This content has been archived. It may no longer be relevant.

- Ethereum trades above $150, having faced resistance at $155

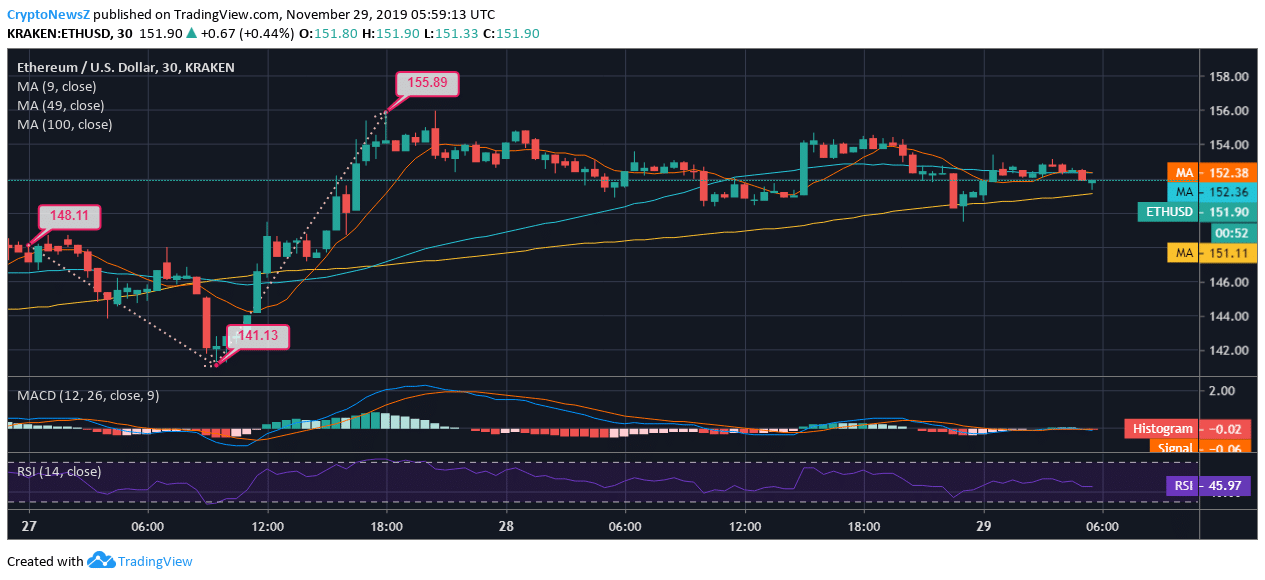

- ETH price has shown a growth of over 10% from the trading price of $141.13 to $155.89 in less than 24 hours

- Currently trades at $151.90, which is 2% less than highest in the past two days

Ethereum is still sailing in the selling zone but has grounded support from the 5-day MA and EMA. Having faced a strict resistance around the price area of $155, it is currently trading at $151.90. After having topped at $155 on November 27, 2019, it has been more or less moving stably. The current price trend withholds zero probability of breakout in either of the direction at present.

Having held a strong selling pressure and bearish crossover, a persistent move above $155 and $160 can help Ethereum price to break the bars.

Ethereum Price Analysis:

Advertisement

Analyzing the half-hourly 2-day movement of ETH/USD on Kraken, we see that the coin was initially trading at $148.11. To which ETH price later dipped to $141.13 by marking a fall of over 4%, but on the contrary, saw a considerable hike in the 24-hour volume and market cap of the top altcoin. The investors and crypto enthusiasts excluding the Bitcoin Whales would never miss upon any chance to invest in the mighty altcoin.

Having the bearish run intact, ETH price soared to $155.89 on the same within no time-marking the highest in the said time frame. Since then, the coin has been trading in the price range pf $150–$155 until the time of penning down. Also, important to note that currently, ETH is trading at $151.90, having a solid inclination towards the lower price range. Click here to find out Ethereum Forecast for Next 5 years.

ETH Technical Indicators:

The MACD of Ethereum is running adjacent to zero with a complete bearish crossover as the signal line crossed the MACD line after having dipped from $155.

Advertisement

While the RSI is at 45.97 and shows no extremities at present.