This content has been archived. It may no longer be relevant.

There are very few forex brokers that give traders access to foreign exchange (forex), cryptocurrency CFDs, indices, shares, commodities, etc., all under one trading platform. Admiral Markets is one of those brokers that provide its registered traders’ access to multiple MetaTrader platforms all at once. In this Admiral Markets Review, all the important points have been discussed. Read below to learn more about how the clients of the Admiral Markets groups make money & much more.

Admiral Markets has garnered notable acclaim with a commendable rating of 8.1 out of 10 from the our reputable platform CryptoNewsZ on the basis of various platforms. This ideal rating reflects the opinions of users who have used the platform’s services.

Admiral Markets Overview

| Official Website | https://admiralmarkets.com/ |

| Headquarters | Tallinn |

| Founded Year | 2001 |

| Regulated | Yes |

| Product Offered | Forex, Stocks, Indices, Cryptos, CFDs |

| Minimum Initial Deposit | 1 EUR, or 1GBP, or 1USD |

| Maximum Leverage | 1:500 |

| Islamic Accounts | Yes |

| Demo Account | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Trading fees | Depends on Currency |

| Inactivity fee | Yes |

| Withdrawal fee | Depends on Payment Methods & Country |

| Supported currencies | USD, EUR, GBP, CHF, JPY, & More |

| Customer Support | Email, Phone, WhatsApp, & Help Centre |

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

What Is Admiral Markets?

Admiral Markets UK is a MetaTrader forex and CFD broker founded in 2001. The Admiral Markets group has its head office in Tallinn, Estonia, but its branch offices are scattered in several other cities like London and Zagreb. The Admiral Markets Group has partnered with MetaQuotes Software Corporation to offer an extensive suite of MetaTrader platforms like MT4, MT5, MetaTrader Supreme Edition, and MetaTrader Web Trader. Apart from this, AdmiralMarket.com has more than 45 cryptocurrency pairs, shares, currencies, indices, gold, and silver, along with other commodities, CFDs for personal investment, and other trading options.

However, crypto CFDs are not available to UK retail traders or UK residents from any forex brokers UK entity. Traders can access the world´s financial markets and trade any popular instrument on competitive terms. Many broker reviews view Admiral Markets as the most reliant platform out there; thus, it is becoming a popular choice among traders.

Features of Admiral Markets

Admiral Markets UK has the following core trading features for its traders:-

- Easy-to-use website.

- Has an extensive list of investment products ranging from forex, commodities, cryptocurrencies, CFDs, indices, shares, etc.

- Has 8000+ markets to trade.

- Robust customer support.

- Affiliate programs that give lucrative rewards to users in the form of commissions.

- Offers an extensive list of educational resources in the form of webinars, traders’ blogs, updated news on markets, etc.

Services & Products Offered by Admiral Markets

Admiral Markets offers the following investment products and services to its clients:-

Forex Trading

The Admiral Markets trading broker has more than 40 minor plus major and exotic currency pairs with flexible leverage (maximum of 1:500) and tight spreads available to trade all 24 hours in 5 weekdays. Admiral Markets follow standard market trading hours. Specific opening and closing hours depend on the instrument traded but usually run from Monday to Friday, although the cryptocurrency is traded in decent volumes over the weekend.

Cryptocurrency Trading

Some of the popular cryptocurrency pairs like bitcoin, Ethereum, Litecoin, and Ripple are available to trade on Admiral Markets’ website.

Share Trading

Forex Users are allowed to trade CFDs on some of the leading blue-chip companies of the world like Apple, Google, BMW, BP, Facebook, etc. The Admiral Markets platform offers leverage rates of up to a maximum of 1:20 which allows the traders to trade in any direction with no extra charges charged on short sales. Moreover, with CFDs, users have not conferred any ownership of stocks and therefore the transaction happens instantaneously on Admiral Markets.

