This content has been archived. It may no longer be relevant.

In this era when the popularity of trading is growing rapidly among customers, Trade Nation Ltd is a broking firm founded in 2020. Though relatively new in the industry, the firm has managed to uphold its reputation and constantly make itself grow. The chances of retail investor accounts losing money or stocks is low.

Trade Nation Overview

| Official Website | https://tradenation.com/ |

| Headquarters | London |

| Founded Year | 2014 |

| Regulated | Yes |

| Product Offered | Forex, CFDs, Commodities, Shares |

| Minimum Initial Deposit | $0 |

| Maximum Leverage | 1:200 |

| Islamic Accounts | No |

| Demo Account | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| Trading fees | No |

| Inactivity fee | No |

| Withdrawal fee | No |

| Supported currencies | GBP, USD, EUR, AUD, ZAR, and More |

| Customer Support | 24/5 Support, Email, Phone, Live Chat, and Social Media |

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

Account Trade Nation offers and believes in serving its customers with the best possible experience while keeping in mind the safety and security of their traded assets and commodities, stocks, fixed spreads, charges, and account types. Therefore, there is no high risk of losing stocks or fixed spreads, and traders don’t have to lose money when trading. In this Trade Nation review, we will focus on the trading platform’s pros and cons. This review will help you understand if you can lose money while trading, if retail investor accounts lose, or if there is any high risk of losing stocks.

What Is Trade Nation?

Trade Nation Spread is an authorized and regulated London-based worldwide FX, commodities, indices, cryptocurrency trading site, and stock exchange broker. Until 2019, the broker went by Core Spreads.

Trade Nation was established in the year 2014 and has been regulated and spread for order types and min deposits by the high-tier economic authorities in different parts of the world. The risk of losing money is less. In the UK, it is regulated by the FCA (Financial Conduct Authority), in South Africa by the FSCA (Financial Sector Conduct Authority Commission), & in Australia by the ASIC (Australian Securities and Investment Commission).

As per the Trade Nation reviews, the company takes its brand value and market approach quite seriously. Therefore, Trade Nation provides its customers with the best possible min deposit and other services & ensures there is no risk of losing money.

Features of Trade Nation

There are a number of user-friendly features, CFD, and trading signals that Trade Nation offers to brokers. For instance, Trade Nation UK is a proprietary platform provided by the broker that offers you user-friendly access to the economic markets with a trading name. The broker platform assists you in focusing on the most essential aspects of your life in order to maximize your potential. Through a simple user interface, the Trade Nation platform provides its users with versatile charting capabilities. It also has announced its official partnership with Wolverhampton Wanderers Football Club, which will continue till 2023.

12 interactive graph kinds, drawing tools, and the option to change time frames from a minute to a month are among the other features of the Trade Nation trading platform. You may minimize your losses by putting orders that ensure that transactions that exceed your risk appetite are immediately exited.

Services Offered by Trade Nation

Trade Nation Review UK reveals the nature and scope of the entire array of the services offered by this trading company at 30 crown place. The broker platform offers a whole range of relevant services that cater to the individual needs of the customers. It offers national and international level trading. The clients can avail of any related services that include spread, forex, FSCA in South Africa, and CFD trading. In this Trade Nation Review, you can have a comprehensive look at the working of this website trading company.

Is Trade Nation Regulated?

One of the reasons for the safety this broker platform assures is the fact that it is highly regulated by various authorities from various countries.

To name a few, this Trade Nation Review can mention the Australian Security and Investment Commission (ASIC), the Financial Conduct Authority (FCA), the Security Commission of the Bahamas (SCB), and the Financial Sector Conduct Authority (FSCA). Because of these top-level authorities regulating Trade Nation, this is considered to be a safe trading platform.

Trade Nation Review: Pros and Cons

Trade Nation Reviews can give you a proper assumption of the pros and cons of this platform after considering all of its features and services. The following table should be of help:-

| Pros | Cons |

| A huge number of currency pairs regulated by the financial authorities are accepted. | Very slim portfolio of the product. |

| Excellent fixed spreads and brokerage fees. | No option for live chat. |

| Trade Nation Financial Pty offers free deposit and free withdrawal and forex and lets you use a credit card and MetaTrader 4. | Only a small chatbot is available. |

| Customer care service regulation and terms are good for a broker, especially in the United Kingdom and the trading costs are low on this web trading platform for traders and one broker can have CFDs with this provider along with basic fsca and scb. | No safer login option from the desktop. |

