After half a year of anticipation, regulators from the SEC greenlighted the introduction of various funds linked to Ethereum. Among the most eagerly awaited are Invesco’s Galaxy Ethereum ETF, known simply as QETH, the Bitwise Ethereum ETF labeled ETHW, and the Grayscale Ethereum Mini Trust, going by the ticker ETH. These products promise to deliver exposure to Ethereum’s price swings in a manner familiar to traditional investors. They are poised to attract considerable sums of new capital in their debuts as some wait for options in this emerging asset class to arrive finally. Based on the technicals, a vast support level lies around $3,350, and significant resistance is at $3.6k. However, the Ethereum price has remained relatively high despite the notable increase in trading volume due to approval. Analysts have also raised concerns that the actual support level for Ethereum ETFs is somewhat lower than many had expected.

Why is Ether Crumbling Down?

Bloomberg analysts James Seyffart and Eric Balchunas reported that the SEC also allowed Grayscale Investments to convert its Grayscale Ethereum Trust (ETHE) into a spot ETF. As with the existing lineup of Grayscale products, each new spot exchange fund will hold Ether (ETH), Ethereum’s native cryptocurrency token. Bloomberg News also reported that most new ETFs will trade on CBOE-General. However, the price of Ethereum dropped by 1.25% since the wee hours of Tuesday.

Despite the increase in trading volume, Ethereum’s free-falling price can be attributed to many reasons. First, the general market sentiment can still be bearish, and prices might decrease despite higher trade volumes. That approach of selling can be a drag on prices when large holders seem to sell to capitalize, and the trading range expands, leading them to operate from both sides. Even in this environment, ongoing regulatory scrutiny and uncertainty could be one of the factors affecting investor appetite for new listings. In addition, multiple Ethereum ETFs launched simultaneously likely contributed to a decreased effect in price growth compared to Bitcoin’s single ETF launch.

ETFs Boost Trading Volumes and Market Sentiment, but Price Surge Falls Short

Before being approved, many in the market saw the ETH ETF as a means of sending ether prices to new heights. The idea was that institutional cash would flow into the space as more investors saw exposure, increasing demand, and rising prices. The approval was expected to coincide with increased trading volumes as new and existing investors bought or dumped ETH on the news of the ETF going live.

Advertisement

Ethereum costs $3,452.31, an increase of 1.25% within a day. This can be seen as a more favorable price movement than the extremists anticipated but still far from what they expected after getting ETF approval. Ethereum has a market cap of $420.06 billion; approximately 120 million coins were circulated when this article was published. The price of Bitcoin has since remained more or less stable, and a substantial but not explosive increase in market capitalization. The anticipated flood of trading volume has come, but not precisely to the degree it was initially thought. This volume increase points to increased investor participation – from speculation and more long-term investment styles alike – but has yet to result in a substantial price gain.

Stakes are high!

As of 21st July, staked ETH remained in a strong Epoch of 33 million. The good news is, however, that consistent levels of Ether (ETH) stake reveal several fundamentals. A consistent amount of ETH is staked, which means that the number of new entrants into the stake ecosystem is limited, or (from another perspective) many stakeholders are choosing to refrain from withdrawing their stakes because they are effectively locked out. Secondly, it suggests robust investor confidence among stakeholders in Ethereum’s Proof-of-Stake (PoS) system, signaling belief in the long-term security and performance of the network and, thereby, the token. So, new investors might not lose money but also might not gain money.

Ethereum ETFs Underwhelming: Anticipated Traction Falls Short

Advertisement

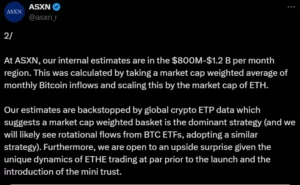

In the July 22 research report, Wintermute found that Ethereum ETFs will pull between $3.2 billion and $4 billion through their first year as a product category, leading up from nothing just before launch. This is significantly lower than the initial estimates and figures of Bitcoin ETF inflows, compared to $32 billion from Bitcoin ETF by year-end, or 10-12%. Alternatively, boutique crypto asset firm ASXN is more bullish about the future of Ethereum ETF inflows and anticipates seeing an average monthly investment of between $800M – $1.2B per month into this market. However, despite these inflows, analysts are still wary of Ethereum ETFs becoming as successful as Bitcoin ETFs. The skepticism mirrors a broader opinion that Ethereum ETFs may not spark the significant price increases they had first expected.