BlackBull Markets was founded in the financial capital of Auckland, New Zealand, in 2014. After its inception, BlackBull Markets’ founders were inspired to work in the equities retail market to provide customers with the most optimal experience. Today, BlackBull Markets supports more than 10,000 traders from more than 180 different nations and actively seeks opportunities to improve their clients’ trading experience.

BlackBull Markets Review Insights

As per our BlackBull Markets review, the client’s deposits are separated from corporate funds through ANZ Bank. BlackBull Markets is a trustworthy licensed ECN broker. BlackBull Markets offer access to 26,000+ instruments that can be traded in Equities, CFDs, FX, and Commodities on MetaTrader 4, MetaTrader 5, WebTrader, BlackBull shares, and TradingView. BlackBull Markets offers several trading tools and copy trading with third-party providers such as Zulutrade, MyFXbook, Autotrader, and many more.

BlackBull Markets Overview

| Official Website | https://blackbull.com/ |

| Headquarters | Auckland, New Zealand |

| Founded Year | 2014 |

| Regulated | FMA, FSA |

| Market Instruments | Forex, Shares, Commodities, Precious Metals, Energy, Crypto |

| Minimum Initial Deposit | US$0 for ECN Standard Account US$2,000 for ECN Prime Account US$20,000 for ECN Institutional Account |

| Maximum Leverage | 1:500 |

| Islamic Accounts | Yes |

| Demo Account | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Trading fees | US$0 for ECN Standard Account US$6 for ECN Prime Account US$3 for ECN Institutional Account |

| Inactivity fee | No |

| Withdrawal fee | Average |

| Supported currencies | USD, JPY, EUR, CAD, GBP, CHF, SGD, AUD, NZD, HKD |

| Customer Support | Live Chat, Email, & Phone Support |

What Is BlackBull Markets?

BlackBull Markets combines decades of Institutional Forex trading expertise, emphasizing forex trading instruments providing resources to retail traders. Since its inception, the broker has offered numerous solutions as a financial services company using proprietary software that aggregates strong trading performance and affordable pricing. The company is regulated by the Financial Markets Authority of New Zealand (FMA) and the Financial Services Authority of Seychelles (FSA). BlackBull Markets is considered safe as it is regulated and controlled by the top-tier FEMA in New Zealand.

BlackBull Markets are ideal for beginners and experienced traders. BlackBull Markets trading tools offer traders the necessary tools for beginners new to trading. The more experienced traders prefer a higher minimum deposit and a small fee per trade to get tight spreads, which BlackBull Markets offers.

Why Choose BlackBull Markets?

BlackBull Markets was founded as an online broker, offering retail CFD accounts, trading solutions, and also maintaining trade facilitations within the world’s trading hubs like London, the UK, and Malaysia to provide exposure globally. Many options, such as diverse conditions and trading financial assets, are available, backed by learning tools and programs designed for active trader accounts. Along with numerous solutions offered to retail traders, professional services are available for institutional accounts and money managers, PAMM, and MAM accounts.

Here are the important reasons why you should choose BlackBull Markets:-

High Level of Customer Service

BlackBull Markets offer customer support with topmost priority to its clients. The friendly, supportive and dedicated account managers provide 24/7 assistance in various languages through live chat, phone, and email.

Superior Trading Conditions

Users can enjoy average spreads starting as low as 0.0 pips, lightning-fast execution speeds, and leverage as high as 1:500. They are also offered more than 26,000 tradable assets like stocks, forex, Indices, and more.

Working Together Toward Your Investment Goals

Whether you are an expert or novice trader, you can gain knowledge and expertise from the BlackBull Markets team. Traders can benefit from the array of educational materials, such as the Forex economic calendar, trading guides, and videos on significant economic events.

No Fees on Deposits

As per our BlackBull Markets review, the BlackBull market does not charge any deposit fees. The No-Fee Funding model applies to all accepted payment methods, including credit cards, bank deposits, Skrill, and Neteller.

