This FXOpen review intends to give you a glimpse of the trading platform. The FXOpen broker review will introduce you to the functions and operations of the platform. Different trading platforms offer different levels of complexity and risk, points that should be considered before finally choosing one. For example, some allow access to stocks and other types of securities, while others limit your investment to more simple purchases like gold or real estate properties.

FXOpen Overview

| Official Website | https://www.fxopen.com/ |

| Headquarters | Australia, United Kingdom |

| Founded Year | 2003 |

| Regulated | FCA, ASIC, CySEC |

| Product Offered | Forex, Cryptocurrency, Indices, Stocks, Shares, Commodities |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 500:1 |

| Islamic Accounts | Yes |

| Demo Account | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Trading fees | $1.5 Per Standard Lot |

| Inactivity fee | $10 per month |

| Withdrawal fee | Yes |

| Supported currencies | USD, EUR, GBP, RUB, JPY, ETC, BTC, LTC |

| Customer Support | Yes, via Live Chat, Email, FAQ, Help Center, & Tickets Support |

Before joining a trading site, it is necessary to know more than just a demo account. Risk is a major concern that stops many people from trying out trading platforms. But, a person can gain a lot of personal experience in funding methods with different account types, financial services, informational purposes, account features, and payment methods and become a good broker. This review of FXOpen explores unique topics like how to trade digital currencies, Australian securities, micro account, negative balance protection, ECN forex broker, forex cup competition, micro account, and more.

Trading sites are the most common form of traditional stock exchanges. A trading site is a marketplace where buyers and sellers trade securities, commodities, and other financial instruments. This is the most popular type of stock exchange. Trading sites play a crucial role in the world of finance as they provide liquidity to those who need it most. Trading sites facilitate people to trade equities, bonds, and other assets with one another.

This can be done anonymously or through a pre-established account on the trading site. Trading sites offer a wide range of powerful tools and features: charts and graphs, analytical tools for an in-depth analysis of your investments, news, and articles that help you stay updated on what’s going on in financial markets.

What Is FXOpen?

FXOpen is an online trading platform where you can trade forex, shares, commodities, indices, cryptocurrencies, etc. It is regulated by the Financial Conduct Authority (FCA). You will find different trading accounts along with various financial markets on FXOpen markets limited. The head office of FXopen is situated at three different locations. It is considered one of the most respectful and honest companies. A forex broker and trader can watch the market and price movement. As per many user FXOpen reviews, trading digital currencies, trading forex, and trading conditions are some of the important features of the reputable company. You can customize your investments on FXOpen.

This reduces the chances of your assets facing high risk. FXOpen has investments commission ASIC but offers a great variety of trading options and a safe, stable website. FXOpen has different account types to choose from. You will get to choose FXOpen STP account, and FXOpen ecn account among the different account types. STP account and ECN account are popular in the world of trading. A good ECN broker will easily connect with the smooth navigation of FXOpen and the exciting offers. The website is also regulated by Australian Securities to gain the trust of Australian users.

FXOpen User Experience

Clients mostly give a positive FXOpen review! Trading with FXOpen is easy and secure. You can get a demo account & ECN accounts. The technical support service responds to your queries and problems. There are more than three trading platforms that include FXOpen platforms MT4 & MT5.

You can also opt for auto trading, mobile trading, cryptocurrency trading, social trading, copy trading, and more. All the new traders as well as existing users get risk warning, exotic forex pairs, financial advice, smooth and secure payment methods, and a payment system. You would not find an insufficient bonus system as it is filled with exciting offers. You can be a good broker in no time with help and support from the FXOpen team.

When you are trading CFDs, watch out for the market movements from your retail investor accounts. It is a company win if it can provide its users with different account types, almost no spread, copy trading, minor forex pairs, strong Arab support, low minimum deposits, fast payment methods, STP low min deposit, and more. Such distribution and inclusiveness are hallmarks of big companies and FXOpen is one of them.

UK customers can select an account type and start trading with FXOpen platform’s available methods. The details of the funding methods are clear. No matter your past performance, FXOpen gives you hope for a better next period.

