U.S. spot Ethereum exchange-traded funds (ETFs) saw more than $1 billion in trading on their first day. This shows investors are very interested and the market is ready to accept these new products. The launch of several spot Ethereum ETFs on Tuesday is a big step forward for digital assets.

BlackRock’s ETHA Is the Leader

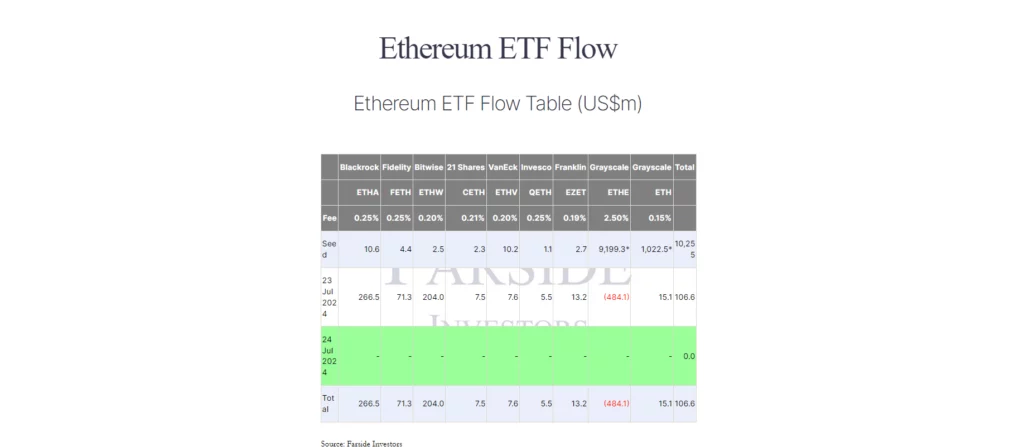

Source: Farside Investors

According to data shared by Farside Investors, BlackRock’s iShares Ethereum Trust (ETHA) led the pack bringing in $266 million in net inflows on its first day. This beat out other big names like the Bitwise Ethereum ETF (ETHW) and the Fidelity Ethereum Fund (FETH), which saw inflows of $204 million and $71 million.

Besides BlackRock’s strong showing, other ETFs also did well. The Franklin Ethereum ETF (EZET), VanEck Ethereum ETF (ETHV), 21Shares Core Ethereum ETF (CETH), Invesco Galaxy Ethereum ETF (QETH), and the Grayscale Ethereum Mini Trust (ETH) all reported high trading volumes.

On the flip side, the Grayscale Ethereum Trust (ETHE) saw a big drop of $484 million, about 5% of the fund’s total assets, which are over $9 billion. This big drop shows that investors wanted to cash out after it changed to a spot ETF.

Advertisement

This movement parallels the initial market reaction to the launch of spot Bitcoin ETFs earlier in the year, where Grayscale’s Bitcoin Trust (GBTC) also saw major outflows.

Ethereum ETFs vs. Bitcoin ETFs

These new Ethereum ETFs are similar to the spot Bitcoin ETFs that launched in January. Bitcoin ETFs traded $4.6 billion on their first day.

The launch of spot Ethereum ETFs outshone Bitcoin ETFs shaking up market trends. Farside’s figures show U.S. spot Bitcoin funds lost $78 million on Tuesday ending a 12-day run of gains that started July 5.

BlackRock’s iShares Bitcoin Trust (IBIT) bucked the trend pulling in $72 million in fresh money that day.

On the flip side, investors took out $80 million in total from both Grayscale’s Bitcoin Trust (GBTC) and ARK Invest’s Bitcoin ETF (ARKB). Also, Bitwise’s BITB saw the biggest outflow of the day, with withdrawals topping $70 million.

Projections for Ethereum ETF inflows have varied widely. In a bullish scenario, Galaxy Digital estimated inflows of $5 billion by the end of 2024, reflecting 30% of the inflows seen by Bitcoin ETFs. Bitwise shared a similar sentiment, predicting $15 billion inflows in 2025.

Advertisement

On the bearish end, Mechanism Capital’s Andrew Kang forecasted inflows of $1.5 billion, attributing the tepid expectation to a general preference for Bitcoin and the absence of staking features in the Ethereum ETFs.

Also Read: Mt. Gox Moved Bitcoin Worth $2.8 Billion in the Last 6 Hours