ActivTrades is a leading UK-based financial trading platform offering forex, CFDs, and spread betting on various trading platforms, including its proprietary ActivTrader user-friendly platform and two other platforms, MT4 and MT5. ActivTrades PLC was established in Switzerland in 2001 and is headquartered in London. The broker has quite a strong customer base in the EU across Germany, Italy, Portugal, and France and an extensive overseas market extending to Australia.

ActivTrades Overview

| Official Website | https://www.activtrades.com/ |

| Headquarters | London |

| Founded Year | 2001 |

| Regulated | CSSF, FCA, CMVM, SCB, BACEN |

| Product Offered | Forex, CFD, Shares, Commodities, ETFs, Indices |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 400:1 |

| Islamic Accounts | Yes |

| Demo Account | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| Trading fees | Low Trading Fees |

| Inactivity fee | €10, Monthly |

| Withdrawal fee | It depends on the Currency and Transfer Request |

| Supported currencies | EUR, USD, CHF, GBP |

| Customer Support | 24*5 via Live Chat, Email, Call, & Enquiry Support |

What Is ActivTrades?

ActivTrades online broker is an independent forex brokerage company established in Switzerland in 2001. Initially, it was a small brokerage company that has now developed into one of the leading global brokers for institutions and retail traders. ActivTrades moved its headquarters to London in 2005, after which the company started showing rapid growth throughout Europe.

It has become a market leader in France, Germany, and Italy and continues to grow as a company across international borders in Australia, Russia, South East Asia, and South America. More recently, the ActivTrades online broker has started serving its trading platforms in Dubai, covering the trading needs of the Middle East.

ActivTrades has a low minimum deposit requirement of $10. It also offers a demo ActivTrades account to traders to experiment with the platform’s features and familiarize themselves with trading platforms. ActivTrades ECN broker is authorized & regulated by the Financial Conduct Authority (FRN: 434413), the leading regulatory body in the UK.

Among its notable security features, it is worth mentioning that ActivTrades is a reliable forex broker that keeps all client money in segregated accounts and employs top tier-1 banks to do this. Thus, accounts lose money rarely, which makes it safe to trade.

In this ActivTrades review, we will discuss the platform’s advanced and additional features, services offered, pros and cons, multiple trading platforms, market instruments, financial instruments directive, leverage, fees, bonuses, partnership program, and many more.

ActivTrades User Experience

As per this ActivTrades Review, ActivTrades offers corporate and individual retail investor accounts and professional accounts for eligible traders. Swap-free/Islamic accounts are also available along with a free demo account for demo trading.

All ActivTrades accounts have access to over a thousand tradable products through spread betting, forex, indices, commodities, ETFs, shares, and CFDs with this provider. The good news is that ActivTrades offers STP execution. Hence, traders can expect tighter spreads & more transparency.