You will get MT4 & MT5 among the trading platforms. Trading CFDs is easy on FXOpen. You can also trade gold. The account types get you covered all the time. The registration process has only a few steps and is hassle-free. You will get a registration number. You can deposit from your segregated bank account. You are always updated about your bank statement. Few brokers are unaware of crypto accounts, social trading, minimum deposits, very tight spreads and active account. Only risk capital is meant to be closed if you are going for high risk investments.

Features of FXOpen

Negative Balance Protection

Negative Balance Protection is a feature that automatically resets the account balance to zero if it falls below zero following a halt out. Forex accounts are regarded to be heavily leveraged, which increases the chances of losing more money than you put in.

Trusted by Traders Worldwide

FXOpen is trusted by forex brokers and other types of brokers worldwide. The brokerage services are loved and cherished by professional traders, novice traders, and experienced traders. If you are a beginner trader, expert advisors will guide you along all the financial markets and market fluctuations. New traders can be unaware of the market movement and FXOpen Markets. You do not have to worry much about complex instruments. The customer support will help you with all this information. You will never be asked about your trading experience on FXOpen Markets Limited.

Your Choice of Trading Strategy

You can avail investment advice or make your own trading strategy. It has risk management features and a bonus system for successful trading. You can customize the financial services, risk capital, currency pairs movement, deposited funds as per your trading needs.

Good Customer Support

There are almost no technical support defaults as per user reviews. There has been good response about Arab technical support and other customer services. You can clarify queries regarding local bank transfers, major currency pairs, Australian securities, trading account balance, investment commission asic, active stocks, and more.

Regulated by the FCA

It is very important to check if the trading platform is regulated when you are about to invest real money. Once you open the FXOpen website, you will find that it is regulated by the Financial Conduct Authority FCA. You can start trading right away after signing up on the platform.

Peace of Mind

It is one of the industry’s largest liquidity providers. The financial commission is reasonable as per industry standards. The financial instruments provided on FXOpen while you are trading are top-notch in comparison to many trading platforms and mobile platforms.

We Want You to Be a Successful Trader

The trading platform is not about investment commission asic and low trading commissions. The company is determined to make you a successful trader. Compared to other forex broker companies, the company’s credibility has gained significant experience. It does not want you to continue trading company flaws. There are no hidden trading costs. If in doubt, you can always avail free registration bonus and demo account. A forex broker can commit to easy trading anytime.

Make Your Money Go Further

Trade forex and other products to make profits in the future. It is evident that trading involves risk. There will be risky days on all trading platforms and crypto markets. But the company gives you risk warning. You can invest in both high risk and low risk. A reliable broker can also invest from a micro account. You will get an ECN trading account along with a demo account. You can also trade in Us dollar, Canadian dollars, and Japanese yen.

200+ Markets Offered

There are more than 200 markets for you to invest in and study. You can certainly trade your minimum deposit to lower the risk of your loss in the early stages of your trading career. There are hardly any company disadvantages mentioned in the FXOpen review. The market makers have given special attention to forex markets, clients ECN trading, active stock, tight spreads, multi-asset broker, many currency pairs, CFD trading, and many other trading options.

FXOpen Ultra-fast Execution

One of the important advantages of FxOpen is its ultra-fast execution of commands. Traders can access any market and invest instantly. You can also correct past mistakes to reduce the loss percentage. The respectable and honest company has STP accounts, ECN accounts, and a demo account for each trader. The execution from your trading account will be super fast- be it a bank transfer, forex market trading, auto trading, mobile trading, secondary currency pairs trading, and more. A good reputation encourages traders to trade on the platform happily.

Commission-Free Trading

As per the seasonal gift from FxOpen Ltd, you can avail commission-free trading and additional bonus. New customers should not miss this offer and give trading a chance. The offer is open for Arab members, UK customers, and many more. With commission-free trading platforms, you can open your own account and trade with many deposit options and basic compliance checks in a carefree manner.

