Block Rewards are Halved

In the Bitcoin network, miners are responsible for validating transactions and ensuring the integrity of the blockchain. In return for their efforts, they receive newly minted bitcoins, known as “mining rewards.” However, every four years, these rewards are reduced by half, a pre-programmed event known as Bitcoin halving.

This process is crucial and designed to ensure control of the supply of bitcoins and decrease the rate at which new ones are created over time. This provides the long-term sustainability and stability of the Bitcoin network, as it helps to prevent inflation and maintain the value of existing Bitcoins. By limiting the supply of BTC to a maximum of 21 million, Bitcoin can function similarly to precious metals like gold, where scarcity contributes to value. As such, the halving process is an essential component of the Bitcoin ecosystem and is closely monitored by investors, miners, and other stakeholders.

Frequency of Halving

Following the explanation of block reward halving, let’s explore how often this halving occurs. In Bitcoin, a pre-programmed event roughly cuts the mining reward in half every four years.

The reward for mining a Bitcoin block was initially set at 50 bitcoins. After roughly every 210,000 blocks, this reward is halved. The first bitcoin halving event reduces the reward to 25 bitcoins, 12.5 bitcoins, and so on. This process continues until the maximum supply of the cryptocurrency is achieved.

Significance of Halving

Bitcoin halving plays a critical role in managing long-term value and regulating the creation of new coins to mitigate inflationary pressures. It also aims to combat inflation, which refers to decreased purchasing power over time.

Before understanding the significance of halving, let’s know why it was integrated into the Bitcoin ecosystem from the start. Bitcoin Halving was introduced as a fundamental feature of Bitcoin Protocol during the launch to regulate the creation of new BTC coins. This decision aimed to mitigate inflationary pressures.

Controlling Bitcoin Supply

By limiting the inflow of new bitcoins entering circulation, halving helps to maintain and reduce the pace at which new Bitcoins are generated. This could prevent inflation from encoding the value of the existing bitcoins and lead to increased bitcoin scarcity.

Potential Price Impact

The decrease in the rate of producing new Bitcoins could lead to a bullish trend in the future price of Bitcoin. However, it should be noted that while halving may lay a foundation for an increase in Bitcoin’s prices, market dynamics play a huge role. These may include investor sentiment, adoption rates, regulatory developments, etc.

Impact on Mining Difficulty

As a result of halvings, miners may face reduced block rewards, making it hard for them to maintain their mining operations. Due to the changing conditions within the Bitcoin system, individual miners’ profits may fluctuate.

The Recent Halving

Advertisement

The latest Bitcoin Halving occurred on April 20, 2024. The exact date was anticipated with varying predictions, but it was finally confirmed on this day when the block height reached 840,000.

Predicting the exact date of a Bitcoin halving is akin to forecasting the precise time of sunrise tomorrow. While the general occurrence can be anticipated due to the structure of Bitcoin mining, the exact timing is less predictable. Bitcoin aims to create a new block approximately every 10 minutes. However, just as the sun may take a few extra moments to rise above the horizon, the actual block creation time can vary, causing slight deviations in the halving date.

These minor variations make pinpointing the precise date of future halvings complex. Based on historical data and the pre-programmed block height, the next halving is projected to occur in 2028.

How different groups are affected?

Bitcoin Halving affects different groups differently. While it slashes rewards for miners, it allows investors to fetch better profits.

Miners and reduced rewards

The most immediate effects are on miners. What started from 50 BTC is down to 3.125 BTC in 2024. Small miners are expected to run out of sufficient resources to keep up their pace. Others could adapt to the situation and craft a new strategy altogether.

Investors and potential price increase

The potential long-term impact for investors could be positive. Limiting BTC supply brings scarcity, which, in economics, often leads to an increased price. While there is no guarantee, some investors believe this could lead to an increase in price.

Historical performance after Halving Events

Bitcoin was around $12 when halving happened for the first time in 2012. Bitcoin prices have already reached an all-time high of $75,830 this year. There have been surges after the Halving event at a certain time, if not instantly.

