This content has been archived. It may no longer be relevant.

Blueberry Markets is an international forex broker that has been offering access to the financial and currency markets since 2016. Since its foundation, it has become increasingly popular among online traders who want to access various financial instruments. With this Blueberry trading platform, you can trade more than 300 instruments (assets), including currency pairs and CFDs, join copy trading platforms, and invest in MAM accounts. We discovered via detailed analysis that the broker provides Forex day trading, momentum, support, resistance trading methods, and Forex fundamental and technical analysis trading strategies. The following Blueberry Markets review aims to help traders understand the financial service they offer before adopting it as their forex trading broker.

Blueberry Markets Overview

| Official Website | https://blueberrymarkets.com/ |

| Headquarters | Vanuatu, Australia |

| Found in | 2017 |

| Regulators | VFSC, ASIC |

| Products Offered | Cryptos, Forex, CFD, Commodities, Currency Pairs, Indices and Metals. |

| Minimum Initial Deposit | $100 |

| Maximum Leverage | 30:1(ASIC), 500:1(Vanuatu (VFSC)) |

| Islamic Accounts | No |

| Demo Account | Yes |

| Meta trader 4 (MT4) | Yes |

| Meta trader 5 (MT5) | Yes |

| Trading Fees | $7 for Direct Account (Spreads from 0.0 pips) $0 for Standard Account (Spreads from 1 pips) |

| Inactivity fees | No |

| Withdrawal fees | $0 |

| Supported currencies | AUD, USD, CAD, GBP, NZD, EUR, SGD, & more |

| Customer Support | 24/7 |

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

Pros and Cons of Blueberry Markets:

Like all other forex brokers, Blueberry Markets has some plus points as well as some downsides. However, the following summary highlights that the company is far more beneficial than counter-productive for traders.

| Pros | Cons |

What is Blueberry Markets?

Headquartered in Sydney, Australia, Blueberry Markets is an online broker offering its financial services to clients worldwide. By using electronic communication networks to provide its forex financial expertise, Blueberry Markets is currently a top-level ECN broker globally.

Blueberry Markets offers its services for more than 300 tradable instruments under multiple asset classes. The company has gained its position in the market by providing low spreads.

Blueberry Markets is designed to implement the most complex and customized trading strategies. It is built on a robust infrastructure of advanced trading technologies that help traders in fast executions, tight spreads, and high-profit outcomes. Watch this introduction video to learn more about Blueberry Markets

