The popular memecoin Floki is approaching the critical $0.0001441 barrier, an area historically proven important. This scenario follows a recent price rebound from the $0.00011 support level, which resulted in an over-31% uptick.

Floki Price Action

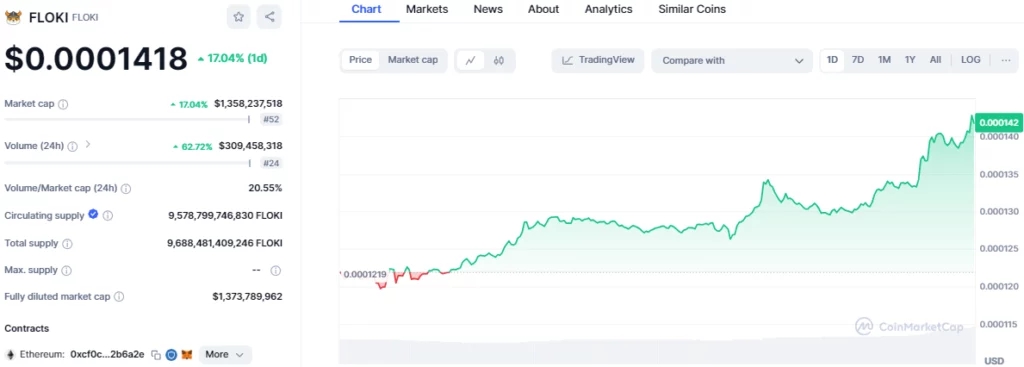

As of press time, the FLOKI token exchanged hands at $0.0001418, reflecting a 17.04% gain compared to its previous day’s value. Marking today’s top gainer, its market cap has also increased, peaking at the $1.358 billion zone. This puts the cryptocurrency in the 52nd spot in terms of market capitalization.

Adding to the positive momentum, the memecoin’s trading volume surged 62.72% in just 24 hours, reaching $309.458 million. This spike highlights growing investor confidence and interest in the memecoin market.

Despite these gains, FLOKI has not yet shaken off the bearish sentiment. On the monthly chart, its value has dipped by 30.40%. However, breaking above the $0.0001843 resistance level could reverse the negative trend and signal a strong uptrend.

Will FLOKI Break the $0.0001441 Resistance?

Advertisement

From a technical perspective, the relative strength index (RSI) is hovering around the neutral zone, suggesting a potential price consolidation in the short term before resuming its upward momentum.

Currently positioned at 53.52, the RSI indicates that FLOKI has ample space for further bullish movement before hitting overbought conditions. Should this upward trend continue, the token could break through the $0.0001441 resistance and rally toward the 38.2% Fibonacci level at $0.00017, last seen on July 31.

If successful, the memecoin would break above its longstanding bearish trendline, potentially boosting bullish sentiment and driving the cryptocurrency toward retesting previous highs near the 50% Fibonacci level at $0.000195.

However, the token also faces the risk of a pullback. The daily Bollinger Band indicates that the memecoin is trending in overbought conditions near the upper band, often hinting at a short-term reversal. This could lead to a correction toward the middle band at $0.0001238 before another bullish attempt.

This consolidation phase might provide traders with an opportunity to short at higher levels before a possible downside breakout, possibly retesting the lower Bollinger Band arm at $0.0001079. The 100-day moving average, above FLOKI’s price at $0.0001830, further supports this cautious outlook.

Advertisement

Also Read: $DOGS Token Debuts on Major Exchanges, Targets Telegram Utility