Services Offered by FXOpen

Web Trader

A web trader is an online platform that allows forex traders to initiate and terminate trades without having to download any software. Traders may observe Bid-Ask spreads, set Stop-loss order and Stronger Position orders, and monitor all positions completed in the past and present using a web browser. The Web Trader interface is similar to that of the desktop MetaTrader 4 terminal. If you’ve previously used the standard desktop MetaTrader, switching to the online version will be a breeze. Because of its straightforward layout, first-time users will have no trouble comprehending the essential functionalities of the MetaTrader Web Trader.

You can use Web Trader to make and finish trades, establish stop and entry levels, place and modify stop and limiting orders, limit loss and take some profits, and set and edit stopping and limiting orders. All current online browsers and software platforms, such as Mac OS and Linux are supported by MetaTrader 4 Web Trader. You don’t need to install or download MetaTrader 4 or any other trading program on your computer. All you need is a reliable Internet connection to get started. Logging into your trading account and starting trading takes only a few clicks.

- On PC or Mac OS, there is no need to download anything.

- All operating systems are supported.

- All main browsers are supported.

- MT4 Desktop has a familiar UI.

- Data security that is dependable.

- Trading with FXOpen with a single click.

- Close Multiple and by Requests for trade closure.

Trader’s Tools

FXOpen offers a number of valuable trading tools that assist in increasing trading efficiency. These can also be used to aid in financial planning and market analysis. There are tools that can help you plan your trading, evaluate prospective profits/risks, and optimize your lot sizes by providing exact estimations of pip value, swaps, margin, and fees.

VPS

The Virtual Private Server (VPS) is a virtual computer that an Internet hosting firm sells as a service. Your web hosting company creates a digital layer above the server’s operating system (OS using virtualization technology,). This layer divides the server into multiple compartments separated by virtual walls, allowing each user to install their own operating system and software. A VPS is actually a private server since it isolates your files from many other customers on the OS level. This implies that your website is housed in a safe box with assured server resources, such as memory, storage space, and CPU cores. You are not obligated to publish any of it.

- Use any computer in the globe to access your MT4 platform.

- Expert Advisors continue to work even if the computer is turned off or the power or internet is turned off.

- Cross-connected to FXOpen servers for speed.

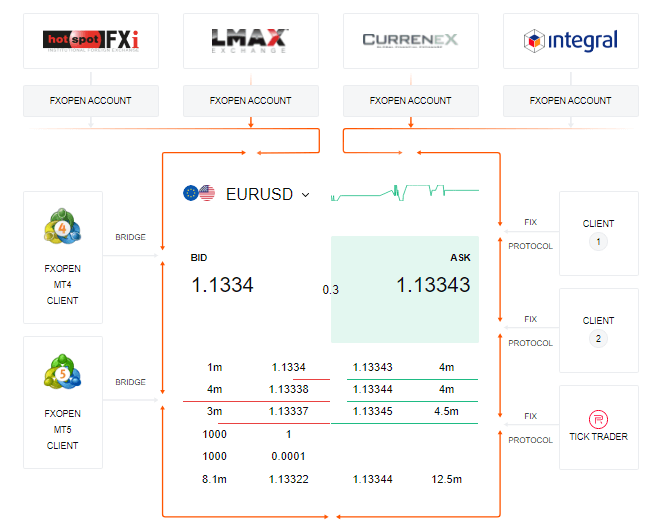

Fix API

The Financial Information Exchange API is a collection of well-defined rules and techniques for transferring financial data electronically. Digital communications standard for actual data exchange for monetary securities transactions is how the industry refers to it. The FIX API allows currency traders to exchange real-time data in a smooth manner. Liquidity producers, traders (both retail and corporate), and authorities utilize it to handle market issues on a regular basis.

Pre-trade data is utilized to develop strategies and make decisions that will be implemented on the market. Degrees of liquidity, depth-of-market statistics, order flow are examples of data that is streamed directly from market servers. The act of doing commerce is the subject of trade-related information. The FIX protocol is used to convey data between order input, confirmation, and execution processes. Post-trade data is used to help with the recording, processing, and transfer of financial assets in market-based trades.

- The FIX Protocol enables the transport of large amounts of data in a short amount of time.

