DeFi vaults are the next frontier of automated asset managementDecentralized Finance (DeFi) vaults are emerging as a lucrative asset management tool for investors looking to maximize crypto market opportunities.

This DeFi niche became popular in the summer of 2020 when some pioneer protocols, including Yearn Finance, MakerDAO, and Compound, debuted automated yield-bearing products. Technically, most of the current DeFi vaults are powered by automated smart contract ecosystems and algorithms, with the main goal of optimizing returns through various strategies.

However, while DeFi vaults have been around for some time, it is worth noting that they are still undergoing constant evolution to improve and expand the range of offerings and avoid some of the pitfalls witnessed in the past.

In this article, we will delve deeper into the evolution of DeFi vaults, from the early yield optimization products by Yearn Finance, MakerDAO’s lending vaults to more recent developments by Real World Assets (RWA) DEX modules such as MANTRA Finance.

From Yield Farming to More Complex Financial Products

Similar to the life cycle of most financial products, DeFi vaults have evolved from simple yield farming vaults to feature more sophisticated multi-layered strategies.

Yearn Finance, which was among the first DeFi protocols to launch a vault, heralded the era of yield farming. The whole idea was to launch a ‘saving/investment’ avenue for crypto users that would employ a hands-off approach.

This led to the launch of Yearn’s pioneer vault. This yVault series allows DeFi users to simply deposit a token, after which the Yearn aggregator puts it to use and returns the generated yield to investors.

Around the same time, Yearn launched its yield farming vaults, MakerDAO also rolled out a lending and borrowing vault. This novel concept introduced an option for DeFi users to commit their idle digital assets as collateral and, in return, mint the DAI stablecoin. In other words, MakerDAO made it possible for investors to do what they typically do with their traditional assets: borrow a loan while retaining ownership as long as one does not default.