Safe & Protected

BBG Limited (BlackBull Markets) is a limited liability company legally registered in Seychelles. BlackBull Markets’ head office is located in Auckland, New Zealand. The Company is authorized and monitored under the supervision of the Financial Services Authority in Seychelles (FSA) and FMA (NZ). The trading platform follows the guidelines and regulations of the FSA, FCA and FMA, which ensures that the users are safe and secure.

Strong Global Presence

BlackBull Markets has employees and technology that covers Australasia, Europe, North and South America, Asia, and Africa. The global network provides the clients with 24-hour support and rapid accessibility to the Equity, CFD trading, FX, and commodity markets, no matter where their clients reside.

Is BlackBull Markets Regulated?

As per our BlackBull Markets review and research, the broker is regulated by top-tier regulatory authorities. BBG (Black Bull Group) Limited trading (BlackBull Markets) is an LLC incorporated within the legal framework of Seychelles and has a company number 857010-1. Black Bull Group limited company is licensed and controlled under the supervision of the FSA in Seychelles Financial Services Authority under license number SD045 for providing investors with investment-related services.

Security and accessibility for users’ funds are of paramount importance in the operation of BlackBull Markets, and it works with ANZ Bank as its banking partner. ANZ Bank is one of the top banking institutions within the Australasia region and has an international presence across Europe, the USA, the Pacific, and Asia.

BlackBull Markets Pros and Cons

| Pros | Cons |

| BlackBull Markets offers an array of assets for trading. | Withdrawal fees are high. |

| Offers the tightest spread and high leverage of up to 1:500. | Restricted in certain countries. |

| Retail trades are offered institutional-grade pricing. | Minimum deposit requirements are a bit high. |

| This trading platform is ideal for beginners, and experienced traders. | |

| BlackBull Markets provide dedicated customer support. |

Market Instruments by BlackBull Markets

This platform is regulated and provides access to a broad range of markets that can be traded using different types of accounts offered by the platform. It offers competitive trading costs, and top-quality trading execution, providing customers with a wide selection of commodities to trade. BlackBull Markets trading options include more than 64 currency pairs, indices of major markets, precious metals, such as silver and gold, and commodities, such as gas, energy, and oil. Here is the list of Market instruments offered by this broker:-

Forex

The forex market is highly competitive and liquid and offers registered traders a stable platform with competitive trading costs. Blackbull offers institutional spreads at a low cost for traders who trade retail, with flexible leverage that can reach 1:500 with spreads as low as 0.0 pips with an average transaction time of 20 milliseconds. Demo accounts are accessible to people who are new in this Forex market. Some options for forex currency pairs include USD/CAD, AUD/CHF, AUD/JPY, and more.

Index and Share CFDs

CFDs are contracts between a buyer and seller that stipulate that the user has to pay each other the difference between the asset’s present value and the value at the date the contract was signed. Retail CFD accounts allow investors to trade assets without owning the asset used. You can trade 2000+ stocks like Tesla, Apple, Amazon, Netflix, and Facebook.

Precious Metals

The term “precious” refers to a naturally occurring chemical element with a high economic value. The term “precious metals” is often used to refer to the most secure investments during periods of turbulent markets and volatility. Due to this, many experienced investors have at least a portion of their portfolios with precious metals. Some of them are Gold SPot Gold Futures, Silver Spot, and futures.

Commodities

You can trade your favorite commodities using BlackBull Markets, including Gold, Silver, Crude Oil, Natural Gas, and cash Crops such as Soybeans and Sugar.

Energy

Energy commodities are the physical storage of energy like Natural gas and Crude oil. These are the commodities used for producing and supplying other commodities virtually. Energy commodities are crucial for modern-day economies, and many elements, including major geopolitical events, impact them. They include crude Brent cash, crude oil Brent futures, west texas intermediate crude oil cash, and much more.

