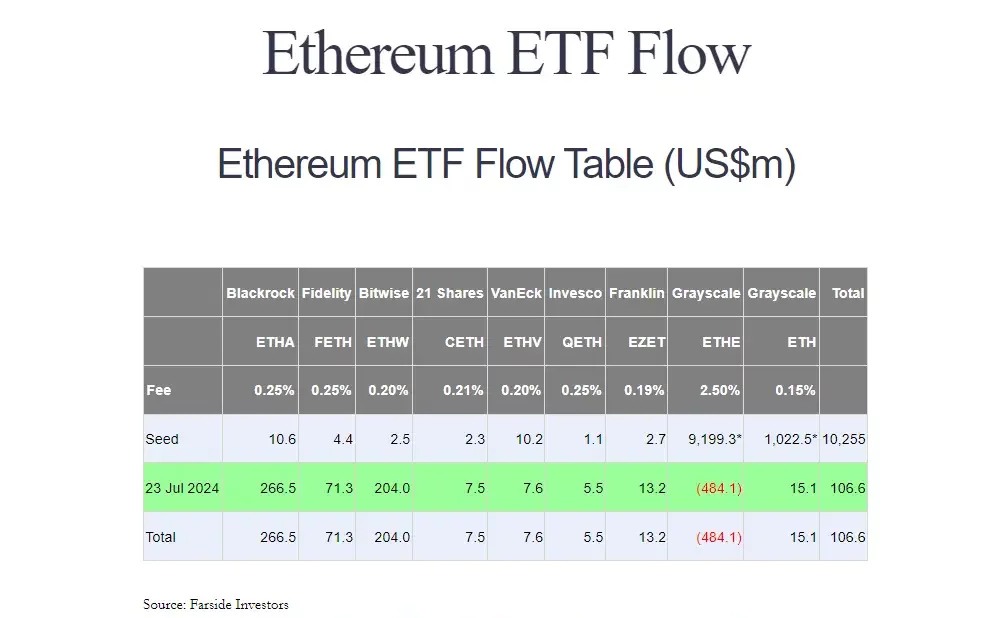

During the inaugural trading session, overall volumes rocketed past $1.1B as the newly launched Ethereum exchange-traded funds mushroomed to $10.2B in assets under management. At first light, Grayscale’s Ethereum Trust (ETHE) sprinted ahead with $469.7M transacted – unsurprising given its head start converting from a closed-end fund launched in 2017. However, the most staggering development arrived with Grayscale: a whopping $484M drained from the trust. ETF analyst Eric Balchunas of Bloomberg voiced his astonishment at the enormous outflows from Grayscale Ethereum Trust on day one.

In sharp contrast, BlackRock’s iShares Ethereum Trust (ETHA) witnessed significant cash infusions of $266M, followed by Bitwise absorbing $204M, while Fidelity garnered $71M. This positions BlackRock as a formidable foe in the Ether ETF arena. ETHA’s auspicious entrance echoes BlackRock’s initial Bitcoin Fund (IBIT), which rapidly overtook Grayscale’s Bitcoin Trust (GBTC) within months, thanks to substantial investor belief and money flooding in.

Advertisement

Grayscale’s Bitcoin Trust (GBTC) saw less than $100 million in outflows compared to the Ethereum ETFs’ first day of trading. It was a decisive moment. At first, GBTC traded at a premium, but from February 2021 onwards, it traded at a deep discount. By December 2022, it had a record low of almost 50%. The main reason for outflows from ETHE is that Grayscale charges high fees on the expensive trust.

Investors chose a cheaper alternative as Grayscale’s management fee ranged to 2.5%, driving out investors. ETHA is to continue the market dominance; BlackRock’s Ether ETFs will need to maintain their high trading volumes and inflows from investors. They also need to attract additional institutional investments to utilize their enormous market power and internal assets. Key factors include continued governing endorsement, well-crafted marketing strategies, and steadfast affiliations.

Advertisement

With ETHA shining from the start, BlackRock is strategically placed to challenge and possibly overtake Grayscale’s Ethereum Trust (ETHE) in terms of trading volume, too. The big question is whether or not BlackRock will continue to beat Grayscale and become the most significant player in the Ether ETF market.