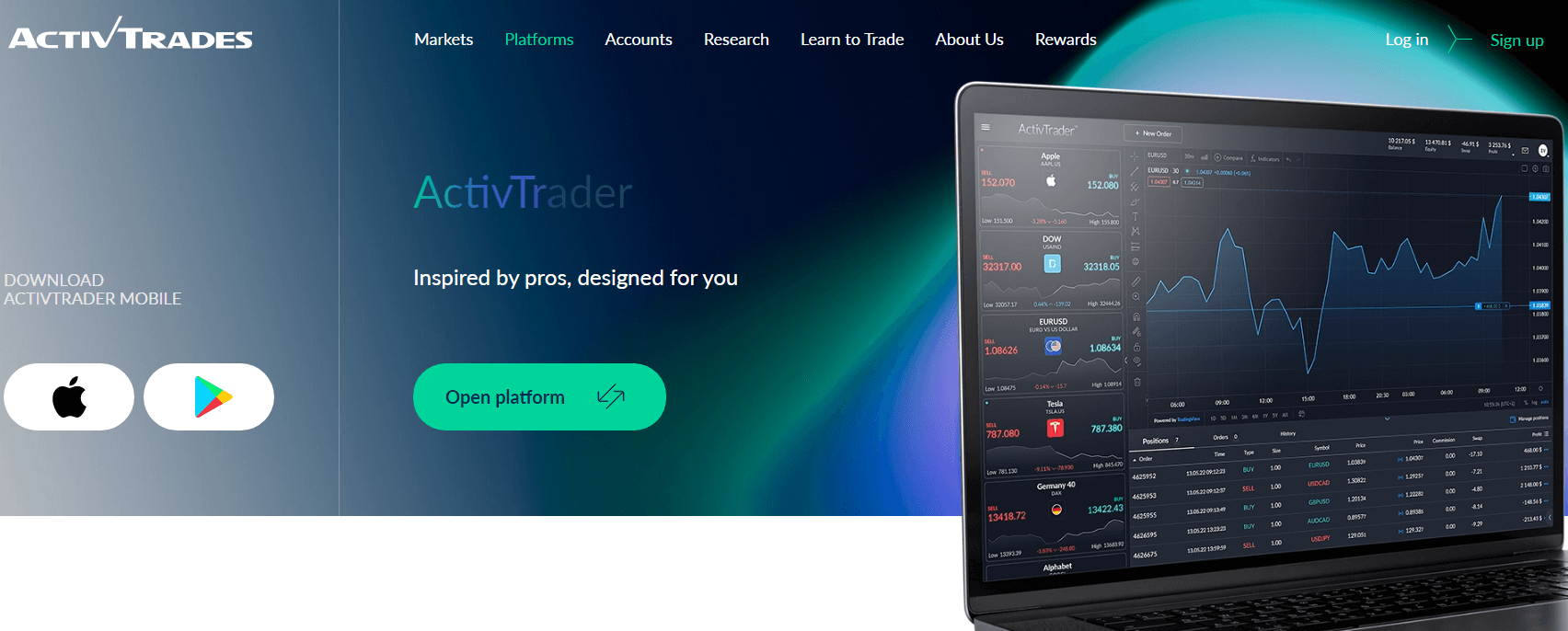

One of the best things about ActivTrades is its impressive user interface that displays clear and easily navigable features and functions. ActivTrades traders can trade any product of their choice through the well-established proprietary trading platform, ActivTrader, MetaTrader 4, and MetaTrader 5.

ActivTrades includes the Progressive Trailing Stops Order and all the platforms are compatible on PC, iOS, and Android devices, allowing mobile trading on the go. The trading broker also offers free advanced trading tools including Smart Lines, Smart Order Two, Smart Patter, Smart Forecast, and many more.

The ActivTrades broker offers 24-hour customer service 5 days a week through live chat, email, and phone support. The broker offers daily exclusive markets and technical analysis and the clients have access to a huge archive of regular webinars.

The broker also offers demonstration videos for traders who are not well acquainted with foreign exchange, CFDs trading, and financial markets. Although trader research and technical analysis are limited, the educational videos and other course studies enrich beginners about forex trading and investments.

Features of ActivTrades

Negative Balance Protection

One of the notable features of the ActivTrades company is negative balance protection. This feature ensures that clients never lose more capital than they initially invested with this company. This means that losses can never exceed deposits at ActivTrades.

Leverage

According to this ActivTrades review, the broker has chosen an optimal path that maximizes its offering of tighter spreads and maximum leverage, capped at 400:1. However, the leverage is available only for residents who trade with the Bahamas or Dubai entity of the ActivTrades platform. The FCA regulation strictly restricts the leverage to up to 1:30 for major and minor forex pairs.

Customer Support

Another notable feature of ActivTrades is its customer support center. The support team has won several awards, like Best Forex Broker in the UK – from Brokertested.com, and its main objective is to keep investors and traders updated with market news, additional features, market opportunities, trends, and technology developments. ActivTrades offers live chat 24 hours a day, five days a week, and email support with the fastest response time of 27 minutes. These features make the platform a fairly good broker.

