Financial markets are full of profitable opportunities for those who are well-versed in forex trading. It is an overwhelming situation for investors to have so many financial instruments to invest in and earn money from them. However, to make the most out of trading in global financial markets, one needs to understand its behavior in the first place. Seeking broker services can do the magic. Let’s look at the overview of Oanda:-

Oanda Overview

| Official Website | https://www.oanda.com/ |

| Headquarters | USA with official entities in Canada, the UK, Japan, Singapore, & Australia |

| Founded Year | 1996 |

| Regulated | Yes( CFTC, NFA, FCA, MAS, ASIC, IIROC) |

| Product Offered | Forex, CFDs |

| Minimum Initial Deposit | ($0) |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| Trading fees | Low |

| Minimum Trade | $0 |

| Inactivity fees | Yes (the inactivity fee is charged £10 per month after one year) |

| Withdrawal fees | $0 |

| Supported currencies | (55+) EUR, USD, GBP, AUD, CAD, CHF, HKD, JPY, SGD |

| Customer Support | 24/7 via email |

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

Earlier, due to the limited resources, it was almost impossible for investors to navigate the markets for the perfect deal and dedicate more time to such endeavors. But with the arrival of automated trading systems, there is very little left to worry about if you will succeed or not. This article will talk about the forex broker reviews of Oanda and see if it checks the boxes of a reliable and consistent trading platform.

Read this Oanda review & get detailed information provided, such as features, services, Oanda pros, cons, trading fees, trading platform & more, before you start trading with these exchange rates. Oanda regulations include ASIC (Australian Securities and Investment Commission), IIROC (Investment Industry Regulatory Organization of Canada), & the Monetary Authority of Singapore (MAS).

Oanda corporation is a registered Futures Commission Merchant (FCM) and Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC)and is a member of the NFA.

What Is Oanda?

Oanda is a regulated online best forex broker in USA, having branches across the globe. Initially established as a forex and CFDs (CFDs are complex instruments) trading platform, Oanda offers a variety of asset classes, including stock indices, bonds, commodities, and precious metals. When it comes to creating profitable opportunities, Oanda has more to offer in the form of its award-proprietary platforms & precise technical indicators.

Oanda clients find it easy and safe to trade FX with Oanda because of its advanced trading tools and regulation by international authorities. And that is why foreign exchange trading, once a distant dream for investors, has now taken the shape of reality. So, we thought that it would be great to review Oanda to help new Oanda users with the knowledge they need about an automated broker.

The shareholders of OANDA Global Corporation (OANDA) have announced that they have accepted an offer from a wholly-owned subsidiary of CVC Capital Partners (CVC) Asia Fund IV to acquire all of the outstanding equity of OANDA.

Oanda a Multi-award winning broker also offers a currency converter tool (Oanda currency converter). Oanda Currency Converter allows you to convert currency into a different currency; this currency calculator tool uses OANDA Rates™, the touchstone FX rates compiled from leading forex market data contributors.

Rates of Oanda are trusted and used by major corporations, tax authorities, auditing firms, and individuals around the world. Deposit options vary depending on your residency and your account currency.

Who Can Use Oanda Platform?

From accessing the platforms to leveraging them for generating money, Oanda trade web has made trading more convenient for investors, no matter how much trading experience they have. Oanda offers a user-friendly website that provides investors with multiple trading options. It has helpful information that can assist traders in getting ahead.

Novice traders can take advantage of Oanda’s research and educational material to empower themselves with the required trading knowledge. Furthermore, its broad range of base currency pairs, market sentiment indicators, and accurate charting tools can help professional forex traders or trusted broker earn money on any given day. Oanda’s trading platform promises to deliver a faster, transparent, and seamless trading experience to all its traders across all devices.

Is Oanda Regulated?

It is always a good idea to do a background check before you start. While evaluating Oanda, we spent a lot of time investigating its authenticity. We found that Oanda is licensed and complies with the regulatory financial standards and norms.

It is well-regulated by six top-tier regulatory authorities, including the US Commodity Futures Trading Commission (CFTC), the US National Futures Association (NFA), the UK Financial Conduct Authority (FCA), and the Australian Securities and Investment Commission (ASIC).