- The uniform language of FIX, as well as its broad popularity, ensures a rapid and simple setup.

- It is simple to develop unique computational or black-box techniques.

- The use of a FIX API protects the safety and confidentiality of proprietary systems that operate in the market.

Advertisement

Is FXOpen Regulated?

The Financial Conduct Authority FCA has approved and regulated FXOpen. You will find it mentioned in most FXOpen review. Forex trading became more reliable to forex brokers on FxOpen trading platforms. It does not have the company weak technical support. The company account count has increased over the past year.

Traders who began trading on this site have benefit money and almost no complaints about the financial commission. People prefer trading on this site because it has competitive investments commission asic, favorable trading conditions, and different account types. A novice trader, forex broker, and other brokers can check the FXOpen regulation mentioned on the FXopen website.

Types of FXOpen Trading Platforms

There are many popular trading platforms on FxOpen like MT4 & MT5. In this FxOpen review three most famous trading platforms will be discussed.

MetaTrader 4 Platform

MetaQuotes’ MetaTrader 4 (MT4) trading platform was released in 2005. MetaTrader 4 may be used to trade a variety of markets via CFDs, including indices, forex, commodities, and commodities, but it is most usually linked with FX trading. The fact that MT4 can be tailored to your own trading preferences has made it immensely popular. It is also used to manage your trading by utilizing algorithms that make and terminate deals on your behalf based on a set of predetermined parameters.

MetaTrader 5 Platform

MetaTrader 5 is a platform that was designed for traders to access financial markets. Its features include the ability to execute orders, test trading strategies, and analyze markets. The MetaTrader 5 Platform offers many features that will be beneficial for both experienced and novice traders. Some of these features are an advanced charting package with technical indicators and drawing tools, trading algorithms (including neural networks), social trading where you can follow other traders, and design your own platform strategies with the Strategy Tester tool.

TickTrader Platform

TickTrader is a trading platform that can be used by beginners and experts alike. It provides the most comprehensive yet the most intuitive trading experience on the market. TickTrader offers a wide range of features including a sophisticated charting package, a real-time news feed, and powerful analytical tools. Moreover, it has an intuitive user interface with powerful features enabling traders to make decisions quickly and efficiently.

Market Instruments by FXOpen

Forex

Forex is a financial term that stands for the foreign exchange market. It is a global or international market where traders can trade currencies or price them against each other. The currencies traded in the Forex market are usually the major ones of the world, including the US Dollar, Euro, Japanese yen, and British pound. Forex trading is often seen as one of the most popular forms of global investing.

It can be done through different markets, but they are all interconnected in some way. For the beginner trader, there are many terms to learn and understand before they can start making trades. One of the most important is understanding risk management and how it applies to forex trading.

Indices

An index is a statistic that measures changes in the financial markets. It is used to track trends of an entire market or a market sector. Investors use many indices to measure the performance of a specific industry or region. It is important to note that an index is a performance measure, not a buy/sell signal. An index allows investors to invest in a portfolio in order to track the performance of a certain sector or region without having exposure to all the securities.

Cryptocurrency

Cryptocurrencies are digital coins designed to be secure and anonymous. They are the first workable attempts at creating viable alternatives to national currencies. The main idea behind cryptocurrencies is that their design makes them immune to the kind of manipulation that has undermined the traditional financial system in recent years. Individuals can use cryptographic techniques to create money and transfer value with no middlemen or centralized authority.

Shares

Shares are a representation of the relative ownership that company shareholders have in a company. Stockholders receive dividends from the profits that the company makes. The price of a share is determined by its earnings per share, or EPS, and the total number of shares outstanding. The EPS is calculated as net income divided by the number of shares outstanding. Shares can be acquired through purchase or as a dividend from a corporation’s profits.

Purchasing shares comes with certain risks because you have to wait for your investment to grow in value before you can sell it and make money. Dividends come with less risk because they are an instant return on your initial investment and don’t require any additional cash infusions into the stock’s value to realize profit.