Index Trading

Forex Users can also trade the stock market with indices on some of the leading financial exchanges of the world. Leverage for index trading on the platform is offered up to a maximum of 1:500 with no commission or expiration. The Admiral Markets minimum deposit required in this case is only $1.

Bonds Trading

Clients of Admiral Markets are able to trade CFDs on government treasury bonds with a leverage of up to a maximum of 1:200, and without any commissions charged for CFD trading. The Admiral Markets minimum deposit required for CFD trading on government treasury bonds is only $1. Users can also go for short or long sales with no extra commission charged on short sales.

Commodity Trading

Users are allowed to trade CFDs on oil, gas, and precious metals like gold and silver with an initial investment of $200. Leverage for commodities on the website is offered up to a maximum of 1:500 without any extra commissions charged. Commodity trading is available 5 days a week all throughout the day (24/5).

The following commodity futures CFDs are also available:-

- ARABICA_

- COCOA_

- COPPER_

- COTTON_

- CrudeOilUK_

- CrudeOilUS_

- ORANGE.JUICE_

- ROBUSTA_

- SUGAR.RAW_

- SUGAR.WHITE_

- XAU_

Is Admiral Markets Regulated?

Admiral Markets is regulated under 2 tier 1 jurisdictions and 2 tier 2 jurisdictions thus making it a safe online broking platform for both forex and CFD trading. The tier 1 regulators are FCA (Financial Conduct Authority) and ASIC (Australian Securities and Investment Commission).

The group is also licensed under the Estonian Financial Supervision Authority EFSA, JSC (Jordan Securities Commissions), and CySEC (Cyprus Securities and Exchange Commission Cysec). The online broker is also legally allowed to operate in various other countries, like France, Romania, and Indonesia.

Admiral Markets forex brokers keep their client capital separate from the group’s assets; it stores its client’s assets in an EEA-regulated credit body to comply with the various regulatory trading conditions. Admiral Markets also ensures robust protection of its clients’ money(in case the broker goes bankrupt) via various financial services schemes like Deposit guarantee schemes and compensation schemes.

Admiral Markets Review: Pros and Cons

| Pros | Cons |

| Regulated broker; Admiral Markets is regulated with ASIC, FCA, CySec, and EFSA. | The Brokers Customer support is only available 5 days a week. |

| The Forex brokers Provide commission-free trading. | |

| No Restrictions | |

| Has an extensive list of educational materials. | |

| Flexible Trading Accounts in 2024 |

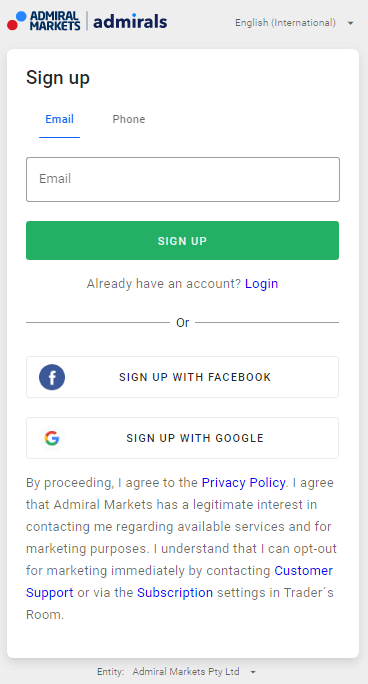

Admiral Markets Account Opening Process

The account opening process with the online broker Admiral Markets is quite easy and quick. Users need to visit the broker’s official website and click on the ‘Live Account’ button on the broker’s homepage. This will direct the users to register their account with the broker, where they can find a short online form that needs to be filled in with all the necessary details. It hardly takes a few minutes to enter the first and last name of the user along with his email id. After this, the users are prompted to provide some more personal details like client type (individual or corporate), mobile number, etc.

After filling up the form, users must verify their email address and upload identification proof like a driver’s license or a passport. Address proof is also required along with the identification proof; it may be a recent utility bill like an electricity bill or a bank account statement, etc. The documents should be recent, not more than 6 months old. Once the team and all its documents have verified the account with Admiral Markets, it allows the user to deposit funds into their accounts and begin trading on the website.