Moreover, regulatory bodies ensure complete protection of customers’ funds with reimbursement schemes in the event of financial crises. Thus, investors can high trust Oanda for its safe (no lose money) and transparent trading environment. Also, this platform is counted in the list of best forex trading platform Australia due to licenses & regularity (Oanda Australia Pty Ltd). Oanda supports the regulatory oversight of the industry and the live account protection of forex customers.

Features of Oanda Trading Platform

Oanda boasts an extensive range of features that are useful for all types of traders and fx brokers. They are easily accessible and enable traders to trade forex the way they want to. Here, you will get a glimpse of how they function.

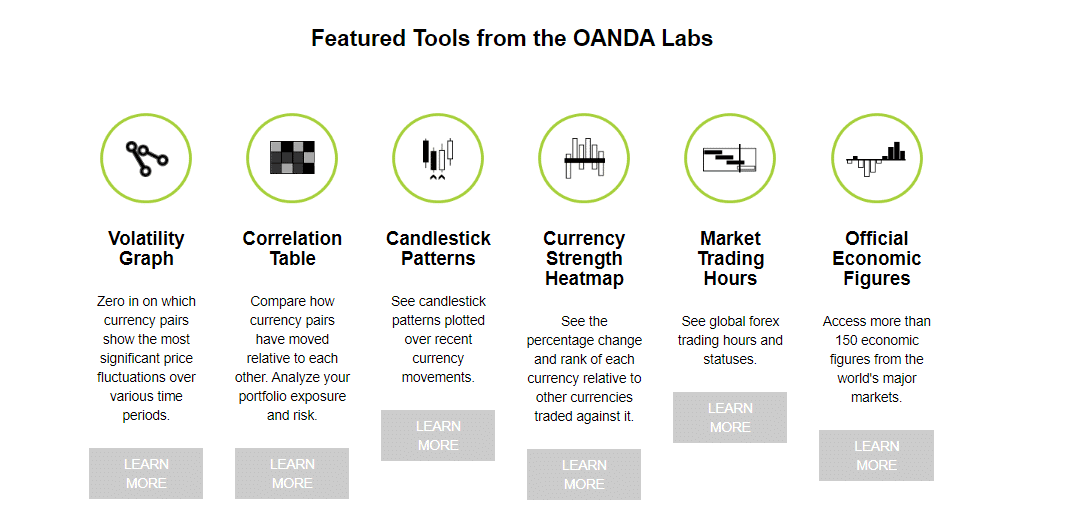

Analysis Tools

Winning trade demands a solid trading strategy. With its advanced analysis tools, specifically designed for seasoned traders, you can develop an effective strategy and master your trading skills. The analysis tools include coding languages, news analysis, and visual market data analysis.

Trading Platforms

Oanda, the best brokers for forex trader, offers a diverse selection of trading platforms based on one’s requirements. These platforms work well on the web, computers, and smartphones. You can trade Bitcoin CFDs from your desktop trading platform or mobile platform. Positive held overnight, traders have to pay interest.

This trading platform is available in following languages: English, German, Spanish, Italian, French, Portuguese, and Russian to increase the trading experience. This platform has managed to earn a reputation as a reliable broker who provides its retail clients with trading conditions. Additional platforms are available from third-party within Oanda’s marketplace.

Algorithmic Trading

Oanda impressed us with its fully automated trading capabilities. The CFD best brokers utilizes a highly intelligent algorithm that helps you find the most profitable opportunity and execute it with great precision.

Wide Range of Assets

There is no shortage of tradable assets at Oanda as it supports over 60 currency pairs and 30 CFDs. Also, it allows you to trade in nine different base currencies, including USD, EUR, GBP, AUD, CAD, HKD, JPY, CHF, and SGD, which means you can save on currency conversion fees. Oanda offers maximum leverage of 50:1 for major currency pairs, and this platform has a wide selection of CFD products.

Which Instruments Can Be Traded with Oanda?

Oanda allows you to trade with more than 100 trading instruments, which include stock indices (but not stock trading), bonds, commodities, futures, forex markets and trading CFDs precious metals. Apart from that, it offers a comprehensive selection of currency pairs. The availability of the assets is subject to jurisdiction.

The whole notion of offering these assets is to allow forex traders and brokers to benefit from liquidity. However, no support for cryptocurrency trading is one area that might disappoint traders, especially at a time when they are rising in value, but it allows fiat currency trading, Keep in mind that CFDs are complex instruments that might result in a high risk of losing, we would suggest taking extreme precautions when trading with CFD broker.