Commodities

Commodities are an important asset class in the world of finance. They are physical products typically traded on a trading platform. Commodities come with different risks and benefits, but they have one thing in common – they all have a physical counterpart. Commodities trading is a high-volume, high-frequency market. Investors trade in commodities such as crude oil, gold, coffee, and copper. Unlike other assets, commodities can be traded 24 hours a day and used as an alternative investment to currencies and stocks.

Range of Trading Instruments

- 9 Index CFDs: There are nine index CFDs. You will find UK100, Germany 40, France 40, Europe 50, Wall street 30 and other major global indices on the site.

- 51 Forex: There are around fifty one forex available for you to trade. Few examples are AUDCAD, EURAUD, GBPAUD, NOKSEK, SGDJPY, USDRUB and many more.

- 5 Commodity CDFs: There are five commodities- gold, silver, US crude oil, UK Bent oil and US natural gas.

- 3 CFD Spot Materials: FxOpen has three spot materials: gold, silver, and platinum.

- 2 CFD Energies: Two types of crude oils can be traded on the site. One is Brent crude oil and another is WTI crude oil.

- 1 CFD Shares: There is only one USD share.

- 10 CFD Cryptocurrency: You can trade on ten popular cryptocurrencies. They are Bitcoin, Ethereum, Litecoin, DashCoin, Ripple and more.

FXOpen Review: Pros and Cons

| Pros | Cons |

| Profitable trading circumstances for traders of all levels of expertise, from novice to professional. | Insufficient training materials. |

| A wide range of financial instruments for trading. | There is no means to request a callback. |

| A wide selection of accounts, including a specific crypto account for trading cryptocurrency. | |

| Minimum withdrawal commissions and a cash-back program will further lower your commission expenses. | |

| PAMM-service for imitating successful traders’ trades. | |

| The availability of auto-trading. | |

| Account status reports are available at the end of every day and every month. |

FXOpen Account Opening Process

To create a trading account & begin trading, first create an eWallet in the My FXOpen section. It is a tool to manage your assets and trading accounts. After that, follow the steps below:-

- Log in to your account on My FXOpen;

- Choose the kind of account you require;

- Relevant files should be read and accepted; and

- Fill out the account registration form.

Types of FXOpen Accounts

ECN

Electronic Communication Networks or ECNs are online trading platforms that allow investors to buy and sell securities. ECNs are profitable because they often have lower transaction costs than traditional stock exchanges and the transactions happen in real-time. It offers traders low commissions and fast execution speeds.

STP

The STP account is a type of account that allows a person to set up an unlimited number of sub-accounts, where the funds in one account can be transferred to another account. The benefits of using this type of account are usually two-fold. The first is the ability to generate interest on your money without being limited by your time frame for investing or withdrawing funds. The second benefit is the ability to have more control over your investments because you can decide how much money goes into each sub-account and what percentage it gets.

| ECN Account | TP Account |

|---|---|

| The minimum deposit is 10 dollars, and the account balance is infinite. | With a minimum deposit of ten dollars and an account balance of 100 dollars, there is no limit to how much money you may put in. |

| Transaction volumes and open deals are unlimited. | The minimal transaction size is 0.01 lots, and market execution is available. |

| Market execution and a 0.01 lot minimum transaction size. | Transaction sizes are unrestricted, and trades are always available. |

| You can use a leverage of up to 500:1. | Use a 500:1 leverage ratio. |

| Fifty Forex pairs, CFDs, indices, gold, and silver are all available. | Stop-out of 30% and a 50% margin call. |

| Floating spreads start at 0.0 pips, and commissions start at US$15. | Fifty Forex pairs, gold, silver, are available. |

| Bonuses, EAs, hedging, scalping, phone dealing, news trading, are all available. | Bonuses, EAs, hedging, scalping, phone dealing, news trading, are all available. |

| A 100 percent margin call with a 50 percent stop-out. | Commission-free trading and floating spreads. |

FXOpen Leverage & Margin Requirements

For cryptocurrency trading, leverage starts at 2:1 and for FX investment, it starts at 30:1. Indicators have a maximum leverage of 20:1, whereas commodities have a maximum leverage of 10:1, with the exception of gold, which has a maximum leverage of 20:1. Leverage up to 500:1 is available to professional clients. Change the leverage levels by speaking with the support team. On the broker’s website, there are helpful limit and pip value analyzers.

