After the successful trajectory of Bitcoin ETFs, the ETFs for Ethereum’s ETHER, too, were finally approved on May 23, 2024, and officially launched in the U.S. on July 23rd, 2024.

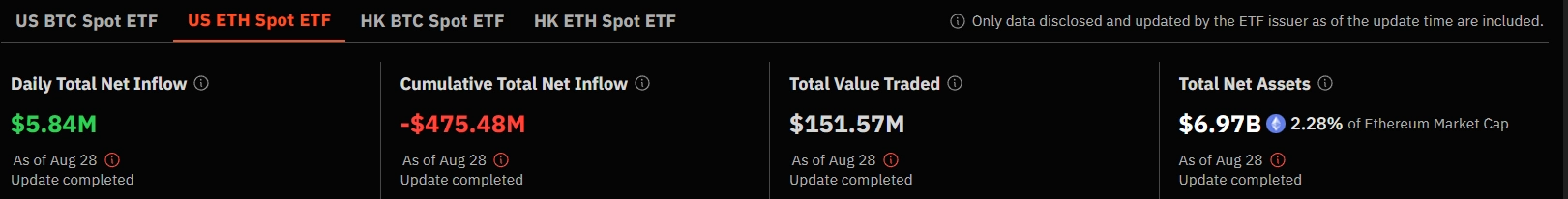

As of August 28, the BTC ETF had total assets of $54.32 billion, which amounts to 4.64% of the total BTC market cap. The Ethereum ETF’s total assets are 6.97 billion, which is 2.28% of the Ethereum Market Cap as of August 28. With Ethereum ETF completing over one month of its launch, here’s what the performance, trends, issues, and predictions surround ETH ETFs in our July-August report.

ETH ETF: Big Performers

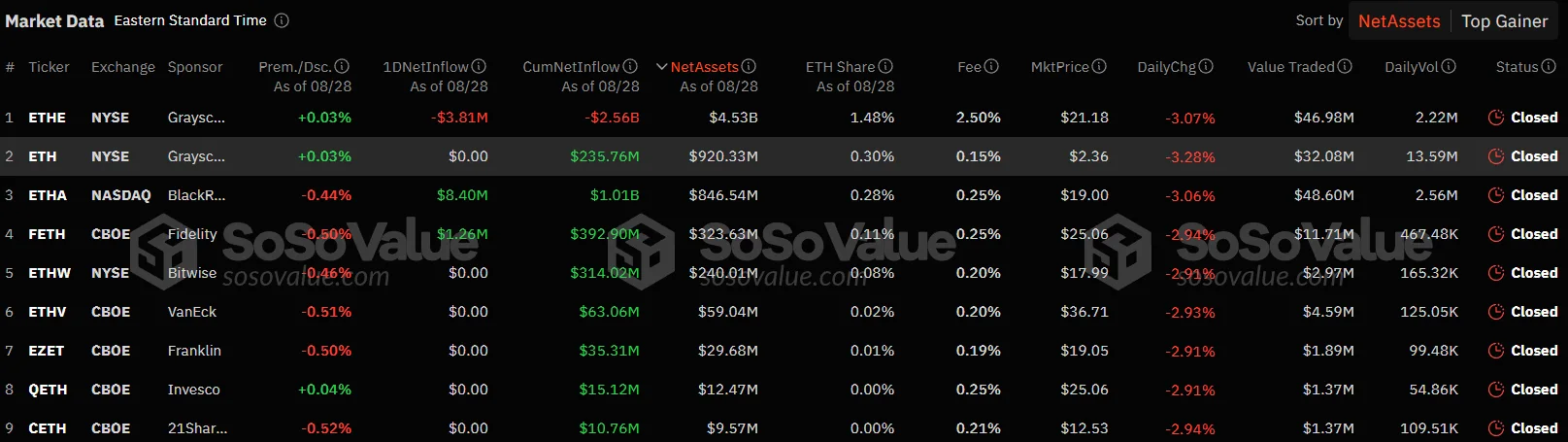

When ETH ETFs were first launched, these 9 ETFs were the first ones to hit the market includes BlackRock’s iSHares Ethereum Trust (ETHA), Fidelity Ethereum Fund (FETH), Bitwise Ethereum ETF (ETHW), Grayscale Ethereum Trust ETF (ETHE), Grayscale Ethereum Mini Trust (ETH), 21Shares Core Ethereum ETF (CETH), VanEck Ethereum ETF (ETHV), Invesco Galaxy Ethereum ETF (QETH) and Franklin Ethereum ETF (EZET).

Some of the big players in the ETH ETF space have made short-term offers for traditional finance investors to get fair exposure in the relatively new space. BlackRock’s iSHares Ethereum Trust ETF was offered for a 0.12% starting fee and a post-waiver fee of 0.25% (for 12 months or until $2.5 billion AUM). Fidelity Ethereum Fund ETFs were available for a 0.00% starting fee and a post-waiver fee of 0.25% (until 31/12/2024).

Also Read: ETH ETF outpaces Bitcoin ETF in institutional investment race

Bitwise Ethereum ETF was available for a 0.00% starting fee, a post-waiver fee of 0.20% (for 6 months or until $0.5 billion AUM). Grayscale Ethereum Trust ETF was available for 2.5% flat fee (ETHE is an ETF conversion of the Grayscale Ethereum Trust that predates the release of ETH ETFs). Meanwhile, its Mini Trust ETF was available for a 0.00% starting fee, a post-waiver fee of 0.15% (for 6 months or until $2 billion AUM).

As of now, the three largest ETH ETFs have over $300 million in AUM, with BlackRock’s ETHA alone attaining $1 billion in AUM.

Also Read: BlackRock ETF Holdings Surpasses Grayscale ETF Holdings

Fidelity and Bitwise have already reached $300 million in AUM. Meanwhile, Grayscale’s Mini Trust ETF shows a cumulative total net flow of $235.76M.

Advertisement

Issues with ETH ETF

With Crypto ETFs, traditional financial investors can also get exposed to the crypto space without having to create a crypto wallet, find their way out on crypto exchanges, or even worry about the wallet’s security. But that doesn’t take away the fact that several native crypto investors are not giving in to the ETH ETF, and the issue happens to be the absence of staking rewards.

However, traditional investors also find a limitation in the ETH ETF investment, as reported by Onchain Foundation, “Traditional investors might also encounter limitations with Ethereum ETFs, such as the current absence of in-kind creation and redemption options, as well as the lack of available options trading”

Predictions:

Predicting the future of the ETH ETF would be a slippery slope. However, even as other ETH ETFs are performing well, Grayscale has been seeing a constant outflow, as opportunistic traders who purchased ETHE shares at a discount are realizing a profit on their trades and selling them off, as reported. Thus, once the outflow is balanced, ETH ETFs can witness prolonged flows over time.

Many are speculating that future U.S. crypto ETFs will join the Wall Street party over the coming years. However, considering how promising the journey of ETFs has been in just one month and the current US election fervor that is increasingly trying to appeal to the crypto industry, Solana ETFs in the US after its successful approval with Brazil might also be a possibility in 2025.

All in all, it had been a great start for Ethereum ETFs in the first month since its launch in July, and following this performance, other crypto ETFs might just be around the corner!

Advertisement

Also Read: Elon Musk & Donald Trump Unfiltered: Crypto, Elections & More