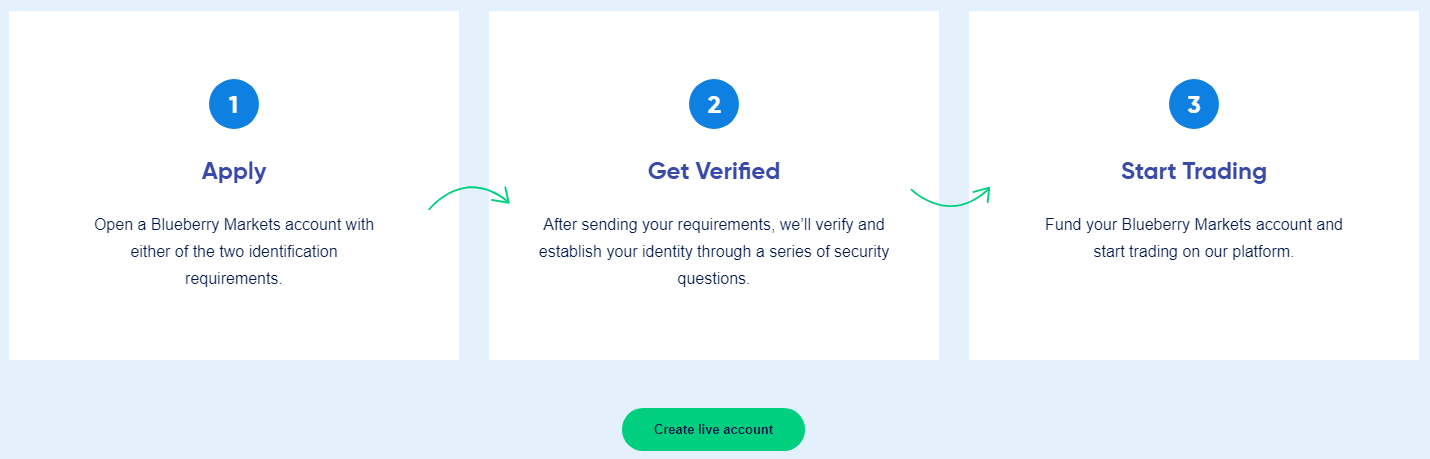

Get started with Blueberry Markets Account Opening

The working application of Blueberry Markets is quite dynamic, assisting in trading a wide range of financial instruments. One can try the demo account (Practice account) of Blueberry Markets to experience how the broker works. The process of opening a Blueberry Markets account is simple.

Step 1: Visit the Blueberry Markets website and click on “Start Trading” at the top right corner

Step 2: Select between foreign exchange trading accounts (Standard or Direct/Professional Accounts) or click on the “demo account” link next to these respective accounts

Step 3: Fill an online form to register a new foreign exchange trading account on Blueberry Markets

Step 4: In this form, provide an active email address and phone number for online user verification

Step 5: After filling up other credentials, submit the form and complete the verification process

KYC and Address Document Process

Blueberry Markets requires users to complete a “Know Your Client” (KYC) process for account activation. This involves submitting proof of ID, like a passport or driver’s license, and proof of address through recent utility bills. Documents must be under three months old and verify your identity. Verification takes a few working days.

While waiting for verification, you can explore their services through a demo account. Once verified, you can deposit funds and begin trading various forex instruments across multiple markets. Minimum deposit amounts vary by account type.

Blueberry Markets Trading Instruments

The primary financial instrument traded on Blueberry Markets is forex. The company also supports the trade of CFDs, cryptocurrencies, metals, commodities, and indices.

- Currency Pairs: The most common kind of trading instrument is a currency pair, which lets traders make predictions about the relative values of two currencies. Various currency pairings are available at Blueberry Markets, including minor and exotic currencies in addition to main ones like EUR/USD and USD/JPY.

- Exotic Currency Pairs: These are currency pairs that involve less often traded currencies, including the South African rand (ZAR) or the Turkish lira (TRY). Although exotic currency pairs have more potential gains than important pairs, they can also be more volatile.

- Indices: A securities basket that represents a certain market or industry is called an index. An index that follows the performance of 500 large-cap businesses listed on US stock exchanges is the S&P 500, for instance. A range of indices are available from Blueberry Markets, including sector-specific and globally relevant indexes.

- Metals: Another common kind of trading instrument is metals. The most traded metals are copper, silver, and gold. Metals from Blueberry Markets include basic metals, industrial metals, and precious metals.

- Commodities: Physical things that may be exchanged on exchanges are known as commodities. Coffee, natural gas, and oil are a few commodities. Energy, agricultural, and soft commodities are just a few of the commodities that Blueberry Markets provides.

Trading Instruments Overview

|

MetaTrader 4 |

MetaTrader 5 |

|---|---|---|

| Forex Pairs | 44 | 44 |

| Global Indices | 10 | 10 |

| Metal Commodities | 3 | 3 |

| Commodities – Oil | 2 | 2 |

| Cryptocurrency CFDs | 5 | |

| Share CFDs | 197 ASX and 50 US stock shares |

Blueberry Markets Popular Currency Pairs

It has been observed that EUR/USD and GBP/USD are the leading forex currency pairs traded through Blueberry Markets. The company also trades in the market for minor pairs and exotic cross-pairs.

In addition to the forex pairs, Blueberry Markets helps traders with popular indices such as UK100, AUS200, JPN225, GER30, FRA40, SPX500, US30, and EUSTX50.

The company also brokers the trading of precious metals, namely, Gold (XAU/USD) and Silver (XAG/USD).

In energy trading, Blueberry Markets is suitable for investors in the oil trade, particularly for assets in WIT-grade oil and Brent-grade oil.