FXOpen Fees

The FXOpen Fees are mentioned below:-

| Account Type | Crypto | Micro | STP | ECN |

|---|---|---|---|---|

| Initial Deposit | $10 | $1 | $10 | $100 |

| Spread | Floating | Floating | Fixed | Floating |

| Commission | Yes | No | NA | No |

| Leverage | 3:1 | 500:1 | 500:1 | 500:1 |

FXOpen Deposit & Withdrawal Options

The following FXOpen deposit options are available:-

- China Union Pay with 3.5% commission fees.

- Paypaid with 4% commission fees.

- Airtm with 0.5% commission fees.

- FasaPay with 0 commission fees.

- Bitcoin with 0.0001 BTC commission fees.

- BitcoinCash with 0.0001 BCH commission fees.

- Litecoin with 0 commission fees.

- Emercoin with 0 commission fees.

- Ethereum with 0.001 ETH / 5 UST commission fees.

- Tether with 5 UST / 5 USDT commission fees.

- Online Banking with 3.5% commission fees.

The following FXOpen withdrawal options are available:-

- China Union Pay with 3% commission fees.

- Paypaid with 2% commission fees.

- SEPA with 5 EUR commission fees.

- Airtm with 0 commission fees.

- Advcash with 0.5% commission fees.

- FasaPay with 0.5% commission fees.

- Bitcoin with 0.001 BTC commission fees.

- BitcoinCash with 0.001 BCH commission fees.

- Litecoin with 0.01 LTC commission fees.

- Emercoin with 0.1 EMC commission fees.

- Ethereum with 30 UST / 0.01 ETH commission fees.

- Tether with 30 USDT / 30 UST commission fees.

- AstroPay with 0.5% commission fees.

- Online Banking with 2.5% commission fees.

FXOpen Bonuses & Promotions

FXOpen offers a 10 dollars no deposit bonus for ECN TickTrader and STP PAMM accounts, in addition to a one-dollar welcome bonus for Micro accounts. It also has a ForexCup Trading Contest subject to demo contest terms and conditions that could get you over one million dollars (if you win!). You can get your hands on free money. When you visit the broker’s website, you get the most up-to-date promotional codes. Check out the bonuses and promotions that are now available. It also has unique offers for UK merchants!

FXOpen Partnership Programmes

FXOpen works with a diverse group of foreign affiliates and institutional partners from across the world. Its Partnership Program allows you to earn passive income by trading their products, which may account for up to ninety percent of your profits. When you join the FXOpen partnership program, you may make money in a variety of ways.

- The Forex IB is compensated for attracting clients through escalating rebates over the course of their tenure with the organization.

- You may receive up to 90% of your trading commission using the Forex rebate scheme.

- Every eligible trader earns a CPA payment from CPA Partner (one-time payment). FXOpen pays substantial fees for bringing in new clients (leads).

- You can become a Regional Associate or start your personal Forex business using the White Label approach.

Resources Offered by FXOpen

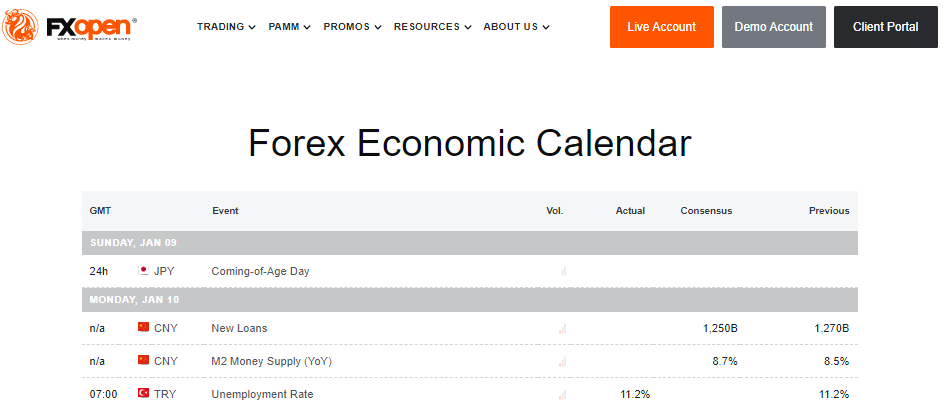

Education resources on a trading platform can be a great help for new users. FXOpen offers an economic calendar, market news, articles about different topics on trading, and more. The economic calendar for the fx and stock markets is a list of major economic events and major announcements throughout trading sessions.