Regulations

Coming to regulations, ActivTrades Corp is regulated by the Securities Commission of the Bahamas, whereas the subsidiary company of ActivTrades PLC is authorized and regulated by the FCA, CSSF, SCB, CMVM, and BACEN. Experienced and professional traders know that the FCA is a leading and respectable regulatory authority which makes the ActivTrades forex brokers a reliable and trustworthy trading platform for foreign exchange and CFD trading.

Awards

ActivTrades offers an award-winning platform, MetaTrader 4. It has won multiple awards over the years of its operation. The awards won by ActivTrades are-

- Best Online Trading Services 2018 – ADVFN

- Forex Broker of the Year 2017 – Le Fonti International Financial Awards

- Best Online Trading Services 2017 – Shared Magazine Awards

Clients

ActivTrades brokers boasts more than 1000 financial instruments with thousands of registered traders from across the globe, including customers in countries like Singapore, France, and the UAE.

Funds Protection

ActivTrades Corp offers funds protection insurance of up to $1 million. The trading platform uses different security measures to protect servers, payments, and client trades. One of the security measures supported by ActivTrades is encryption protocols, apart from negative account balance protection, funds protection, and segregated bank account.

In addition to this, the MetaTrader platform also offers robust user security features with an additional authentication option at login or sign up. Hence, traders seeking a reliable and safe forex broker can keep ActivTrades in their top 5 list of brokers as it offers enhanced client fund protection through additional insurance.

Fast Execution

The powerful ActivTrades broker is carefully designed keeping in mind the trading requirements of its clients. The intuitive interface offers a lightning-fast execution speed of 0.4 seconds, which is one of the most notable features of the platform.

Fully Automated Trades

Several technical tools on ActivTrades such as the APIs (Application Programming Interfaces) help the broker implement an automated trading strategy. These APIs facilitate fully automated trades where traders can directly connect their software with their broker accounts to place orders. APIs allow traders to directly connect their screening software with their broker account to place a market order or other order types.

No Hidden Fees

ActivTrades offers low trading and non-trading fees that include an inactivity fee of $10 for every month of inactivity after a year of no trading. The fees at ActivTrades are as transparent as possible, which means there are no hidden fees. This is something that every client desires while searching for the best trading platform in this industry.

Services Offered by ActivTrades

ActivTrades offers good spreads, multiple trading accounts, trading platforms, and a fully automated trading environment with the best execution speed of 0.4 seconds. The services offered by ActivTrades are:-

- Negative account balance protection so that the clients’ losses do not exceed deposits.

- Additional insurance covers up to $1 million.

- Being a non-dealing desk broker, ActivTrades offers direct executions without any human intervention.

- Multiple currency pairs including exotic forex pairs for the best trading experience. This includes EUR, USD, GBP, CHF, and more.

- An experienced customer support team is available 24 hours, 5 days a week, and offers support in 14 different languages.

- Multiple funding, withdrawal, and trading options including bank transfers, credit or debit card payments, Skrill, Neteller, and PayPal.

- A powerful proprietary ActivTrader broker that provides fast executions, an intuitive interface, and the most efficient trading experience for all.

- Private coaching and one-to-one training with industry experts offering a range of add-ons and trading tools.

Is ActivTrades Regulated?

As discussed before in this ActivTrades review, the broker is authorized and regulated by the FCA in the UK, under the subsidiary of ActivTrades PLC, reference number: 434413.

In addition to the FCA regulations, ActivTrades is also authorized by the Security Commission of the Bahamas, and more like CSSF, BACEN, and CMVM. According to the company, ActivTrades Corp is still under development to offer platforms to the South American markets and broaden its customer base to non-EU clients as well.