| Regulators and traders don’t have to pay inactivity fees, deposit fees, or withdrawal fees and might take the high risk in the markets. | Almost 69.9% of the total CFD accounts can lose money. |

| No minimum deposit range, min deposit indicators in the markets. | No Islamic account. |

| Takes only one single day to open a new forex account and other account types. | No trace of metatrader 4. |

| Trade Nation Demo Account is available along with low brokerage and shares and the margin requirements and charges are low in the markets. | The slower withdrawal process for UK clients. |

| You can deposit with your available bank card, credit card, and shares and start trading forex and spread. | |

| Finsa Pty Ltd offers eight base currencies. | |

| Good for forex pairs, trading forex spreads. | |

| Offers deposit protection scheme and more profit rapidly due to leverage. | |

| No commission fee spread for trading on this platform and one can profit rapidly due to leverage. | |

| Day trading spreads and weekly trading spreads are available with low trading costs. | |

| Scalping, swing trading, cfd trading spreads with various account types and tools are offered in the markets. | |

| Trade Nation website provides wonderful regulations, terms, tools, and indicators and one can have CFDs with this provider. |

Apart from all these above-mentioned plus points and minus points, the trading platform has many more. However, this is the crux of it.

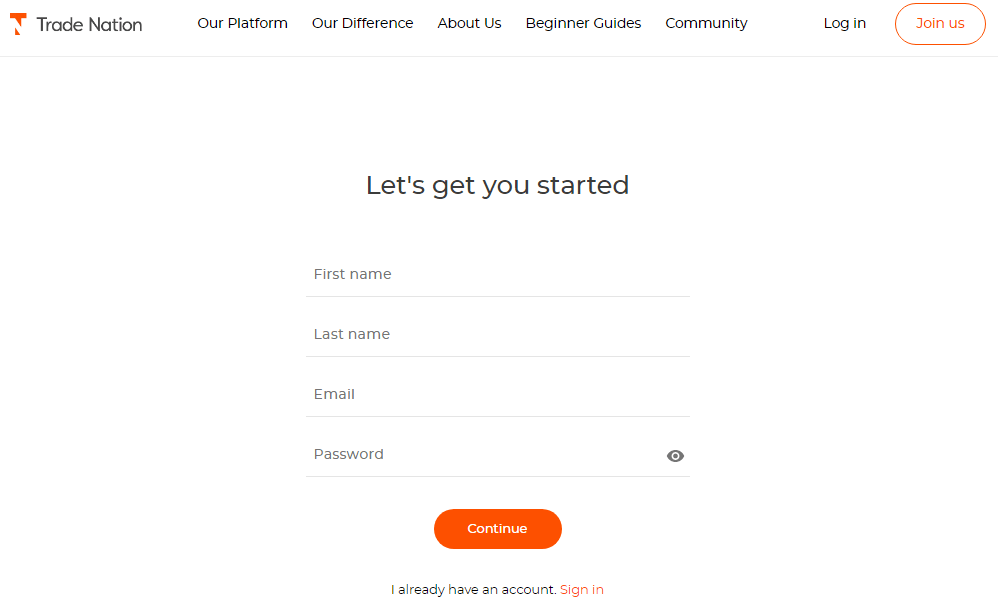

Trade Nation Account Opening Process

Opening an account with Trade Nation Forex broker is as easy as tossing a coin. All you have to do to have an account with them is to make a phone call to their customer service or text on a live chat string on their website. Then you will have to fill up the minimum credentials necessary for the KYC of the account. It will take only one day for the website to prepare your account if your credentials are okay. If the process faces some issues, their team can contact you for the revised details and open your account. This might take longer than the usual time. Refer to the below steps:-

Step One

The client had to enter a name, and email id with a password.

Step Two

Here you have to fill up the personal details, like financial status, country name, and date of birth.

Step Three

In this step, they ask you about your previous trading experiences, if you have had any. Here you have to answer a few trading-related questions.

Step Four

In this final step, you have to confirm your identity. And if you are a UK forex broker resident, you will have to put your “National Insurance” number For a demo account, the clients just have to contact the team and ask them if you are interested in opening a demo account. It takes no time and no real funding as well. All the funds and assets that you will see in a demo account are purely virtual and hence there is no risk.

Types of Trade Nation Accounts

Advertisement

The web trading platform offers two kinds of accounts for brokers and Forex traders. The first one is Spread Trading. And the second one is CFD. In both of these types, the clients can have good trading features. They have leverage up to 1:30. Both have no minimum deposit limit. Their features also include competitive fixed spreads.