Pros and Cons

| Pros | Cons |

| Easy to navigate website. | Does not support cryptocurrencies. |

| Simple and fully digital account setup. | No negative balance protection for US traders. |

| Minimum deposit $1. | No guaranteed stop losses for US and UK traders. |

| Regulated by top-tier regulatory authorities. | Less competitive spreads. |

| Multiple trading platforms. | Inadequate research tools. |

| Access to over 60 currency pairs. | Slow customer service. |

| A wide range of tradable instruments. | |

| Useful research and education resources. | |

| Negative balance protection. | |

| Lower forex fees. |

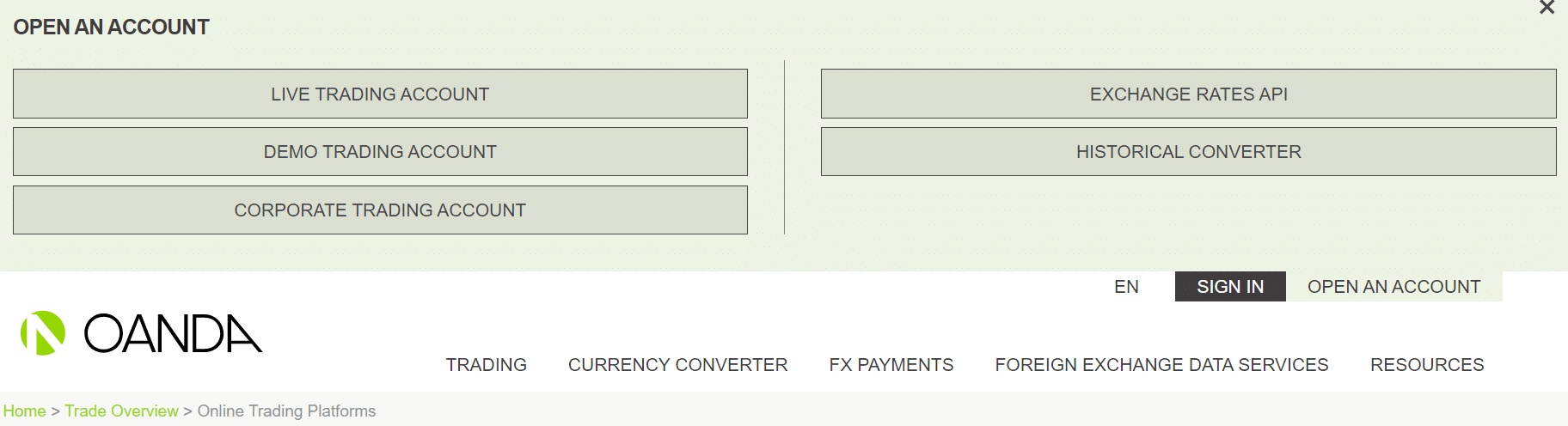

How to Open an Account with Oanda?

Opening a trading account with Oanda is quick and involves three simple steps, including filling in the registration form, submitting identity and residency proofs, and making a deposit methods. All that begins with accessing its website on desktop platform and clicking on the ‘Start Trading’ button.

It will lead you to the registration page, where you need to set your username and password. The subsequent steps ask for your financial status, a competence test, and proofs of identity. Oanda account verification usually takes up to 3 days, depending on how quickly you submit the required documents. Remember, you are not charged any fees for joining the Oanda’s desktop platform. This platform is available in desktop version as well.