Types of Admiral Markets Accounts

The forex CFD broker provides the following accounts to its clients:-

Demo Account

Admiral Markets offers its users a demo account with a total sum of $10,000 in virtual funds. To use this demo account, users need to select the ‘Practice Account’ tab on the sign-up page which will direct them to receive their Admiral Markets login credentials. With this Admiral Markets login credential, users can test all the trading features offered by the broker like the Admiral Markets MT4 (MetaTrader 4) and Admiral Markets MT5 (MetaTrader 5) platforms, and also try leveraged trading on a wide range of trading instruments. The Admiral Markets demo account offers all the real-time market data as in the original version with just a delay of 15 minutes.

The website does not accept customers from certain countries like the USA, Canada, Afghanistan, Iran, Iraq, Burundi, Equatorial Guinea, Democratic Republic of Congo, Ethiopia, Jamaica, (DRC), Libya, Sudan, Syria, Myanmar (Burma), North Korea (DPRK), Somalia, Yemen, Turkey, and Vanuatu. Japan is also on this restricted list but residents of this country are at least allowed to use the demo version of the broker.

Micro Account

Micro account allows users to trade micro-lots of the currencies e.g 1000 units of the base currency.

Mini Account

Mini Account allows users to trade mini lots of the currencies e.g 10,000 units of the base currency.

Standard Account

A Standard account allows its users to trade in standard lots of currency pairs like 100,000 units of the base currency.

ECN Account

ECN account or the Electronic Communications Network account connects a buy or sell order with a network of banks, liquidity providers, and other brokers. ECN accounts offer their holders variable spreads and also allows them to try almost all the accounting strategies including scalping.

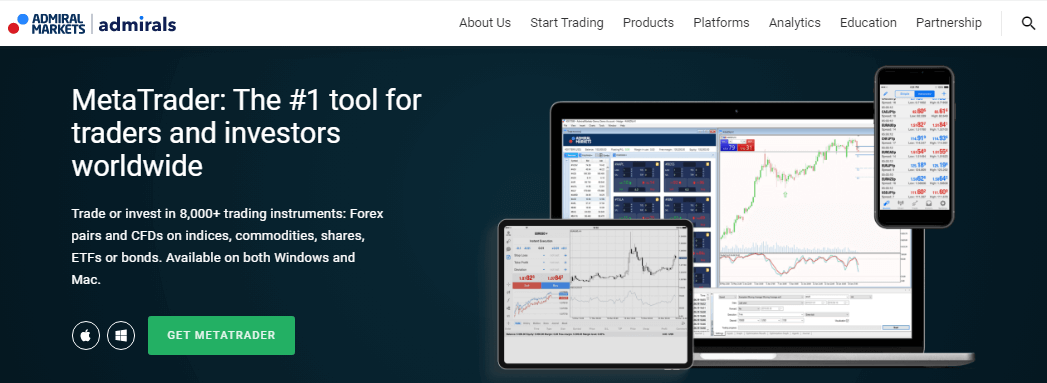

Admiral Markets Trading Platforms & Trading Tools

Admiral Markets Groups has partnered with MetaQuotes Software Corporation to provide its clients with a full suite of MetaTrader platforms that includes the following:-

MetaTrader 4 or MT4

MT4 or MetaTrader 4 is considered one of the leading retail trading platforms of the world designed specifically for CFD trading and forex trading. Charting functionality and advanced order management tools make certain you could monitor your positions quickly and economically. MT4 account (either a Live or Demo account, on all servers) can set up Acuity Trading Widgets by downloading and updating to the latest version of MetaTrader 4 Supreme Edition. The software is compatible with all Windows and Mac devices and offers a fast and reliable trading experience to users. Metatrader 4 offers the following features to its users:-

- Multiple time frames, ranging from 1 minute up to a maximum of 1 month.