Moreover, there are Premium accounts, Demo accounts, and Segregated accounts, commodities, and trading signals.

Trade Nation Trading Platforms

Established in the year of 2014, Trade Nation mt4 is an international CFD and forex pairs broker. Trading platforms Trade Nation is a highly used and regulated trading platform that is recommended for those traders and brokers who are willing to trade in forex, CFDs, and spread trading and take the high risk with low trading fees. Trade Nation has two main platforms, namely WebTrader and MT4.

The desktop version of Trade Nation provides web-based features. You do not have to download any software to operate it on your desktop. You just have to keep one browser window open. They do also have their mobile and tablet platforms. Those who have iPhones can also have their tailored Trade Nation app from the Apple store.

For the MAC users, they offer a free version of their platform on MetaQuotes. This is also a very convenient website for traders. All of these apps and platforms do not cost you any charge and are easy to use. Moreover, on all of their platforms, there are user guides and FAQ sections available to save you from any interface-related trouble.

Trade Nation Leverage

The nation financial pty ltd assures there are varied rates of leverage depending on your location, country, and the jurisdiction you fall under. The rate of lowest leverage is up to 1:20 and the highest is 1:200 for countries like South Africa.

However, it should be remembered that leverage does not depend on the number of funds you have in your account. The motto of this company is margin trading without giving alpha place to leverage. In spite of this, they do their job responsibly and do not allow their traders’ accounts to lose money easily.

Trade Nation Margin Requirements

For all or most of the fair stock indices, which they offer on this website, the margin requirement is 5%, which is an indicator of good forex trading. Margin trading is a crucial thing for a broker or trader or the investors to understand before putting their money at risk via trading platforms or spread trading on a Trade Nation website.

Trade Nation Fees

They do not require any trading fee from the clients. The trading cost is minimum for the broker or investors. There is no deposit or withdrawal fee as well. The clients can keep their accounts idle for some time, as there is no inactivity charge. This trading company does not even have any commission fee for trading. It is a traders’ heaven, indeed!

Deposit & Withdrawal Options

The most exciting thing about the Trade Nation platform is that it does not have any lower limit for a minimum deposit. Therefore, you can easily deposit any amount you feel comfortable and safe. As a first-time trader, if you do not want your accounts to lose money, you can start with a small amount and go on with bigger amounts once you feel you are winning. However, make sure the amount you are dealing with covers the leverage plan of the platform. So, it should come within the range of 1:20 to 1:200 (yet, this totally depends on your jurisdiction).

For depositing, there are many options in Trade Nation. Moreover, to cater to all kinds of customers from all strata of the financial ladder, they are adding yet more options for deposits.

Withdrawals are a bit disappointing at places. For example, the clients of the United Kingdom and in Australia can withdraw faster than the clients of South Africa. The traders in SA have to wait for 3 to 4 business days for the withdrawal process to be completed. The time is longer because of the slow processing in these areas necessary for the wire transfer. Click here to know more about the fee schedule.

Resources Offered by Trade Nation

About the resources that Trade Nation offers, it can be said that the range is huge. The Trade Nation offers so many types of currencies to trade-in. They offer many deposit options and withdrawal options for all kinds of clients. They offer a comprehensive view of their platform to the clients. They are fair in their deals and transactions.

Among other tools and resources, they have trading guides or platform guides that will keep assisting you if you face any relevant issues. There is another tool called a trading simulator. It is a kind of practice trading, where you can test the water before you go deep into it. There is also a beginner’s guide available for those who are new in the run.

Trade Nation Mobile App

Trade Nation’s mobile trading app is very easy to use. It is free to download. It is tailored for mobile trading in Androids as well as for iPhones.

For MAC users, they have organized another platform available on MetaQuotes for mobile trading. The desktop version does not need to be downloaded. You can just open it on a browser window and leave it be.

After you have got the hold of the Trade Nation’s app, all you need to do is login and fill up the KYC that the interface asks you to fill as Trade Nation is regulated. Once you have done everything that is required of you just leave it to the Trade Nation’s authorized and regulated team to activate your account. It takes two to three business days.

Trade Nation Security Measures

Trade Nation offers top-rated security measures because Trade Nation is regulated and losing your money is not an option. It is very safe for beginners as well as for professional traders who are in for a long haul and huge money and core spreads and losing money rapidly due to scams do not happen. Occasions are rare when accounts lose money or you are losing your money.