ActivTrades Review: Pros and Cons

| Pros | Cons |

| Segregated client funds. | High inactivity fee of €10 per month. |

| Multiple trading platforms and accounts. | Improvements are required in the Education department. |

| Multilingual 24*5 customer support. | Lacks social trading and copy trading. |

| Above-par security measures include negative balance protection. | |

| Regulated and licensed by leading regulatory authorities. |

Types of ActivTrades Trading Platforms

ActivTrader

A proprietary platform, ActivTrader, is a beginner-friendly forex and CFDs trading platform that offers advanced features and industry-leading technology. It is ideal for inexperienced as well as professional traders. Some of the features of the ActivTrader platform are:-

- Scalping and hedging strategies

- Market sentiment indicators

- Pending and Instant order types

- 14 drawing tools and chart types to aid pattern recognition

- Progressive trailing stop function to protect profits and revenue

The ActivTrader platform is supported on various devices including a web platform, desktop platform, and mobile trading (mobile apps are available) platform. However, it does not function on Internet Explorer. ActivTrader also has additional advanced trading tools specially designed to improve the experience of online trading CFDs and foreign exchange. The advanced trading tools are:-

- The Smart Order 2 app, built by the ActivTrades to increase the trading speed and enhance the integration between the app and the platform.

- The tools are compatible with both MT4 and MT5 online trading platforms.

- Predefined Trendlines set by Smartlines; when the value of a particular investment product crosses trendlines, the orders are instantly placed.

- SmartTemplates indicate short and long opportunities depending on charts signals and trend strength.

- SmartCalculator provides useful risk management features through simulation of different price and trade scenarios.

MetaTrader 4

ActivTrades offers an award-winning MetaTrader 4 (MT4) platform which is one of the globally recognized MT platforms, especially for forex trading. Some of the features of MT4 have been highlighted below:-

- Fully automated trading through API

- Advanced stop out levels

- Markets sentiment indicators

- Extensive historical data

- Advanced frame view

- One-click trading

MT4 users can download the software on any desktop device or trade stocks, foreign exchange, indices, and other financial assets through their web browsers. Hence, mobile trading is enabled by using mobile apps.

MetaTrader 5

Lastly, ActivTrades offers the MetaTrader 5 (MT5) platform, which is most suitable for experienced traders. In addition to trading forex, shares, and indices, MetaTrader 5 offers access to more than 500 ETFs and CFDs. The key advantages of trading on MT5 platforms are:-

- Strategy tester and historical data

- Trailing stops and price alerts

- Economic news headlines

- Integrated trading statements

- 21 time frames

- One-click trading for all financial markets

MT5 users can download the MT5 software on their desktop to trade and invest from their mobile devices (mobile app is available) or use the WebTrader version.

Market Instruments by ActivTrades

As per this ActivTrades Review, the ActivTrades website offers various trading instruments allowing consumers to choose to trade forex, indices, shares, commodities, and cryptocurrencies for the UK residents. Traders may also gain access to the essential Fixed Income contracts like the German bund and the US T-Note.

ActivTrades also offers a range of spread Betting and ETFs which are available for UK residents. Binary options and bonds are not available on ActivTrades. The following are the popular instruments offered by the ActivTrades website:-

- Forex

- Commodities

- Indices

- Shares/Stocks

- Financials

- Cryptocurrencies

Range of Trading Instruments

ActivTrades site offers many assets that include:-

- Over 50 forex major currency pairs such as EUR/USD, USD/GBP, and many other currencies.

- More than 500 company stocks and shares such as German shares and Japanese shares.

- More than 35 large indices like Dow Jones, NASDAQ, 100 UK, Euronext, and Ger 30.

- More than 15 commodity CFDs including silver, gold, grains, and energies.

ActivTrades Account Opening Process

To open an account, every new client should answer some basic compliance checks for basic informational purposes to make sure they understand the risk involved in forex investments and trades as retail investor accounts lose money and past performance do not guarantee future results.

After answering the basic compliance questions, traders on the ActivTrades website can open the following retail investor accounts – a free demo account, a live Individual account, and an Islamic account. The account opening process on ActivTrades is straightforward and does not take much time.