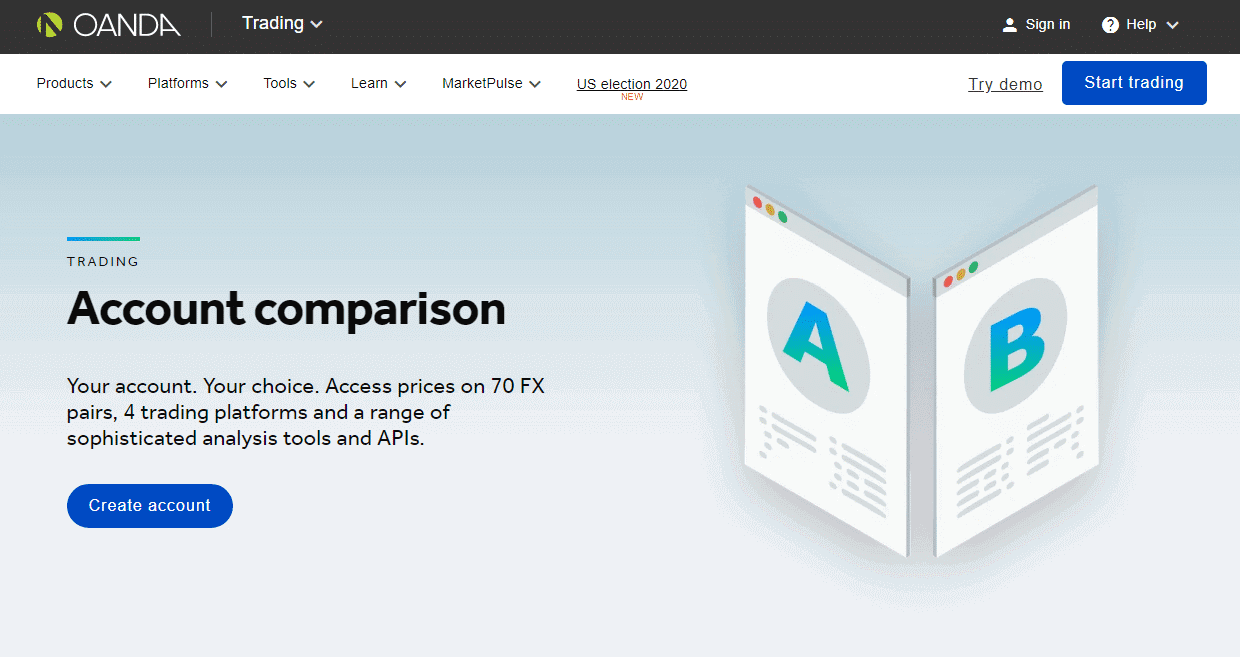

Oanda Review – Account Types

There are two types of accounts that you can choose to open with Oanda – standard account and premium account.

As the name suggests, the standard account is for traders with different experience levels to consider whether trading with forex and CFDs. Having a premium account, on the other hand, requires meeting certain conditions. As a premium account holder, you are privileged to get custom pricing, tight spreads, free wire transfers, and a relationship manager.

In addition to these retail investor accounts, Oanda permits new traders to create a demo account using virtual money (don’t lose money with a demo account). We would advise beginners to use a demo account. Practice with it until you know the web platform and develop your forex and CFD trading skills. It will save you from the high level of risk of losses in funds.

Oanda Review – Order Types

Oanda allows you to execute three types of orders, including:

- Market Order to execute a trade at the prevailing market price.

- Limit Order to limit the price for an instrument.

- Stop Loss Orders to cancel the unfavorable trade.

Oanda Review – Spreads and Commission Fees

Oanda offers a transparent approach and a competitive and industry-standard pricing structure consisting of average spread, core pricing, commission fees, and swaps (overnight fees). Of these, spreads and commission fees are the source of revenue generation for Oanda. Oanda offers competitive CFD spreads on 70 forex pairs, including all majors and minors, and high volatility, in particular, can widen spreads. Oanda has clear portfolio and fee reports. There is no hidden fees in Oanda trading platform.

Due to the liquidity and the volatile nature of financial markets, spreads are highly variable at Oanda. Being one of the best forex companies, this platform offers two pricing options: spread only and commission plus the core spread. However, it still charges low fees on trading forex and no deposits or withdrawal fee. The monthly inactivity fee would be charged if there would be no trading activity for 12 months. Positive held overnight, traders have to pay interest.

Advertisement

This transparent approach was echoed by Vatsa Narasimha, CEO of the Oanda Global Group, who stated,” We believe the retail trading industry as a whole will benefit from a more transparent approach where brokers are held accountable for making questionable statements or falsely disclosing their interests.”

- Spreads: The difference between the bid and ask prices of an instrument is called a spread. Factors that can influence a spread include the base currency chosen to trade with and the forex market behavior.

- You can get to know about changes in the spread using a percentage calculator located on its website, which makes it the preferred option for new traders.

- Core Pricing: Under the core pricing structure, Oanda’s commission charges $40 per million USD traded. It is the tighter spreads that make it the ideal choice for professional traders.

- Commission Fees: Oanda charges a commission fee on placing or canceling or modifying an order. The fee structure varies with the order types, trading instruments, and accounts.