Past price increase

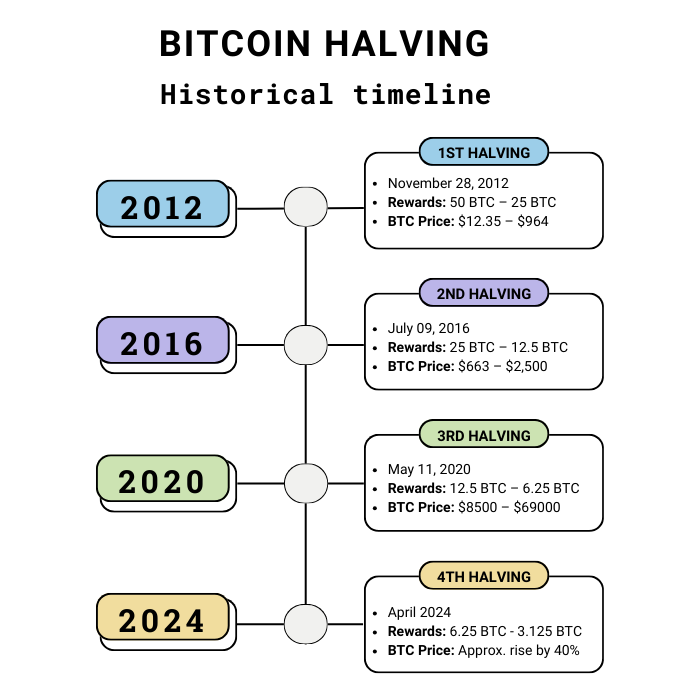

- Before first halving in 2012 BTC was listed at $12.35 and after it was over $900.

- In 2016, we saw a jump from around $650 to over $2,500.

- And last, in 2020, the third Bitcoin Halving incident caused a surge from $8,500 to a peak of nearly $70,000 in late 2021.

Comparison to past performance

BTC is already around $50,000, a point where the third Halving event left, given that a surge in Bitcoin price after the Halving event has happened over the period. Analysts have predicted that the token may end 2024 as high as $70,000.

Additional considerations

The Bitcoin market will not solely be driven by Bitcoin Halving. Other factors are going to come into the picture.

- The rise of meme coins and AI tokens along with altcoins.

- The rate at which cryptocurrencies will get adopted.

- How strict regulations turn out to be.

Criticisms of Bitcoin Halving

As Bitcoin halving plays a critical role in maintaining Bitcoin’s scarcity and long-term value, it will not be unaffected without criticism.

- Centralized Mining: Reducing block rewards can lead to mining centralization, making it less profitable for smaller miners to participate. This can lead to consolidation of mining power in the hands of larger entities, undermining Bitcoin’s decentralized ethos.

- Security Risks with Lower Incentives: There are concerns about security risks, as miners may need to be incentivized more to secure the network correctly. Critics also worry about market manipulation where some traders with large amounts of Bitcoin, also known as whales, may exploit halving events for profit.

Bitcoin Halving timeline

Here’s how Bitcoin Halving has rolled out so far.

Conclusion: Bitcoin Halving – A Double-Edged Sword

Bitcoin halving is a deflationary mechanism that cuts down the supply of Bitcoin by half. This event occurs every 4 years and makes Bitcoin a deflationary currency. It will affect different types of community members differently. This includes investors who will likely take profits home and miners who will experience a hefty reduction in their incentives for their work.

It has often helped holders navigate digital inflation – different from actual economic inflation that a country suffers from. So, despite criticisms and the extent to which it paints a gloomy picture, Bitcoin Halving brings a bullish run for the Bitcoin ecosystem.

FAQ

Can I make money from the BTC Halving?

Given the historic price movement, you can profit from Bitcoin halving if you hold Bitcoin and wait for the market to make positive changes. Before considering this investment, it is important to note that many other market factors also drive the price of BTC.

What will the BTC price be after the Halving?

The predicted estimated price of BTC is $70,000 by the end of 2024, fueled by Bitcoin Halving. Or, as high as $90,000.

Should I buy Bitcoin before Halving?

Advertisement

Many believe buying Bitcoin before halving is profitable as BTC price can rise any time down the road given its historical context. But, purchases or investments in Bitcoin, or any other cryptocurrencies for that matter, should only be done after thorough research and according to one’s risk assessment.

How many Bitcoin Halvings are left?

Theoretically, Bitcoin Halving will go on till 2,140. That is 116 more years and 29 more Halving events on paper.

Will BTC go up after Halving?

Predicted estimates do indicate that the value of BTC may increase by around 40% after the Halving event.