Trading Platforms of Blueberry Markets

Blueberry Markets offers popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on desktop (Windows, macOS), web browsers, and mobile (iOS, Android) at no additional cost. These platforms are industry-leading solutions for global markets.

MT4 Trading Platform

With millions of users, MT 4 is a well-known online trading platform worldwide. It has a very easy-to-use and simple user interface for both beginners and advanced traders.

Over 30+ technical indicators and analytical items are available in MetaTrader 4 for in-depth research. Further features of the platform include the ability to create custom indicators using the MQL programming language using MT4 MetaEditor and to automate trading with Expert Advisors.

MT 4 provides traders with different chart options, a live trading room, and real-time quotations, enabling them to make well-informed judgments in a range of market situations.

MT5 Trading Platform

The MetaTrader 5 platforms also offer one-click trading. Traders can set notification alerts and run templates for their trading activities and access a marketplace with dozens of additional tools. The MT5 WebTrader web app can run directly through web browsers.

The mobile applications of these platforms are useful for accessing trading accounts remotely. The clients can stay connected to their markets on the go anywhere in the world, as long as they have an internet connection. Blueberry Markets offers these platforms and tools to its clients through both types of trading accounts.

Types of Accounts Offered by Blueberry Markets

The company offers two main retail accounts: Standard (lower fees) and Direct (tighter spreads, selective features). Both aggregate the best prices, offer tight spreads, and provide good executions in a safe environment. Both access the broker’s platforms, but spreads vary by account. They also offer a 30-day Practice account trial.

Blueberry Standard Account

Advertisement

With this account, the Blueberry Markets spreads start from 1 pip. There is no commission charged on the trades. The spread is inclusive of the broker costs.

A minimum deposit of $100 is required to open this account.

Trading in the Standard account entails a minimum position size requirement of 0.01 lots.

Traders get access to all the trading instruments provided by the MetaTrader platforms with the Standard account.

Blueberry Direct account

With this account, the Blueberry Markets spreads start from 0 pips. There is a $7 commission charged per standard lot trade for a round turn. This competitive commission may increase on substantial trading volumes.

A minimum deposit of $100 is required to open this account. This professional account comes with more transparency, allowing retail traders to see the raw market spread.

The minimum position size requirement is the same, which is 0.01 lots.

Similarly, traders also get access to all MetaTrader trading instruments with this account.

Practice account

Blueberry Markets offer a demo account, which has a 30-day trial period. It is used to test the platforms, tools, and other trading features before opening a Direct or a Standard account.

The broker fees of Blueberry Markets vary, and these changes are reflected on the website.

The fees and costs mentioned in this review can get updated in due course of time. Moreover, the broker may charge additional fees that may not be listed in this Blueberry Markets review.

Traders must check the latest information on the website as the company has its rights reserved to change this information at its discretion.

Blueberry Markets Account Types Comparison

|

Blueberry Standard Account |

Blueberry Direct Account |

|---|---|---|

|

Minimum Deposit |

$100 | $100 |

|

Spreads |

From 1.0 pips | From 0.0 pips |

|

Commission |

$0 | $7 |

|

Maximum Leverage |

1:500 | 1:500 |

|

Minimum Trade Size |

0.01 | 0.01 |

|

Trading Platforms |

MetaTrader 4 or MetaTrader 5 | MetaTrader 4 or MetaTrader 5 |

|

Tradable Instruments |

300+ | 300+ |

Blueberry Markets Deposit and Withdrawals

The broker has ensured that the process of depositing and withdrawing funds is easy for all traders. Hence, several methods make fund transfers convenient for clients.

Deposit Methods

For depositing funds, traders need to link a bank account and transfer the funds electronically. Alternatively, they can use payment gateways integrated with the platforms to add funds. Credit card and SSL-secured online payment methods such as Skrill are also used by the clients.

Some of these methods may not be available in certain countries, which is why traders need to follow the payment process carefully.

The processing time for deposit money is less than 15 minutes.

It is important to note that the funds deposited into the trading accounts must be under the same name. The name on the Blueberry Markets trading account must match with the name issued on the fund transfer.