- Customizable indicators.

- Rich historical data.

- Automated trading through APIs.

- Advanced charting.

- One-click trading option.

MetaTrader 5 or MT5

MT4 is the latest evolution of MT4 and is focused on serving more experienced traders and hence the MT5 trading platform more advanced analytical and technical trading tools with a fully customizable user interface. The platform has the following features:-

- Free market data.

- Live news feeds (Dow Jones News).

- Education market.

- Level 2 pricing.

- VPS support.

MetaTrader Supreme Edition

This trading platform is for veteran traders who are keen to enhance their trading operations. There are sophisticated technical and analytical indicators embedded on the platform, high-quality pattern recognition technology, day trading strategies, and various holding timeframes. The platform also has Global Opinion widgets which provide add-ons to manage multiple market orders and currencies.

MetaTrader Web Trader

MetaTrader WebTrader is an easy-to-access web-based platform that allows anyone with a robust internet connection to open an account with Admiral Markets and to trade from anywhere. It allows users to do their own price analysis and thus enables them for straightforward trade management. Users can access a wide range of trade indicators on the Web Trader platform, including Bollinger Bands and pivot points along with an easy-to-use foreign exchange pip calculator. Apart from these, the platform also facilitates popular strategies, like 1-minute scalping and hedging. Various risk management and charting tools like the guaranteed stop-out levels can also be implemented on this platform which in turn helps to minimize losses.

Admiral Markets Leverage

Advertisement

The average Admiral Markets leverage offered by the Admiral Markets broker is around 1:30 for retail clients. Admiral Markets Clients settled in Jordan (whether EU, non-EU or domestic), can access leverage rates up to a maximum of 1:500. The list of leverages offered is listed as follows:-

- For Forex pairs- the maximum leverage offered is 1:30.

- For Stocks, ETFs, and Bonds- the maximum leverage offered is 1:5.

- For indices and commodities- the maximum leverage offered is 1:10.

- For cryptocurrencies- the maximum leverage that the broker provides is 1:2.

To enable traders to calculate the margin call process, Admiral Markets brokers has an easy-to-use leverage calculator on its website. Margin requirements for some markets can be found in Contract Specifications by selecting the needed instrument in the look-up menu of the website.

Admiral Markets Fees

The trading with Admiral Markets costs is comparatively low, the online broker charges fees from spreads that start from zero pips. Average live spreads on major foreign exchange (forex) pairs like EUR/USD and GBP/USD, are 0.6 pips and 1 pip respectively. All accounts with Admiral Markets offer real-time data brokerage fees meaning you can view live, up-to-date prices of all global markets offered. Brokerage fees vary between different asset classes. Spreads on indices like US Dow Jones are somewhere around 1 pip. Apart from this, there is an inactivity fee charged by the online broker on dormant accounts (dormant for more than 2 years) which is around $10 monthly. Also, there are swap rates, also known as interest fees, that are charged to clients for holding positions overnight. Details of various swap fees charged by Admiral Markets can be found on the exchange’s website. Thus, according to the various Admiral Markets reviews, the broker charges a similar price as compared to the industry average best forex broker in the market.

Deposit & Withdrawal Options

The deposit and withdrawal options offered by the Admiral Markets online broker are as follows:-

Admiral Markets Deposits

Admiral Markets brokers have a plethora of deposit options, thus offering its users a huge amount of convenience and flexibility for depositing funds into this company, but it does not accept cash deposits from banks.

Bank Transfer

It is the safest and most legitimate way to transfer large sums of money. However, the major drawback of this payment option is the relatively long waiting period that may sometimes extend to 7 days; the broker’s official website states that the average waiting time is up to 3 business days, but trading issues may arise anytime that might prolong the waiting period to a full week.