This basic data has an impact on both small and large markets. This is why the economic outlook calendar could become one of your first-tier instruments for real-time analysis if you decide to go into forex. The market news is also a great opportunity for the traders to keep themselves updated, so always do your research before going in.

FXOpen Supported Country

FXOpen welcomes clients from all around the world. However, FXOpen does not provide operations to citizens of the United States because of tight US regulatory constraints. Due to legal constraints, some FXOpen broker services and products described in this FXOpen review might not be accessible to users from specific countries.

FXOpen allows traders from the following countries:-

- Australia

- Thailand

- Canada

- United Kingdom

- South Africa

- Singapore

- Hong Kong

- India

- France

- Germany

- Norway

- Sweden

- Italy

- Denmark

- United Arab Emirates

- Saudi Arabia, Kuwait

- Luxembourg

- Qatar and many other countries.

FXOpen Security Measures

Both the MT4 and MT5 systems adhere to industry-standard security protocols, such as 128-bit Security Socket Layer (SSL) authentication and two-factor authentication. All customer money is held in full segregation at Lloyds Bank Plc or London’s Barclays Bank.

FXOpen Customer Support

As per user reviews & our research, we can say that FXOpen customer service is available 24 hours a day, 7 days a week by online chat, phone, and email. Local phone numbers are available in New Zealand, Russia, France, and Germany. On business days, tickets to FXOpen’s sales, finance, trading desk, and support divisions are answered from 7 a.m. to 6 p.m. GMT. Support will gladly answer any queries you may have about FXOpen’s products and services. On the website, there is a body of knowledge center that answers many commonly asked topics.

Advertisement

FXOpen Review: Conclusion

FXOpen is a strong ECN broker that offers active traders a dynamic trading environment with several platforms. Although instructional materials are limited, cheap spreads and fees, and also a solid track record, make it an appealing alternative for big volume traders. It is governed by the most reputable authorities and uses modern price aggregation technology to guarantee that its ECN can provide the highest suitable trading circumstances, such as low spreads, quick transaction execution, and cheap commissions.

FAQs

Is There a Cost For Inactivity at FXOpen?

Yes, let’s say your account has been idle for six months since the last time you used it. In such a scenario, FXOpen reserves the right to apply a ten dollar per month until activity on the account resumes or your account balance hits zero. The account will indeed be closed at this point, and you’ll be notified.

Is FXOpen Legit?

FXOpen Markets Limited is a Nevis-based business that has been licensed by the Financial Conduct Authority (FCA) since 2013. FXOpen UK is a London-based firm that has been licensed by the FCA since 2013. Indeed, the opening of the Headquarters in London and the www.fxopen.co.uk webpage resulted in significant firm development throughout the EU and beyond, and FXOpen is currently one of the most popular brokers.

Where Is FXOpen Located?

FXOpen Headquarters are located in three locations-Perth, Australia; London, UK; Charlestown, Saint Kitts, and Nevis.

What Is the Minimum Deposit for FXOpen?

The minimum deposit amount at FXOpen is only 10 dollars. This means you may check out various trading platforms, goods, and services with a little deposit. This is a fairly acceptable amount to start with, especially when you consider that some brokers want a minimum deposit of thousands of dollars. Because every trader is different, you should simply trade using whatever you can afford, just like any other broker.

Is FXOpen an ECN Broker?

Yes, on FXOpen you can choose an ECN trading account.

How Do I Deposit Funds in FXOpen?

To deposit funds you need to make an e-wallet first. From then on you can go through the various payment options and make your deposit.