Shares

Investors can access more than 80 global markets and 26,000+ shares on the BlackBull Markets platform. The users can explore some of the most important features, which include:-

- 70+ Order Types

- ESG/ Impact Dashboard Filters

- Extended Trading Hours

- Data Feeds From 66+ Third Parties

- Advanced Analysis Tools

BlackBull Markets Trading Platforms

BlackBull Markets offers full support for Metatrader 4 and Metatrader 5, two of the most well-known trading platforms. The advantage of BlackBull Markets offering third-party platforms like MT4 and MT5 is that customers can use customized versions of these platforms should they wish to move to a different broker. This broker provides its proprietary platforms, which are more accessible to beginners and easy to set up.

MetaTrader 4

BlackBull Markets is proud to provide its clients with the choice to trade with the MT4 trading platform. You can trade using MT4 on the web, desktop, and mobile devices and benefit from its flexibility, including tools for price analysis, expert advisors, forex signals, and copy-trading.

MetaTrader 5

BlackBull Markets allow their customers to trade with MT5; you can trade them on your desktop, web, and mobile devices that benefit from its flexibility, with tools for thorough price analysis, trading robots, EA, or copy trading. With MT5, customers can trade 26,000 assets integrated with the MT5 platform with 1:500 leverage.

WebTrader

Through BlackBull Markets, you can log into BlackBull Markets MetaTrader 4 account using any browser or operating system (Windows, Linux, Mac) via MT4 WebTrader.

Features of WebTrader include:-

- All the benefits of the MetaTrader 4 platform.

- Users can trade from any device, like a desktop, tablet, or laptop, and switch between devices seamlessly.

- The data transmitted is encrypted.

- No download or additional software required.

- It is compatible with major web browsers like Google Chrome, Mozilla Firefox, etc.

TradingView

BlackBull Markets offer its customers the choice to trade directly on TradingView, the world’s most popular charting platform and social trading platform. TradingView’s charts will enhance the CFD trading process regardless of whether you trade on mobile or desktop. Over 30 million traders worldwide have experienced the ease and fun of trading using highly customizable and automated tools and charts.

Advertisement

Tools Offered by BlackBull Markets

BlackBull Markets provides a no-cost VPS service for customers with Prime Accounts and FIX API for clients with institutional accounts who wish to connect directly to BlackBull’s ECN grid. Additionally, it offers the option of copy trading through two third-party providers, Zulutrade and Myfxbook Autotrade, both available at BlackBull Markets at a cost. BlackBull Markets is also planning to provide its clients with free TradingView, an excellent analytical tool that is expected to be available soon.

FIX API Trading

FIX is the code employed in the trading process to execute live orders at the exchange. BlackBull Markets use MetaTrader 4 (MT4), a FIX application. FIX API allows institution users to skip the BlackBull MT4 application and connect directly to the ECN grid using the company’s FIX.

Some of the benefits of FIX API trading include the following:-

- ECN integration

- Connects directly to BlackBull Markets bridge provider

- Direct Market Access (DMA)

- Compatible with any FIX programme

- Straight Through Processing (STP)

- Totally customizable

- Faster speeds and lower latency

Autochartist

As per our review, BlackBull Markets effortlessly integrated their MT4 trading account in MT5 with the well-known trading plug-in Autochartist. Autochartist is an analytical tool that uses a powerful pattern recognition program to detect potential market opportunities. You can apply Autochartist’s knowledge to your most popular instruments and begin receiving alerts whenever possible.

Some of the features include the following:-

- The key support and resistance levels

- Fibonacci retracements and extensions

- Chart patterns, including channels, wedges, triangles, and flags

- Excessive movement and volatility

- More appropriate stop-loss and take-profit levels

Zulu Trade

You can copy the trading strategies used by thousands of highly skilled as well as registered Forex traders from 192 nations. Utilizing ZuluTrade’s unique performance evaluation method and input from the ZuluTrade expert community, BlackBull Market clients can customize their trades according to their personal preferences, trading strategy, and risk tolerance. The “ZuluRank” evaluates traders based on several different variables. These comprise your general performance stability, stability, maturity, exposure, and the minimum deposit requirement to fund each trader’s position.