Advertisement

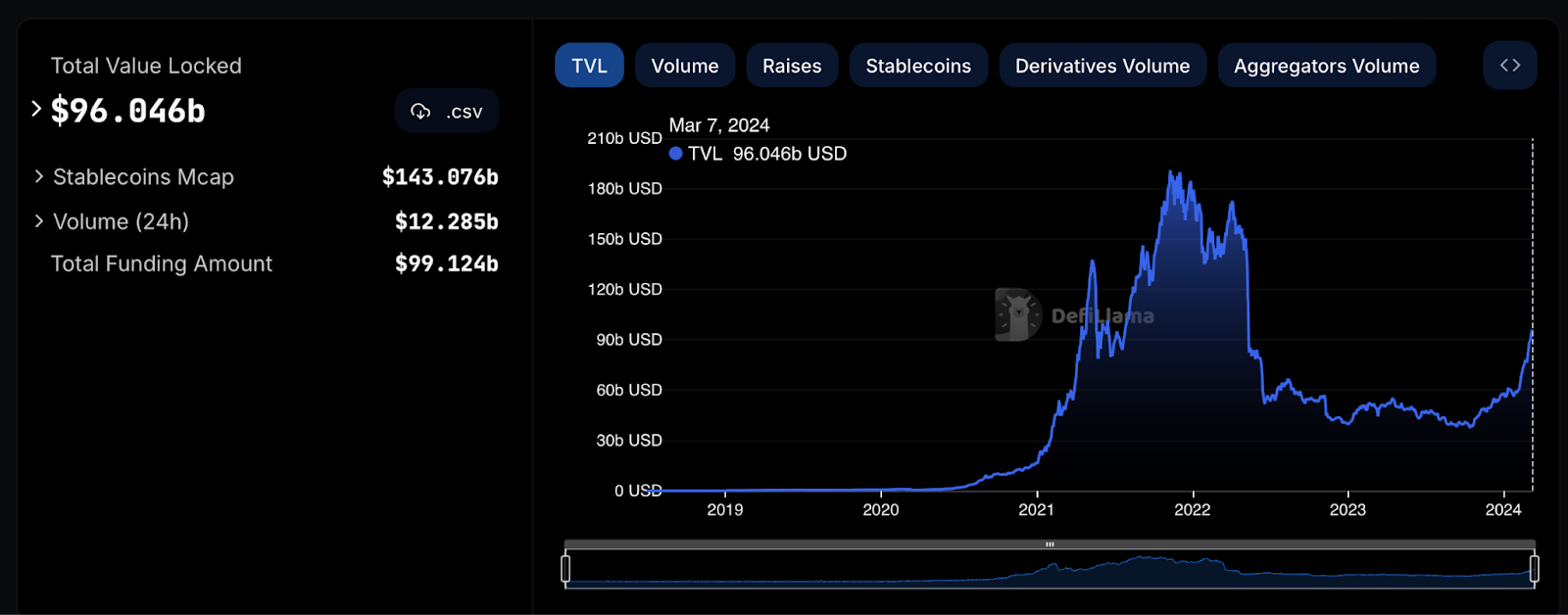

These two examples of DeFi vaults are just the tip of the iceberg. Over the years, more advanced DeFi vaults have been launched, some focusing on complex financial products such as options and undercollateralized lending. In fact, as of writing, the total value locked across all DeFi protocols is well over $96 billion, a good chunk of which is locked in DeFi-oriented vaults.

Source: DeFi Llama

Shortcomings of Early Generation DeFi Vaults

While it’s obvious that DeFi vaults have played a significant role in propelling the DeFi market to where it is today, these platforms have also faced a fair share of challenges, most notably smart contracts and volatility-related risks.

As mentioned above, DeFi lending vaults like MakerDAO require borrowers to deposit collateral. But what happens if the value of the collateral plunges abruptly? This was the case during the infamous Black Thursday in March 2020, when global market prices were nosedive amid fears of the COVID-19 outbreak. Close to $6.65 million worth of collateral was liquidated when ETH’s price fell by over 50% in a span of hours.

Meanwhile, in another more recent instance, the Yearn Finance protocol suffered an exploit where the attackers made away with around $11 million. According to a follow-up audit by crypto security firm PeckShield, the attack resulted from misconfigured yUSDT, which allowed the attackers to mint millions worth of yUSDT tokens by simply tricking the Yearn Finance protocol.

There have also been instances where DeFi vaults designed to operate based on the traditional bank model have gone bankrupt. For example, Iron Finance, which leveraged a partially collateralized stablecoin dubbed IRON to facilitate access to liquidity, went down with $2 billion worth of investors’ funds as a result of a ‘bank run.’

What is the Future of DeFi Vaults?

Evidently, DeFi vaults are not there yet. But at the same time, it is worth acknowledging the progress that has been made to alleviate some of the challenges mentioned above and, more importantly, newer innovations in this realm.

Today, DeFi vaults are looking beyond the crypto market and tapping into traditional assets through what has come to be popularly referred to as Real World Asset (RWA) tokenization. This new DeFi frontier is pioneered by Decentralized Exchange (DEX) modules like MANTRA, which is set to launch a multi-asset ecosystem that will give users access to single-asset and multi-asset vaults.

It is also intriguing to observe that 80% of MakerDAO’s fee revenue over the past year was derived from the platform’s RWA portfolio. While still a relatively new area of DeFi innovation, the fact that some of the earliest DeFi vault providers have already embraced the paradigm shift tells a lot about the potential of integrating DeFi vaults with RWAs.

Notably, crypto users are not the only ones fascinated by RWAs. Legacy financial institutions such as JP Morgan are also taking interest and predict there is still more room for expansion. That said, for DeFi vaults to shape the next frontier of digital asset adoption, much more needs to be done besides tapping into RWAs.

Advertisement

Security concerns and volatility issues caused by technical or fundamental shortcomings should also be among the major aspects that upcoming or existing DeFi vaults ought to pay attention to in order for them to define the next era of automated asset management.

Disclaimer: This article is sponsored content and is not financial advice. CryptoNewsZ does not endorse or guarantee the accuracy of the content. Readers should verify information independently and exercise caution when dealing with any mentioned company. Investing in cryptocurrencies is risky, and seeking advice from a qualified professional is recommended.