To open a live Individual account, all users need to do is visit the official ActivTrades website, click the “Open Account“ button by navigating to the Account section on the platform’s homepage. The users are redirected to the platform’s account opening page where they need to enter personal details including name, email ID, a unique password, telephone information, their savings, employment, account funding details, and trading preferences.

Next, they need to choose a preferred base currency and trading platform. For informational purposes, users are asked certain information relating to their forex trading experience. The broker will redirect the user to the next page only if the broker is satisfied with the answers.

Once the users pass compliance, the ActivTrades website takes the users to the next page for declarations where the interested users who want to trade with ActivTrades need to verify their address and personal identity in compliance with the standard AML and KYC procedures.

Users may also submit scanned color copies of any national ID such as the utility bill, driving license, bank card, or bank statement anytime in the future. Clicking on the ‘Submit’ button takes the users to the ActivTrades Personal Area where the application status is can be viewed along with downloads, funding methods, access to proprietary trading and research tools, and education including Smart Forecast and Smart Pattern.

ActivTrades Account Types

Demo Account

ActivTrades offers a free demo account for new traders so that they can familiarize themselves with the platform’s features and functionality. A new client on the ActivTrades website can test his trading skills with virtual money worth £10,000. The demo accounts are available for all three platforms. Nevertheless, with the Meta Trader 5 demo accounts, market information on CFDs shares is displayed with a 10-15 minutes delay.

To open an account and try out the demo ActivTrades trading platform, users need to click on the “Try Free Demo“ tab on the Accounts page and the broker instantly creates a demo account for the new client without any registration or KYC requirement.

Individual Account

The ActivTrades PLC site offers an Individual account with a variety of ActivTrades trading features such as the negative balance protection, enhanced client funds insurance, direct executions by acting as a non-dealing desk forex broker, multiple currency funding including EUR, USD, CHF, GBP, 24×5 customer support, several funding and withdrawal options, min. deposit requirement of £500 and ESMA restricted leverages.

Apart from the Individual account, ActivTrades also offers a Professional account to eligible traders under the ESMA regulation. Users with the Professional account also enjoy similar trading account features offered on ActivTrades as well as new features including the best trade executions, negative balance protection, segregated accounts, enhanced insurance, and FSCS protection.

Islamic Account

ActivTrades has always given importance to the special requirements of its clients, even with the inception of the Islamic accounts. All account types ActivTrades offers are focused on offering the highest level of financial service to the whole Arab and Islamic population. Hence, the broker offers a Shariah-compliant Islamic account to its traders. Islamic trading account has the following features:-

- No interest paid on expired contracts lasting more than 24 hours

- Zero consistent rollover interest

- No extra roll-over commissions for any contract lasting more than 24 hours

- Compatible on MetaTrader 4 (USD accounts) and MetaTrader 5 (USD, EUR, GBP, CHF accounts)

- Trade microlots and minilots

- Five-digit spreads

- Automated trades via Expert Advisors

- Minimum deposit requirement of $10

- Direct executions

ActivTrades Leverage & Margin Requirements

Leverage is any capital that a broker offers to its clients to potentially raise money, and it is expressed as a ratio of the client’s capital and the volume of the broker’s credit. For example, if a user deposits an amount of $500 in his trading account, he can control $50,000, if the leverage is capped at 100:1.

Leveraged products offer such an opportunity to raise money. However, traders must always be aware of the high risks as retail investor accounts lose money when trading CFD and forex due to leverage. Risk warning: as trading involves risk, the trader must only risk capital if he can afford to lose money rapidly due to leverage.

ActivTrades provides high leveraged products to its clients and the ratios vary depending on the value of the client’s trading account. ActivTrades leverages are:-

| Account Balance | Leverage Ratios |

|---|---|

| 0 – 25000 EUR | 400:1 |

| 25001 – 50000 EUR | 200:1 |

| 50001 – 250000 EUR | 100:1 |

| 250000 EUR – above | 100:1 (Restrictions Applicable) |

Although the leverage ratios at ActivTrades are capped at 1:30 under the ESMA regulation, the maximum leverage rates for different tradable assets are:-

- 30:1 for forex

- 10:1 for commodity CFDs

- 20:1 for shares and indices

- 5:1 for financials

Remember that all clients need to maintain a min. deposit of $10 to enjoy the maximum leverages mentioned above.