Forex VPS (BeeksFX)

BlackBull Markets offers free VPS hosting services to interested customers. The only requirement is having a BlackBull Markets Prime account and an initial deposit of at least US$2,000 with 20 lots of trades each month. BeeksFX is a BlackBull Markets affiliate that supplies Virtual Private Server (VPS) trading NYC servers. BeeksFX is dedicated to hosting websites, not finance servers, that provide a high-quality, low-latency infrastructure that is an unbreakable service for the people who need it. These VPS servers are located in New York, London, and Japan and are located close to strategic locations of exchanges to maximize reliability and execution speed.

MyFxbook

Myfxbook is among the top social trading websites that let users analyze, share, track and compare their actions. You can use Myfxbook to set up automated trading to follow traders you have chosen and set you as the main trader on an auto-trading network. The user-friendliness and ease of use built into the Myfxbook interface permit the use of common basic inputs and outputs. Myfxbook can be considered an affiliate of BlackBull Markets; as such, the MetaTrader 4 trading program is fully integrated into The Myfxbook system.

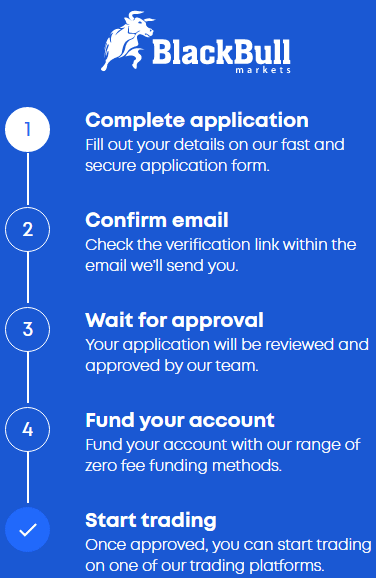

BlackBull Markets Account Opening Process

Here is the step-by-step account opening process explained:-

- Step 1: Complete the application. Users must fill out their details on the fast and secure application form, such as name, email address, and contact number.

- Step 2: Confirm the email sent by BlackBull Markets. You need to check the verification link and confirm the verification link.

- Step 3: Wait for approval when the verification is processed. The team will review your application, and it will be approved.

- Step 4: Fund your account through the broker’s different options. Also, you can fund your account with a wide range of zero-fee funding methods like skrill Neteller, bank transfer, and more.

- Step 5: Start CFD trading. When funding is done, users can start trading on various platforms offered by Blackbull.

Types of BlackBull Markets Accounts

BlackBull Markets account types are suitable for novices as well as experienced traders. BlackBull Markets standard account has a higher minimum deposit requirement of US$200 and allows trading in micro-lots, making it attractive for beginners. Professional traders usually prefer paying more for deposits, and commissions per trade, in exchange for more favorable spreads. Prime and Institutional accounts are equipped with the highest minimum deposit requirements; however, they have reasonable commission structures and wider spreads.

Standard Account

With access to the platform’s entire range of trade instruments and the initial deposit of Zero EUR, the Commission-free Standard Account allows you to have a 360-degree trading experience. The Standard Account is perfect for traders seeking great forex experience. With no commissions and minimal spreads, it is simple to begin. You can trade with your Standard Account using desktop trading platforms, Mac, mobile, and Webtrader.

Some of the account features include the following:-

- No Minimum Initial Deposit

- Micro Lots Available

- No Commission

- 1:500 Leverage

- Access to all tradable Instruments

Prime Account

For traders seeking a competitive edge, this broker provides a Prime Account. With a fee of US$6 per 100,000 of trades and spreads beginning at 0.1 pip, Prime Account is the perfect choice for traders who want the most value from their trades.

Some of the account features include the following:-

- Minimum Initial Deposit of US$2000

- Micro Lots Available

- US$6 per lot for most currency pairs

- 1:500 Leverage

- Access to all tradable Instruments

Institutional Account

To give you a truly professional experience, BlackBull Markets offer customized accounts to their high-volume traders.

Some of the account features include the following:-

- Minimum Initial Deposit of US$20,000

- Customized MAM/PAMM Platform available

- Complimentary VPS Access

- Customizable commission structures

- 24/7 Dedicated technical support

Demo Account

Users are offered a 30-day demo BlackBull Markets trading account to try trades and to get acquainted with the platform. To access the demo account, users should check the following details –

- The new demo account information has been issued to your email. The email includes login details to access your demo MT4 Account. Also, you need to make sure to check your junk mail folder.

