Electroneum is a mobile-first cryptocurrency aimed at mass adoption. It is built off Monero codebase to allow for transactions on a decentralized blockchain. It overcomes the shortcomings of bitcoin’s privacy issues. Transactions are faster with dynamic fees. Electroneum’s stealth address, a one-time public key that prevents recipient’s funds from being linked with their wallet, resolves the security issue. The more interesting feature is the ability to perform mobile mining. The app will allow your phone’s CPU to engage in stimulated mining. Though mobile mining will not confirm the creation of new blocks, however, rewards will be given to the miners.

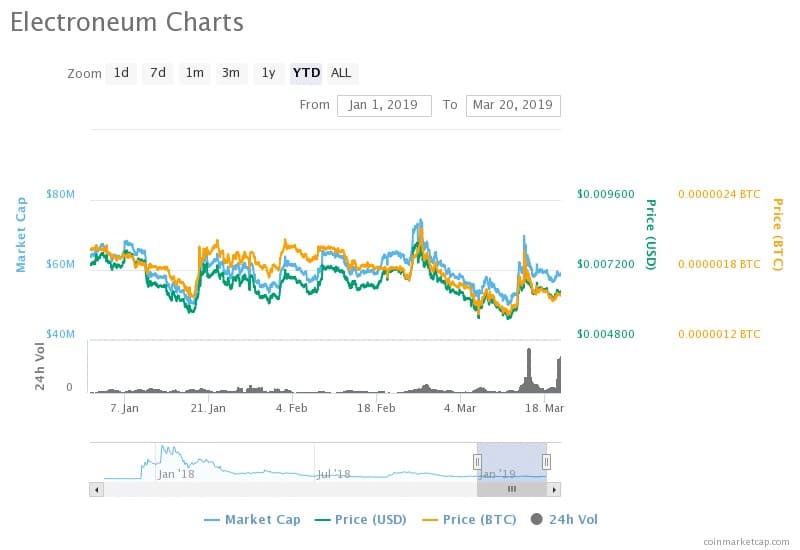

Based on the reports from CoinMarketCap, Electroneum (ETN) is ranked as the 81st cryptocurrency with its MCap value as USD 59,083,355 on March 20 at 15:59 UTC for the corresponding 24h volume of $2,939,820 which is relatively lower by 9.40% from the value of $65,213,502 USD on February 20 at 11:34 UTC. The overall market has been on a downtrend with consequential highs. ETN was at its all-time high on February 25 with the value of USD 73,681,149. The increase in value did not sustain for long, and the market value reached its lowest on March 11 with its MCap value – USD 50,152,705. However, the current value shows that the market hiked 17.81% high since then. The 20-day Exponential Moving Average shows that the market is downtrend, with its values dipping from $61,474,657 USD February 28 to the current value by 3.89%. The overall market and the 20-day EMA is being pushed down by the bearish pressure.

Advertisement

CoinMarketCap has also been observing the pricing movements along with the MCap values. The present prices of USD and BTC on March 20 at 15:59 UTC are $0.006470 and 0.00000160 respectively. Stats show that the MCap and price of USD have been running parallel with the mcap value higher than the price of USD. The price of BTC has been on a complete sway with values rising and falling sequentially. The peak price of USD so far has been $0.008192 on February 25, and the lowest has been $0.005537 on March 11. The price of BTC started as high as 0.00000197 at the beginning of January and has dipped 18.78% to reach the present-day value. Both the USD pricing and the MCap values have been on a similar wave, with the same level of ups and downs. The numbers have been going downhill after the all-time high and have reached the current value. The cryptocurrency reached its milestone with the price of USD bouncing from $0.006864 on February 23 to USD 0.008192 on February 25, a 19.35% spectacular hike in 02 days.

Advertisement

The 14-day moving average shows values ascending from USD 52,849,565 on March 06 to the current value with 11.80% increase. Both the averages moving in either direction, exerts bearish pressure on the market, resulting in the market balance in favor of sellers. Hence, any investors with long term investment plans should observe the market trend before taking a step further. Traders will have to sideline to explore the market further before indulging in any investments. Once the values increase steadily, it will turn out advantageous for the traders, and they will attain more benefit from it.