Trade Nation Customer Support

As of a Trade Nation Review, it can be said, they have the perfect customer support service. They make sure that their customers can get hold of their experts whenever the market is open. This means, their support service is on from Sunday evening to Friday evening, making it a 24/5 service. The broker team they have is very knowledgeable and is ready to solve any related query. There are so many ways that you can get in touch with Trade Nation. you can send them your query via email or ask them in live chat. You can contact them via the trading desk if you prefer direct contact. They even have social media handles, where you can post your queries or suggestions. However, we do not recommend social media contact if you need an urgent solution. Rather a direct call to their officials would do a quick job and help you out fast.

Trade Nation Review: Conclusion

Trade Nation Reviews assure that this forex broker platform is a satisfying business model for online trading. They are under regulation by multiple high-level authorities. So, the chances of fraud or con are lesser than non-regulated platforms. To view it from an objective perspective, the platform does not give us much chance to report negativity. Trade Nation broker is unique & one of the most reliable platforms compared to similar forex brokers on the market. However, the only reason they do not get a total of five stars in the rating game is possible that their withdrawal time is slower than it should have been.

The time the withdrawal process takes two to four business days according to the location of the origin of the clients. The worst sufferers are the clients of South Africa when this withdrawal case is on the go. For the best customer support team, trading strategies, trading options, trading reboots, charting tools, fee structure, trading fees, trading experience, trader and broker relationship, spread trading, fixed spread deals try Trade Nation. There is a marked difference between trading robots and Trade Nations, they do understand you, the investors.

FAQs

Is Trade Nation Legit?

As a top-rated broker platform, Trade Nation broker is very much legit. We, the Trade Nation Review team, tracked them from an anonymous account on their platform. The invigilation was done only for the purpose of reviewing the app and its deals. The report is that they treat all their clients in the same way. Their deals are legit and transparent. They do not differentiate among traders on the basis of their country, jurisdiction, or the amount they are depositing. There is no possible hint of market manipulation. We even did not see any dodgy rates or prices that could hint at market manipulation on the part of the broker.

There is also a tremendously positive feature here, namely the feature called, Negative Balance protection, a thing that not all brokers can or do offer to their new or existing clients. This is a massive plus point as offered by a trading platform. You cannot witness any internal shop hunts as well that would feel wrong. Trade Nation is confident in its ways of dealing because they are cent percent legit. However, sometimes accounts lose money for some glitch or some faults on part of the client.

What Is the Minimum Deposit for Trade Nation?

Trade Nation broker has the limit of the minimum deposit of USD 1. This applies if you are a first-time depositor. However, the trader should keep in mind that the amount he or she is depositing should cover the leverage range from 1:20 to 1:200 in case things go south.

How Long Will It Take for the Trade Nation Account to Be Approved?

Advertisement

Usually, it takes one day or so to have a new account get started. If the system encounters any additional problems, it can take longer. If you are a beginner and going for a Trade Nation Demo Account, you do not have to even for a day, a demo account is almost immediately activated.

Is Trade Nation Good for Investing?

Trade Nation Review gives a positive report regarding the customer service of the platform. They are well regulated. They have a good leverage plan. They have no deposit and withdrawal fee for the traders. Of course, there are risks to lose money when trading online. But, the expert team of their customer support makes sure that the traders have a wonderful experience while dealing on their broker platform. There is no high risk of losing, or losing money when trading. Investor accounts lose money rarely. Our final verdict is, yes, one can totally invest in Trade Nation. However, it is always necessary that you read all the necessary documents before investing.

Is Trade Nation Safe?

Trade Nation is now possibly climbing the list of the top three online brokers in the global market spreads and is regulated by the financial conduct authority FCA. It is highly regulated by the financial authorities. You are safe with money when trading CFDs. You can surely invest money when trading CFDs. There is no chance of losing money rapidly due to some constant reason.

Is Trade Nation Good for Beginners?

Yes. A beginner will never get confused or duped due to his or her inexperience on finsa Europe ltd. The broker app is also easy to use. Trade Nation offers customer care service that helps the traders with any relevant issues. So, you can definitely go for this platform even if you are a beginner.

Another good thing for the beginner brokers is that a demo account Trade Nation is available. The funds are virtual; you do not have to deposit any asset or any real money. This makes the process easier and simpler. This Trade Nation Demo Account is immediately activated for the users. So, once again, this platform is good for beginners.