- If you are yet to install MT4, you can download MT4 on any platform.

- If you have not received an email or have questions, you can email [email protected].

BlackBull Markets Account Types Comparison

We have compared different accounts offered by BlackBull Markets:-

| Standard Account | Prime Account | Institutional Account | |

|---|---|---|---|

| Minimum Deposit | US$0 | US$2000 | US$20,000 |

| Spreads | 0.8 | 0.1 | 0.0 |

| Commission | No commission | US$6.00 per lot | US$3 per lot |

| Maximum Leverage | 1:500 | 1:500 | 1:500 |

| Minimum Trade Size | 0.01 | 0.01 | 0.01 |

| Trading Platforms | MetaTrader 4, MetaTrader 5,WebTrader, TradingView | MetaTrader 4, MetaTrader 5,WebTrader, TradingView | MetaTrader 4, MetaTrader 5,WebTrader, TradingView |

| Trading Instruments | Forex, Index & Shares, Commodities, Precious Metals, Energy, Share Trading | Forex, Index & Shares, Commodities, Precious Metals, Energy, Share Trading | Forex, Index & Shares, Commodities, Precious Metals, Energy, Share Trading |

| Available Base Currencies | EUR, JPY, EUR, CAD, GBP, CHF, SGD, AUD, NZD, HKD | EUR, JPY, EUR, CAD, GBP, CHF, SGD, AUD, NZD, HKD | EUR, JPY, EUR, CAD, GBP, CHF, SGD, AUD, NZD, HKD |

| Swap-Free Islamic Account | Available | Available | Available |

| Equinix Server | NY4 | NY4 | Custom options |

BlackBull Markets Leverage & Margin Requirements

BlackBull Markets support traders with the trading platform MT4 MT5 that offers a feed on the free margin. Leverage lets you trade on an instrument with borrowed funds, with a minimum deposit amount. Leverage allows you to increase the profits or losses you earn on trades. To begin a leveraged position, it is necessary to have a margin. Margin is the amount of money needed in the trading accounts to open the leveraged trade. Consider margin as collateral needed for opening a leveraged account. You will be notified of a margin call when your account has a margin threshold of less than 75%.

BlackBull Markets Fees

BlackBull Markets trading fees are affordable, even though the trading costs differ based on the account type and the instrument. The broker does not charge non-trading fees and commissions for accounts with the ECN Standard Profile and spreads starting at 0.8 percent. Customers who use an ECN Prime account will incur lower spreads beginning at 0.1 pip and commissions starting at US$6 for each lot. Advanced investors who trade under the ECN Institutional accounts can get a better commission rate with negotiable rates and spreads starting at 0.0 pip.

Users should be aware that this broker charges currency conversion fees. This can be avoided by opening a multi-currency bank account. The swap fees are applicable to keep positions open overnight for swap-free accounts. Further, BlackBull Markets offer negative balance protection for its traders compared to other forex brokers in New Zealand.

BlackBull Markets Deposit and Withdrawal Options

BlackBull Markets have a variety of funding options. Deposits are free, but withdrawals can be expensive. BlackBull Market is a well-regulated broker that does not accept third-party payments. All withdrawals from trading accounts must be made to bank accounts or a source account of the traders.

Deposits

Some deposit methods are via bank transfers, credit cards, debit cards, e-wallets (Skrill or Neteller), and more. Credit cards, debit cards, and e-wallets can be processed immediately, while wire transfers may take up to 3 banking days for deposits to reflect. BlackBull Markets withdrawal fees are high compared to other brokers, but no commissions are charged for deposits. You can fund with Bank Transfer, Fasapay Mastercard, Neteller, and Unionpay.

Withdrawals

BlackBull Markets clients can withdraw money from BlackBull Markets using the same options as deposits. BlackBull does not charge withdrawal fees. However, credit cards, Skrill, and Neteller withdrawals are subject to a fee of 5 in the account base currency. These fees are charged by the remitting banks as well as payment system providers. Bank transfer withdrawal is recommended for amounts exceeding the deposit amount.