Oanda Review – Trading Platforms

Oanda offers user-friendly trading platforms compatible with desktop application and mobile application. They have unique and advanced analytics and tools.

1. Web Trading Platform

You can access Oanda’s fast and intuitive web trading platform for forex right from your web browser. The advanced charting tools to analyze market trends using over 100 charts, overlays, technical indicators, and drawing tools. The advanced technical analysis tools to identify trading opportunities with the help of chart pattern recognition, position ratios, and the back-testing feature.

Access to the latest market news and insights from leading news providers such as Dow Jones International. Live Account feature to managed accounts. Oanda is market maker. Industry-standard order execution speed amid higher market volatility. Oanda also offers an advanced trader program.

Oanda’s trading fees are simple to understand and straightforward. Oanda’s Advanced Trader program is a 3-tiered reward system for high volume traders. The range of available markets at Oanda will vary slightly, depending on its entities regulates account.

2. Desktop Trading Platform (fxTrade)

Oanda platform offers user-friendly compatible with mobile and desktop compared to other trading platforms. They have unique and advanced analytics and research tools. FxTrade platform has a wide range of trading instruments.

- Access to various instruments, order types, and analytics.

- Offers highly competitive spread and faster order execution.

- The advanced charting tools to analyze market trends includes charts, technical indicators, and drawing tools.

- Allows placing, monitoring, and closing trades, including limit and stop orders.

- Customize the platform as per your preferences and strategies.

- View snapshots of pending orders and current positions.

- Access to news feed and market analysis from leading news providers such as Dow Jones International.

- A trailing stop order is used to restrict losses and avoid margin closeouts.

3. MetaTrader 4

For those who do not wish to use Oanda’s proprietary platform, there is the MetaTrader 4 (MT4) platform along with Oanda trade. This positive review found Oanda MetaTrader 4 (MT4) comes with fantastic features, which make it the traders’ premier choice for forex trading. Trading algorithms and the back-testing feature. Full support for expert advisors and traders with hedging capabilities.

Trade directly from charts using over 50 technical indicators, including MT4 Order Book Indicator. MT4 Plug-In incorporates tools like intraday market scanning, automatic chart pattern recognition, and trade automation. Regular market reports provided by Autochartist.

4. Mobile Trading Platform

Oanda fxTrade mobile trading platform provide access to your investment portfolio. The app includes excellent features that help you stay on top of trading opportunities. Access to complex order types, account analytics, and competitive spreads. The mobile chart to place orders and set profitability levels for pending orders. Notifications on market sentiment and new price signals.

Technical analysis tools to define your strategy using charts, overlays, technical indicators, and drawing tools. Customizable trade settings for an instrument. Trade directly from charts and adjust stop-loss and limit orders. The mobile application would have the same trading functionality as the desktop trading version. All the additional features are available in the mobile version as well.

Oanda Trading Platform Comparison

Here, we list all features offered by Oanda trading platforms like MT5, MT4, and fxTrade platform. This platform comparison will help you choose which one suits your trading style.

| Features | MT5 | MT4 | fxTrade app |

|---|---|---|---|

| Pending orders | 6 order types | 4 order type | 4 order types (Buy Limit, Sell Limit, Buy Stop, Sell Stop) |

| Chart timeframes | 21 timeframes | 9 timeframes | 6 timeframes (1, 5 & 15 Minutes, 1 & 4 Hours, 1 Day) |

| Supports iOS and Android | |||

| One Click Trading | |||

| CFDs on Fx, Crypto, Commodities, Indices | |||

| Risk Management Tools | |||

| Customizable user interface | |||

| One Key Login for all Sub Accounts | |||

| Share CFDs | Added Soon | Added Soon | |

| Economic Calendar | |||

| Supports Experts Advisors | |||

| Built-in technical Indicators | 38 built-in indicators + 44 analytical objects | 30 built-in indicators +2000 marketplace indicators | Added Soon |

| Programming | MQL5 (supports advanced object oriented coding) | MQL4 | |

| Native depth of market | No (Must be accessed as a plugin through MT4 premium tools (powered by FX Blue) |

Advantages of Using Oanda

Forex and CFD trading is made simple with Oanda’s fair trading view. Access to its award-winning platforms, exceptional execution, and transparent Oanda pricing brings many advantages to experienced traders.

Online Account Management

Be it tracking client funds or making fund transfers, Oanda’s online account management feature lets you do that.