ActivTrades Fees

Compared to other reliable forex broker in the market, the ActivTrades fee structure is extremely transparent with no hidden fees or commissions, be it trading fees or non-trading fees. Similar to most brokers, ActivTrades brokers also charge clients a fee from its spreads. The spread is the difference between the buying and the selling price of any financial instrument. The spreads and commissions are clearly displayed on the official website of the broker.

ActivTrades offers access to competitive spread for trading forex that may go as low as 0.5 pips on currency pairs, for example, USDJPY and EURUSD whereas for currency pair GBPUSD, the spread is at 0.8 pips. The platform does not charge any commission for forex trading. For trading indices and CFDs with this provider, the spreads are fixed at as low as 0.5 pips. The deposit and withdrawal fees vary depending on the payment options ActivTrades provide.

- Deposit Fees – ActivTrades does not charge any deposit fee for payments made through bank transfers or e-wallets like Skrill, Neteller, Sofort, and PayPal. However, deposits made through credit and debit cards are chargeable with a fee of 1.5%.

- Withdrawal Fees – ActivTrades does not charge withdrawal fees for any of the payment methods including bank transfers chosen by the traders.

- Inactivity Fees – ActivTrades charges an inactivity fee of €10 per month if a trader keeps his trading account inactive for over a year.

- Swap Fees – The broker also charges swap fees for overnight open positions.

ActivTrades Deposit & Withdrawal Options

Deposit Methods

ActivTrades traders can deposit real money through the following payment methods:-

| Payment Method | Fees | Standard Processing Time |

|---|---|---|

| Bank transfer | Free | Same working day |

| Neteller, PayPal, Skrill, Sofort | Free | 30 minutes |

| Debit/credit card – EEA and UK | 1.5% | 30 minutes |

| Debit/credit card – non-EEA | 1.5% | 30 minutes |

Withdrawal Methods

Withdrawing money from ActivTrades is as easy as depositing funds. Traders can withdraw their money or trades fund through the following payment methods:-

| Payment Method | Fees | Standard Processing Time |

|---|---|---|

| Bank transfer | 9 GBP | Same day if withdrawal request by 12:30 |

| Debit/Credit Card, Neteller, PayPal, Skrill | Free | Same day if withdrawal request by 12:30 |

However, click here to know about payment methods in detail.

ActivTrades Referral Program

Coming to the ActivTrades Referral Program, the experience is exactly what most traders look for. With the platform’s ‘Refer a Friend’ program, users can earn $1000 for both the referer and the referee.

To enjoy the perks of the referral program, the existing client is required to generate a unique link and send it to his friends, family, and relatives via e-mail. One needs to share the unique link and with every link shared, the user gets a chance to earn up to $1000. Note that the referred friend needs to open an account at ActivTrades using the link and meet the platform’s minimum deposit requirement.

Existing users can refer up to four friends in a year after which the referrals are reset again for the next round. Only those traders who have a real account can refer a friend. Demo account holders can not use the referral program. The rewards are automatically credited to the ActivTrades live account.

For those wondering if a referred friend can refer another friend, it is important to note that the referred friend can benefit from a 20% cashback the moment they qualify and they can start introducing other friends right away. The rewards are not cumulative and are received in the following three monthly periods.

ActivTrades Cashback Program

As per this ActivTrades Review, The ActivTrades Cashback program allows users to earn big bonuses for every trade they place. To enjoy the cashback program, follow the easy steps mentioned below:-

- Place a request to join ActivTrades cashback program

- Trade a minimum notional value of $50 million

- Earn cashbacks on every trade placed

Hence, to qualify for the cashback program, the traders need to make a trade of over $50 million. For every lot traded, the client receives an equivalent of 20 percent reduction on the spreads, 20 percent reduction on Shares commission, and 20 percent on swaps. ActivTrades Cashback program is offered to traders who cross $50 million in notional value of forex and CFD trading.