BlackBull Markets Risk Disclosure: Your capital is at risk. 68% of retail investor accounts lose money rapidly when trading CFDs with this provider.

Trading Commissions and Fees

BlackBull Markets commission rate explained:-

- For an ECN Standard Account, there is no commission

- For an ECN Prime Account, the commission is US$3 per lot (US$6 per round turn)

- For an ECN Institutional Account commission on this Account is negotiable

Here is the table explaining the trading fees charged by the Blackbull market in different regions:-

| US Market | FX (minimum US$2) |

| Fee = trade value * 0.002% | |

| Transaction fee (minimum US$1 | maximum 1% of Trade Value) | |

| Fee = # of shares * US$0.005 | |

| Australian Market | FX (minimum ~2.85 AUD) |

| trade value * 0.002% | |

| Transaction fee (minimum 6 AUD) | |

| Trade value * 0.08% | |

| New Zealand Market | Transaction fee (minimum 9 NZD) |

| 0.2% on amounts under 10,000 NZD | |

| 0.12% on portions over 10,000 NZD up to 20,000 NZD | |

| 0.08% on portions over 20,000 NZD |

BlackBull Markets App

BlackBull Markets presents a mobile-native platform that allows investors to access 23,000+ shares in 80+ global markets, and is accessible from one simple, retail-accessible app. Through this mobile trading platform, you can trade stocks, options, and futures from anywhere. The BlackBull mobile trading platform allows you to trade and manage share accounts from anywhere by offering a great mobile trading environment.

Android, and iOS mobile platforms and tablets can be used to access both trading platforms. Beginners need to be aware of the limitations in functionality. There are fewer charting options and shorter timeframes. The MT4 and MT5 apps let active traders work anywhere with the ability to modify and close orders, calculate profit/loss and even track their profits or loss live.

BlackBull Markets Bonuses and Promotions

Refer a Friend

If you refer a client to the BlackBull Markets brand, the broker deposits US$250 in your trading account and the friend’s accounts as a thank-you bonus. You must invite your friends to trade with you from the Refer A Friend page in the customer area, or your friend can inform you of your email address when they sign up. Refer friend bonuses will be deposited directly into your accounts if your friend meets the trade and deposit requirements within 90 days. You can also refer as many friends as you like to continue receiving the friend bonus.

Here is the table explaining how it works:-

| 1st Deposit | Your Friend Trades | You and Your Friend Will Receive |

|---|---|---|

| US$1,000 | 5 FX Lots | US$100 |

| US$10,000 | 20 FX Lots | US$250 |

BlackBull offers a partnership program in foreign exchange for its traders. It is one of the most successful forex brokers in the world and always puts its partners first. The partner program is flexible enough to accommodate the changing needs of online marketers and financial referrals.

Introducing Brokers

The Introduction of the Brokers Program is a crucial aspect of this broker. It lets clients be partners in business and make income through their teamwork and networking efforts. The program is simple and comes with the broker’s competitive structured rebates based on volume. This IB Program is perfect if you run an FX educational content-based website, forum, or Black Bull Group of traders you want to help establish and work with BlackBull Markets. Most IBs make a steady income by introducing one or two clients per month to this broker.

Affiliate Program

BlackBull Partners introduces a revolutionary and industry-leading payment system to reward their partners for their dedication to a cost per acquisition for each new client they recommend. Each aspect offered in CPA affiliate programs was developed to meet the requirements of marketers on the internet in an evolving referral market.

Some of the benefits include the following:-

- Unlimited earning potential

- CPA up to US$1000 per client

- Variety of payment options

- Fast and reliable payments on time every time

- Incentivized bonuses for referring more business

- Flexible payment structures

Educational Resources Offered by BlackBull Markets

BlackBull Markets have a learning platform that provides high-impact economic event coverage, the latest news expert commentary, video analysis trading guides, and much more offered by global market analysts. BlackBull also provides educational materials that are suitable for traders of various levels. They have videos, education guides, and glossaries that provide high-quality information. To help with the ongoing trading process, BlackBull Markets runs its Blog featuring market overviews, analysis, and research material.