Direct Trading from Charts

Oanda Europe limited enables traders to scan the trading platform opportunities and trade directly from charts using technical indicators across all its platforms.

Lowest Minimum Deposit

You can start with Oanda by paying a minimum deposit of $1 for smallest trade size, making it more convenient for new traders to trade without worrying much about losing money without any third party or other forex brokers. This is the great option for those traders who want to test a small deposit and not be constrained by minimum trade size.

Demo Account

A demo account takes away your fear of failing at trading by giving you the chance to hone your skills. To say, it is a demo, but everything you experience here is real except for virtual deposits.

How to Make a Deposit?

Increasing competition, depending on online broker, has forced forex brokers to bring down their minimum deposit requirement. Going with the trend, Oanda minimum deposit of $1 on a standard account which is less compared to other best forex brokers in the market. It is the best option for new traders who cannot afford to lose money when trading. There is no deposit bonus when you sign up with Oanda.

However, premium Oanda account holders need to deposit $20,000. You can make deposits via credit or debit card, bank wire transfer, or PayPal depending on your requirements. Oanda Europe limited charges no fees on making deposits via credit or debit card or bank transfers, but there is a fee on depositing via PayPal (most of Asia and other emerging markets).

Asia Pacific traders eligible to use DBS Pay bills, internet banking transfer, bank wire transfer, Paypal and cheques. Payment via bank transfer or PayPal can take 1-3 business days, consider whether payment with a third party credit or debit card or bank transfer. Those in China can use China union pay.

How to Make Withdrawals?

Oanda offers a straightforward and instant withdrawing funds system. To be able to withdraw your earnings, you need to submit a withdrawal request. The broker facilitates withdrawals by various means, including a credit or debit card, wire transfer, or PayPal. Oanda charges no processing fees for the first withdrawal request each month. Withdrawal options are the same as those for deposits.

Withdraw funds can take 1-5 business days to reflect into your bank account, depending on your preferred payment methods and country. As Oanda operates in multiple jurisdictions, we suggest you carefully understand the terms and conditions of withdrawals to avoid any hassle.

Unique Features of Oanda Trading Platform

Oanda is best trading platform. It open up advanced features and functionality for traders. There are some extensive range of research and trading tools for the traders. Below we have the unique features which we have listed below :-

1. Leverage

Leverage is one of the crucial elements of trading in financial markets, for it minimizes the high risks of losses. As far as the leverage limit on instruments is concerned, it is entirely upon the discretion of the regulators in different jurisdictions, for example, a US regulator requires 50:1 leverage. The maximum leverage allowed is determined by the regulators in each geographic region.

Significantly, Oanda allows margin trading that increases your chances of earning more money against the invested capital. Since margin trading can incur heavy losses as well, we think that you must reduce the leverage limit and use the stop-loss orders feature to protect yourself. The margin requirements do differ from entity to entity.

2. Research

Nothing could be better than trading with brokers that guides you on every step with useful information. Oanda won our hearts with its impressive selection of research materials that are curated, keeping in mind the amateur and high-volume other traders alike. These materials range from written to digital collections, covering news, reports, and more.

MarketPulse is a website that keeps you up to date with the latest market trends through a wide range of expert analysis reports, articles, podcasts, and visual materials like charts and video tutorials. You can also use its economic calendar to navigate the markets. Charting Tools allow you to make open trades directly from the charts using technical indicators.

The News Feed section features the economic analysis and news from leading news providers such as Reuters, Dow Jones, and CNBC. Technical Analysis Tools help in creating strategies based on technical and fundamental analysis. Advanced-Data Analytics is suited for experienced Oanda entity to test and manage their strategies. Algo Lab allows automated trading using API.

3. Education Resources

Oanda features high-quality educational resources for novice and seasoned traders. The collection is so diverse that you can select the material of your choice based on your experience level. All this comes at no cost, so dedicate some time to knowing how trading works. A series of informative articles, charts, and educational videos guide you through the platforms and trading basics.

There are a series of live webinars on subjects like live market analysis. Oanda also offers client education. The education material is available in multiple languages. The material for beginners is easy and well organized. No minimum deposit & withdrawal. MT4 trading platform is also available. Low Forex fees and CFD fees. Fast execution speed to trade. Assets available Metals, Gold & more.

Trade performance analytics tool available. Authorized and regulated by a government agency in several counties like USA, Canada, UK, Australia, & Asia. Good customer support services.