As a client at ActivTrades, users can earn cashbacks on the trades they place, with additional interest on the unused margin balances of up to $1 million. ActivTrades brokers pay interest on the average free margin requirements during a month. Users can also view their notional traded balance and their acquired rewards in their Personal Area once they place their first trade.

It is important to note that all rewards are paid on the very 1st day of every calendar month for any trading activity occurring in the previous month. The users will receive the reward only if they fulfill the threshold in that particular month.

ActivTrades Affiliate Program

ActivTrades also offers an Affiliate Partnership Program that rewards all the digital marketing experts for each and every client that they refer to the platform via a CPA payment structure. Anyone can become an ActivTrades Affiliate partner by following the steps mentioned below:-

Fill in the affiliate sign-up form with further details and submit it. The ActivTrades support team, upon submission of the form, will get in touch with the user to help him get started trading with the ActivTrades Affiliate program.

As soon as the program starts, the affiliates or partners of the ActivTrades can start trading and earning commissions for every trader they refer to the ActivTrades platform. However, with Activaffiliates, you earn a CPA of up to $1350 for each referred qualified client, so click this link and enjoy the benefits. ActivTrades Affiliate Programme’s mission is to develop long-term financial relationships with the partners and their referred clients.

Know that the values of ActivTrades are at the very core of their operations. It provides one of the best and super fast and instant executions, delivers exceptional customer service, constantly innovates the platform to meet the ever-changing needs of the financial markets, educates its clients to help them gain profits from trading CFDs and forex instruments, and provides a safe and reliable trading environment to clients by offering the high-level security measures.

The affiliate CPA structure at ActivTrades rewards their affiliates/partners based on their residential countries. A qualified trader is the one who meets the minimum initial deposit requirement of $1000 (or its equivalent) and generates a minimum of $50 in spreads for the platform within a period of 90 days of placing their first trade.

Resources Offered by ActivTrades

To be able to trade efficiently with ActivTrades, it is important to have a clear understanding of how the platform works, its trading tools, and the financial markets it offers. Clients should make sure that they make the most out of the education and research tools offered by ActivTrades.

The platform offers a good collection of educational resources that have an extremely analytical approach and imparts extensive knowledge to first-time traders in the financial markets. The in-house research is developed by 3 expert analysts who offer brief trading and financial ideas every day. However, compared to other brokers, the quality of the content offered is below-par. Smart tools provided by ActivTrades offer more valuable and extensive research content published by the analytics team.

Education here is conducted through one-on-one training sessions that act as an excellent service for the new traders. There is also a video library covering MetaTrader platforms introductory topics as well as manuals covering all the MetaTrader platforms available at ActivTrades. Regular webinars are held to discuss more advanced content with additional hosts providing outstanding service to the learners.

ActivTrades Supported Countries

ActivTrades is headquartered in London with offices located in Luxembourg, Sofia, Nassau, and Milan. It delivers exceptional trading conditions as well as outstanding support to all loyal clients in over 140 countries including:-

Australia, the United Kingdom, South Africa, Thailand, Hong Kong, India, Singapore, Germany, France, Norway, Italy, Sweden, United Arab Emirates, Denmark, Kuwait, Saudi Arabia, Luxembourg, Qatar, and many more. However, note that traders from Canada and the United States cannot trade on ActivTrades.

ActivTrades Security Measures

Potential traders must note that thorough research is a must before they decide which broker to trade with. Most brokers offer a bunch of security features for the protection of clients’ information and their money. While there are plenty of similar brokers or investment companies like ActivTrades, very few brokers are regulated and licensed under a leading regulatory authority.

Regulated brokers such as ActivTrades ensure safe trading conditions like segregated bank accounts and the most reliable trading practices as per many online ActivTrades reviews and our research. Being regulated by the Securities Commission of the Bahamas, ActivTrades is one of the few brokers that can be trusted and relied on. ActivTrades Corp is registered under the Commonwealth of the Bahamas (registration number 199667B).