Beginner

BlackBull Markets educational materials are divided into Trading Videos, Trading Guides, and a trading Glossary.

Intermediate

This page provides an easy-to-understand explanation of how trading operates and the basic principles of technical and fundamental analysis. The basic concepts of trading in forex will be explained in a variety of video tutorials as well as trading guides. Additionally, you can keep updated on the most recent market developments by reading their recent market analysis.

Advanced

Good quality Education Materials and advanced research tools are offered in this section. Also, this broker works with top market data providers, which will benefit the traders enormously. The research tools are packed with advanced MetaTrader capabilities, analysis, technical concepts, and other capabilities, including Autochartist.

BlackBull Markets Supported/Restricted Countries

BlackBull Markets accepts traders from the following countries like Australia, Thailand, United Kingdom, Canada, South Africa, France, Singapore, Hong Kong, Sweden, India, Germany, Norway, Italy, Denmark, Kuwait, United Arab Emirates, Saudi Arabia, Luxembourg, Qatar, and other countries. But traders from the United States are not allowed to use this platform.

BlackBull Markets Security Measures

Our team of experts has fully evaluated the safety measures of this brokerage. All information transmitted is secured by a secure SSL connection. BlackBull Markets adheres to segregated client funds at the top-tier banks and provides negative balance protection for its traders. In addition, the company has been registered by the FSPR, which implies strict laws should be adhered to. AML and KYC policies are in place for new client registrations and are ongoing.

BlackBull Markets Customer Support

Advertisement

As per our BlackBull Markets review, the platform offers great customer service through online chat, phone, and email. BlackBull Markets scored top in Customer Service because of their speedy and easy responses and the variety of languages supported. Compared with other forex brokers, BlackBull Markets stacks up against other brokers; traders can access customer support 24 hours a day through live chat. BlackBull Markets answers some questions in its FAQ section, where any queries for products and services are answered thoroughly. It also offers a toll-free number and email address for contacting customer support.

- Email: [email protected]

- UK Phone No.: +44 207 097 8222

- FR Phone No.: +33 184 672 111

- NZ Phone No.: +64 9 558 5142

BlackBull Markets Review: Conclusion

In the BlackBull Markets review conclusion, the BlackBull Markets trading platform offers an extensive range of services to traders worldwide, and it appears to be above the industry average. With its regulatory status, it offers competitive conditions to trade in markets and is also tops among the brokerages with high leverage ratios.

Various trading options are available, including technology used and platforms for trading. BlackBull Markets offers a wide selection of accounts and low spreads compared to other forex brokers.

BlackBull Markets also supports API trading and offers VPS hosting, making it an ideal choice for advanced algorithmic trading. The choice of assets, specifically for traders who trade equity, is among the top brokers in the Forex/CFD retail industry. BlackBull Markets is fairly new to the brokerage world and still has room to expand to be more competitive. BlackBull Markets is worth a try.

FAQs

Is BlackBull Markets a Reliable Broker?

BlackBull Markets has a regulatory license issued by the Financial Markets Authority in New Zealand and the FSA in Seychelles.

Is BlackBull Markets Safe and Legit?

BlackBull Market is a legit broker licensed by the authorities of New Zealand, the UK, and Seychelles, with an exceptional track record.

Is BlackBull Markets Good for Beginners?

As per our in-depth BlackBull Markets review, we can say that it is suitable for beginners. This trading platform provides numerous education resources, including MT4 videos, forex analysis guides, and a glossary for trading compared to most brokers.

Does BlackBul Markets Offer a Bonus?

As of this date, there are no offers or promotional deals at BlackBull Markets. Traders can visit the website or its social media pages for future promotions.

What Is BlackBull Markets Minimum Deposit?

The minimum deposit for the ECN Standard account is US$50, the ECN Prime account minimum deposit is US$2,000, and the Institutional account is US$20,000.