Visa & Mastercard

VISA or MasterCard systems are also accepted at Admiral Market’s websites with transactions processed instantly. Users can use any currency to make payments from these plastic cards- both credit or debit cards. The minimum amount that can be deposited using debit or credit cards is 50 EUR/USD. However, the minimal transaction depends on the currency in use.

Safety Pay, Przelewy, and iBank&BankLink

These 3 are widely used European payment systems. They provide quick processing of payments but they are not instantaneous; users may have to wait for 3 business days.

Klarna

Klarna is one of the most reliable payment systems featured on the Admiral Markets Group. Transactions processed by this payment method are instantaneous and can be used to transfer up to a maximum of 15000 EUR or 15000 GBP. The minimum amount is set at 50 EUR or 50 GBP.

PayPal

This is one of the most common payments and also one of the biggest E-payment systems in the world having millions of users transferring billions of USD every week. Payments via PayPal are processed instantly.

Skrill, Neteller, and IDEAL

This E- payment getaways also offer instant processing and are generally used by companies that operate globally. Skrill and Neteller are widely used in Great Britain and Europe.

The minimum deposit required is $100 and all the above-mentioned payment methods are free, except for e-wallets like Skrill and Neteller, for which they charge 0.9% or a minimum of $1.

Withdrawals

Withdrawals can be made via bank transfer, Skrill, PayPal, and Neteller. All withdrawals are processed instantly except for a bank transfer, which may take up to a maximum of 3 days. For withdrawals, the online broking platform provides the required bank codes whenever a user requests a withdrawal. Traders are eligible for 2 free withdrawals per month with a minimum withdrawal of $1. Admiral Markets may charge an additional bank currency conversion fee. Click here for more details of its fee layout.

Admiral Markets Partnerships

Admiral Markets brokers recently launched a partner program in the name ‘Affiliate Markets Partner Program’ that allows users to earn money by becoming an affiliated partner with the online broker. There are 2 ways to join the partnership program- one is to introduce a new client to Admiral Markets and the second is to become an affiliate with the online broker itself. There are thousands of users who have already joined these newly launched partnership programs just because the broker is under regulation and thus reliable. There are 3 options to choose from and the users can join them as per their own conveniences and specialties. The broker is fair on all partner programs that the users opt for. All the 3 programs are discussed hereunder:-

Introducer

The partnership program allows users to become Admiral Markets’ introducers, and get access to some of the attractive commissions offered by the broker. Users can earn a whopping amount of $200 per referral. All they have to do is to introduce their clients to the market and earn a good number of commission(s).

Admiral Markets Affiliate Program

Admiral Markets brokers affiliate program allows users to earn money by introducing and referring investors to brokers in 2 ways – via transactions and via fiat currencies. When the users introduce clients to brokers, the users get commissions as soon as the clients start taking potions. Whereas, in a fiat-based transaction, users earn a fixed fee for the clients introduced by them to the brokers to start investing money.

Participants of the Affiliate program can earn up to $600 per conversion just by directing the audience to Admiral Markets. To become an affiliate with the Admiral Markets group, clients should follow these steps:-

- Users should register as a foreign exchange affiliate with Admiral Markets and join the affiliate portal.

- Next, they should choose any promotional materials that seem convenient and suit their audience.

- Users should publish various promotional materials on their websites.

- In the final step, as soon as the clients become affiliated with the broker, they start earning commissions up to $600 via any one of the best CPA affiliate programs in the market per client referred to the broker (Admiral Markets).

As soon as the clients become Admiral Markets Affiliate, they can access the following benefits:-

Faster Payments

Transparent reporting allows affiliates to monitor the program and receive their commission fee in a hassle-free way.

Generous Commissions

Affiliates can earn a generous commission of up to $600 for each client referred to the broker.

Trusted Brand

Admiral Markets is a trusted brand, regulated under apex institutions like Australian Securities and Investments Commission ASIC, Financial Conduct Authority FCA, Cyprus Securities, and Exchange Commission CySec, etc, and thus becoming an affiliate with such a trusted brand adds credibility to the platforms.