ActivTrades PLC, on the other hand, is authorized and regulated by the Financial Conduct Authority (FCA) under registration number 434413 with other regulations like CSSF, SCB, BACEN, and CMVM. The brokerage firm is a member of the Financial Services Compensation Scheme (FSCS). Moreover, additional insurance is offered by the platform that covers up to $1 million along with negative balance protection, so that the trader’s losses do not exceed his deposits.

Note that CFDs are complex instruments and come with risks. Retail investors should risk capital only if they can afford to lose money when trading CFDs and forex due to leverage and market risk. 84% of the retail investor accounts lose money when trading CFDs with this provider.

You should consider investment objectives and understand how CFDs work and whether you can afford to take the high risk of losing money when trading CFDs. All information collected in this Alvexo review is for educational purposes and does not constitute investment advice.

ActivTrades Customer Support

According to this ActivTrades review, the platform offers multilingual customer support that is available 24 hours, 5 days a week, from Monday to Friday. Customers with any issue or query relating to the ActivTrades trading platform or seeking investment advice can get in touch with the ActivTrades support team through the live chat option, a call back hotline, email support, or social networks that are available from the respective icons and logos on the right side of the official webpage.

Customers can also navigate to the extensive FAQ section to find answers to the most common issues. The live chat support is especially useful for immediate, informative, and efficient solutions that cover most queries. The FAQ section also has a glossary covering fundamental terminologies to help new traders understand the financial markets in a better way. However, the only thing bad about ActivTrades customer support is the lack of 24*7 availability.

ActivTrades Review: Conclusion

To sum up, this ActivTrades review, it is justified that the platform is a good broker with low trading fees and an adequate number of payment options including bank transfer, credit card payments, and e-wallets, that allow traders to deposit and withdraw funds into and from the trading platform according to their convenience. However, the major drawback of trading with ActivTrades is its limited financial instruments as it offers mainly forex, CFD, and a few other assets.

Nevertheless, ActivTrades makes a great international broker with necessary and reliable regulation, 10 years of successful experience and operation with long-term professional traders, reliable and well-maintained beginner-friendly interface, and effective customer service. The trading features within this ActivTrades review include no dealing desk intervention, lowest spreads and commissions, and competitive trading conditions which act as an advantage to traders of various experience levels.

FAQs

Is ActivTrades Legit?

Yes, ActivTrades is a legit broker and not a scam, since it is regulated by FCA, CSSF, SCB, BACEN, & CMVM and is a member of the Financial Services Compensation Scheme (FSCS). According to the exchange’s latest survey, the overall experience of most traders was described as excellent or good.

Is ActivTrades ECN?

No, ActivTrades is not an ECN broker and hence, it does not offer ECN trading.

Is ActivTrades Safe and Reliable?

Yes, ActivTrades is reliable and safe and not a scam, since it is regulated by the leading authorities such as the FCA, CMVM, SCB, CSSF, and BACEN. The regulatory status of the ActivTrades broker is more than satisfactory and it provides the necessary security features such as segregated bank account, negative balance protection, and many more.

What Is the Minimum Deposit for ActivTrades?

Compared to other brokers, the min. deposit requirement at ActivTrades is $10. ActivTrades deposits can be made through bank transfers, credit/debit cards, or e-wallets.

Is ActivTrades an ECN broker?

No, it is not an ECN Broker.

Is ActivTrades Good for Beginners?

According to this ActivTrades review and customer review feedback, the platform’s features and functionalities are suitable for all kinds of users, irrespective of how much trading experience one has. However, the broker does not offer social trading.

Risk Warning:- CFDs are complex instruments that come with a high risk of losing money due to leverage. 84% of the retail investor accounts lose money when trading CFD and forex. Consider whether you understand how forex and CFDs work and whether you can afford to bear the high risk of losing your money. All information contained in this review is for informational purposes and does not constitute financial advice.