Is Oanda Safe?

The worst nightmare traders or brokers can have is losing all their funds overnight. Thankfully, Oanda’s advanced encryption technology keeps cybercriminals at bay. Its global presence and compliance with international regulatory standards make it a safe broker to trade among traders.

Being a reputed online brokers for more than two decades, Oanda takes all the necessary measures to protect traders’ data and assets. As part of its efforts, Oanda puts all the deposits into segregated tier 1 bank accounts. Furthermore, it provides negative balance protection for European Union traders.

Why Trade with Oanda?

From our Oanda detailed review, we have compiled a list of reasons to use the broker for online trading.

- User-Friendly Features: No matter if you are beginner or experienced traders, social trading, its user-friendly platforms and essential research resources and trading tools are helpful for everyone.

- Transparent Pricing: Oanda offers a transparent pricing model and highly competitive spread.

- Mobile Trading: The easy to use mobile trading apps allows you to forex brokers from anywhere, anytime.

- Research tools and Educational tools: There are a plethora of articles and videos available on its website that you can use to advance your trading knowledge.

- International Regulation: Oanda is regulated by six major regulatory jurisdictions safeguarding customer funds during insolvency.

- Its superior risk management technology provides traders with extra protection against any frauds or scams.

Customer Service

Oanda is backed by its dedicated customer support in providing high-quality service round the clock. The multilingual customer service is available 24/5 to answer your questions via live chat or chatbot or email and over the phone. Here is a quick review of its customer service.

Live Chat is available from Sunday to Friday and is a more convenient way to reach them. In our review of the service, we found it doing well at resolving our queries. The response time was a bit delayed. Chatbot, a virtual assistant, is still in its early days and needs improvements to prove essential. Email customer support is available 24/7 and has an excellent and relevant response rate.

Phone support has the best reaction time. Its well-behaved and skilled customer care professionals provide you with to the point solutions to your problems. Apart from these, you can explore its FAQ section to find answers to the most common issues related to trading and the platform.

Conclusion

Overall Oanda review, this platform can be concluded that Overall from our Oanda review, this platform can be concluded that Oanda uses innovative digital and financial technology to provide transparent and reliable access to the financial markets. The broker has a solid organizational commitment to satisfying its traders, which reflects in its product offerings. Oanda is a reliable broker for all traders.

For our Oanda review, we checked the trading platform on various metrics. The incredible trade execution speed and transparent trading market conditions impressed us the most. 78.3% of retail investor accounts lose money rapidly when trading CFDs with OANDA Europe Markets Ltd and OANDA Asia Pacific Pte Ltd. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

The multi-award-winning broker has won several awards in the industry for its sophisticated trading tools and world-class service. Be it creating the trading account, leveraging competitive spread, or automating trading strategies, Oanda has left no stone unturned to entice all types of active trader with profitable opportunities. Not to mention its strong regulatory history has helped it earn the trust of traders all over the world.

This is not something you usually the traders didn’t find at other broker. Findings from our Oanda review suggest that Oanda is a trustworthy forex trading platform, and you should give it a try to make a fortune. As a beginner in trading, reading Oanda reviews before trading can help. But, if you are already trading with Oanda & need more information, you can read our Oanda Review 2024 for further details.

It would help if you considered whether you understand how CFDs work and can afford to take the high risk of losing money. This content is intended for information and education purposes only and should not be considered investment advice or investment recommendation.

Advertisement

FAQs

Is Oanda legit and regulated?

Yes. Oanda is considered a safe broker as it is regulated by Financial Conduct Authority (FCA) and ASIC.

How does Oanda make money?

Oanda generates revenue from spreads, core pricing, commission fees, and swaps (overnight fees) against all instruments.

How to make deposits at Oanda?

Various depositing methods are available such as credit or debit cards, wire transfer, or PayPal.

Is Oanda safe?

Yes. Oanda keeps your deposits in segregated tier 1 bank accounts to prevent misallocation of funds.

Where is Oanda Europe?

Oanda Europe is based in London, United Kingdom.

Where is the Oanda corporation based?

The main headquarters of Oanda Corporation is in New York.

Is Oanda a good broker?

Yes, Oanda is a famous experienced trader in the forex market for around 25 years, offers a range of products offered, prices & fees are low. It is also regulated & considered a safe broker.