Marketing Materials

The online broker has various marketing resources to the affiliates that can accelerate their trading results with the help of booklets, conversion-optimized banners, widgets, landing pages, email templates, and much more

24/7 Access to Affiliate Portal

Affiliates can access the online portal 24/7 thus getting regular alerts for any upcoming affiliate offers or marketing materials. They can also access their personal data and reports on the affiliate portal as soon as they register there.

Dedicated Customer Support

Affiliates can get in touch directly with a team of dedicated affiliate specialists who are always ready to guide and assist them with customized trading solutions to all their queries. You can also submit a feedback form which is an online query form available on the ‘contact us page

White Level Partnership

Besides introducer and affiliated programs, the broker also has a white label partnership program that gives users access to revenue sharing of up to 30-50%. Based on their partnership, users can even gain access to the Admiral Markets’ sub-licensed platform that allows them to start their own business with the online broker’s support. Users can recruit clients, provide their financial services and earn money all at the same time.

Bonuses

Currently, Admiral Markets offers 100% welcome bonuses. Bonuses will only be credited to the exact same real trading account that was funded.

Resources Offered by Admiral Markets

Admiral Markets brokers have an impressive range of resources in the form of Trading Central and other useful resources like the Market Analysis that includes various instruments like Forex pairs, Indices, Shares, and Commodities. Admiral Markets Clients can also view Heatmaps, Market Sentiment, and Analytics. There are also provisions of educational resources for both beginner traders and advanced traders which include Webinars, Videos, eBooks, and trader’s blogs on Forex and CFDs. Apart from this, traders can also avail the of free online courses on fulfilling certain trading criteria.

A small summary of the major educational resources offered by the broker is listed below:-

Forex and CFD webinars

Regular live trading webinars are held to cover market tips & news hosted by professionals & financial traders.

Articles and Tutorials

These tutorials comprise trading basics, trading psychology, analysis, trade indicators, and much more.

Zero to Hero

As the name implies, this is a complete guide to help users master the foreign exchange markets.

Forex 101

This is a three-step program focused to help clients learn everything about CFDs and Forex trading.

Trading Videos

There are many Youtube videos available on the website covering various analysis reports and market outlooks.

Apart from these, various eBooks on “Blockchain Basics”, are also available on the broker’s website along with a useful Trading Glossary. There is also a dedicated FAQ Section where clients can find ready answers to almost all the common queries related to the trading software and the markets in general, software and the Terms & Conditions of the customer service offered.

Admiral Markets Mobile App

Admiral Markets (United Kingdom) offers a multi-functional mobile application that can be downloaded to all iOS and Android devices. The Admiral Markets mobile trading app can be easily downloaded from either Google PlayStore or Apple AppStore.

This compatible mobile app allows traders to trade on the go while being able to access a live price feed on the website along with other features like 3 chart types, custom indicators, news releases, along a recent trading journal. The mobile app interface can also be customized according to the clients’ needs.

- Users can easily manage their accounts and trade on the go.

- Admiral Markets offer real-time trading and data pricing.

- Can access an extensive list of product offerings.

- Can avail unique features like credit card and document scan depositing.

- Admiral Markets offers unique features like charting or live-to-trade.

Admiral Markets Security Measures

The brokers’ company emphasizes its client’s security and therefore uses robust encryption software on its website to secure client data. Apart from this, the MetaTrader platforms available add an extra layer of security to the website and also to the client’s data. There is also a provision for one-time password authentication available on the MetaTrader platforms while dual-factor authentication via SMS or Google authenticator is used by the broker to authenticate Traders Room. Traders can keep their account balance from sliding to a negative amount. Negative Account Balance Protection Policy AdmiralMarkets UK compensates clients for negative balance caused by regular Forex trading activities such as gaps. Note that Retail clients receive unlimited negative balance protection, while the protection offered to Professional clients is limited to 50,000 GBP. In accordance with FCA rules, all client money is kept fully segregated from Admiral Markets’ own assets in an EEA-regulated credit institution.