The broker has a strict non-acceptance policy for third-party payments. Besides, traders can deposit funds in USD, AUD, GBP, EUR, CAD, NZD, and SGD. These different currency options help traders with quick currency conversion.

Withdrawal Methods

Withdrawing funds from the trading account can be done via these methods as well. However, for non-Australian clients, the broker charges a small processing fee on the withdrawals. If traders lose money on the platforms, the company is not liable for any refunds.

Under certain terms & conditions, traders may not get charged with any fees on their withdrawals. This depends on the withdrawal requests, withdrawal amounts, and the level of trading. One can easily use the withdrawal service and transfer the funds to a trusted bank account.

The faster processing time for Blueberry Markets withdrawal is 24 hours or less on a business day. The processing of bank wire transfer is likely to take more business days than other methods.

Key Points on Deposit and Withdrawal

While some methods are instant, there have been cases where withdrawals took longer due to some unforeseen circumstances. There is no high risk involved in Blueberry Markets withdrawals, and traders do not lose money due to processing latency.

While there is no limit to the amount of funds one can deposit or withdraw, there are some limits described to the payment options. Certain payment systems have transaction limits, which restrict the traders in their financial flexibility.

These systems have all the rights reserved to set these restrictions, clearly indicated on their respective websites. Traders may also need to verify or upgrade their accounts on these payment systems for removing the limits.

In some countries, these payment systems are directly linked to one bank account.

The currency conversion fees are applied only while using regional base currencies for fund transfers.

Customer Support

Blueberry Markets is known to provide best customer service to its clients. The company has a team of experts and technical support staff to help clients 24/7.

The customer support staff is available five days a week, with the weekends excluded. However, on non-business days, the 24/7 live chat features sustain these customer support options.

The staff stays quite responsive on the live chat channels. Their connectivity on the phone and email is somewhat satisfactory.

Is Blueberry Markets Regulated?

Registered under the company – Eightcap Pty Ltd, the Blueberry Markets Group and Eightcap Global Ltd are regulated by the Vanuatu Financial Services Commission (VFSC) and Australian Securities & Investments Commission (ASIC). Eightcap Pty Ltd and Blueberry markets regulated broker registered under the AFSL number 391441.

As regulated by the australian entity, the broker adheres to all standards set by the Australian corporate governance. From financial reporting and operational disclosure, the company is in complete compliance with Australian forex trading market regulators.

All funds are protected under a segregated trust account governed by the National Australia Bank. This helps to ensure that all retail client funds cannot be used for any other purposes.

Conclusion

Being an ASIC-regulated forex broker, Blueberry Markets Forex is praised for its user-friendly MT4/MT5 platforms, diverse instruments (300+), competitive spreads, and low-commission accounts. While lacking advanced tools or extensive education, it offers premium services, convenient funding, and strong customer support. Blueberry Forex is a solid choice for modern traders that stands out as a reliable and accessible option in the ever-evolving world of online trading.

Advertisement

DISCLAIMER : Forex and CFDs are highly leveraged products. CFDs are complex instruments for Forex and CFD trading due to high volatility, and regularly leverage ratios fall.

FAQs

Is Blueberry Markets a good broker?

The short answer is yes, as many Blueberry Markets Reviews presents positive thoughts about their services. And from our thorough research and studying user’s reviews, we can also conclude that Blueberry Markets is a good broker, and people have to try it once!

Can you trade stocks on Blueberry Markets?

Yes, you can trade stocks on Blueberry Markets, as they offer 50+ US stocks to trade.

Is Blueberry Markets an ECN broker?

Yes, Blueberry Markets is an ECN broker.

How do I withdraw from Blueberry Markets?

To withdraw your money from Blueberry Markets, first, fill the online withdrawal form, and later it will proceed within 24 hours. However, it can take more time due to unpredicted circumstances.

What are Blueberry Markets deposit fees?

If you deposit through Credit Card, Debit Card, Poli Payment, and China UnionPay, you don’t have to pay any fees, but by Skrill (3% – 4%) & Fasapay(0.5%). And if through bank wire transfer, you need to check with the particular resource.

What is Blueberry Markets leverage?

The Blueberry Markets leverage is up to 1:500.