Admiral Markets Last 6 Months Financial Results

For a detailed breakdown of Admiral Markets’ last six months financial results, please visit the official website’s report section by following this link. Here, you’ll find admiral markets review, analysis and a transparent overview of the company’s financial performance, reinforcing the broker’s commitment to transparency and accountability.

Admiral Markets Customer Support

Admiral Markets offer highly efficient client support services; the team comprises trade specialists who are always ready with their solutions and can be reached at any time of the day. The customer support team has highly positive reviews. The website provides support in multiple languages that include English, Spanish, Bulgarian, Czech, Hungarian, French, Estonian, German, Dutch, Greek, Lithuanian, Moldovian, Latvian, Croatian, Serbian, Romanian, Slovenian, Polish, Ukrainian, Russian, and Croatian. Therefore, traders located in all parts of the world will be able to avail the customer service of the website.

The customer support team of Admiral Markets brokers can be contacted via a number of channels including email, telephone, live chat, etc. A separate feedback form is also available on the “Contact Us” page on the broker’s website where the novice traders can submit an online query regarding their trade-related issues which are generally resolved within a maximum of 24 hours according to Admiral Markets review. It has an Email address, Telephone support number, Live chat where traders need to click on the ‘Chat’ logo found at the bottom of the exchange’s website.

Advertisement

Customers can get in touch directly with the customer support representative within a few minutes via live chat or telephone. The multilingual customer support team can deal with almost all trading accounts and technical-related queries, including requests for closure or deletion of a trading account. Clients can also stay updated with the latest news about the Admiral Markets Group on various social media platforms like Facebook, Twitter, Instagram, YouTube, and LinkedIn.

Admiral Markets Review: Conclusion

According to the various Admiral Markets reviews online, the broker provides all the essential trading services to its clients; it provides them easy access to more than 8,000 markets at a very low cost. Clients can choose any markets among the 8,000+ ones across Forex, shares, indices, CFDs for Commodities, ETFs (Exchange Traded Funds), Cryptocurrencies, and bonds all across the leading trading platforms like MetaTrader 4 and MetaTrader 5. Forex and CFD traders choose Admiral Markets for its excellent investor education and advanced MetaTrader features, including the Supreme add-on and market research via Premium Analytics.

There is also an extensive list of research and educational and reference materials available to traders according to their trading needs irrespective of their trading experience levels. The MetaTrader Supreme Edition Add-in is the most beneficial education resource amongst all that does not charge any additional trading fees for customers to access it. Admiral Markets brokers let you access mobile trading from almost any Android device available. With an Admiral Markets risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money using features like the stop-loss order. You can also limit orders and take profits even on instant price spikes. Admiral Markets has a wider, more sophisticated range of orders and settings, which can be beneficial to virtually any strategy and help our clients get significant advantages in volatile conditions.

As we go through the list of many top brokers, Admiral Markets is a well-known broker. It offers multiple trading account options to choose from according to their trading styles, either slightly larger spreads, no commission, or the Zero account types with lower spreads but with high commission. These varied trading account options give the traders the flexibility to choose their preferred retail investor accounts types. Most reviews recognize Admiral Markets UK as a platform to start over especially for traders who are keen to diversify their portfolios and explore new markets.

FAQs

Is Admiral Market Legit?

Yes, Admiral Markets UK is a legit platform regulated under 4 apex institutions namely, CySec, FCA, ASIC, and EFSA

Is Admiral Markets a Market Maker?

Yes, Admiral Markets is a market maker. It does not use an ECN account-model across any of its registered retail investor accounts.

What Is the Minimum Deposit for Admiral Markets?

The minimum deposit for Admiral Markets is 1 EUR, or 1GBP, or 1USD.

Is Admiral Markets FCA Under Regulation?

Yes, it is under regulation by the Financial Conduct Authority FCA.