Bitcoin spot ETFs, in a striking show of investor confidence, have accounted for A remarkable daily net inflow of $402.8 million, solidifying Bitcoin dominant possession in the Crypto ETF race. However, as observed previously, the Ethereum ETF has experienced an outflow worth $19.16 million, upholding the growing divide in investor sentiment between the two index funds.

The BTC ETF Saga

According to data presented by SoSoValue, the total net inflow for Bitcoin has reached an astonishing $21.93 billion as of October 25th. Leading the way, Blackrock’s IBIT ETF attracted a whopping $291.96 million, while Fidelity’s FBTC brought in an additional $56.95 million.

This clearly indicates that institutional interest in Bitcoin is not diminishing; on the contrary, it seems to be increasing as the market rallies around the hope for more spot BTC ETFs to be released.

Advertisement

The likely cause for the rapid interest BTC ETFs are enjoying can be indebted to institutions viewing Bitcoin as a secure and reliable entry point into the Crypto market, especially since an ETF offers a simpler way to invest than directly holding Bitcoin.

Further, Bitcoin’s recent increase in price in the last 30 days and the upcoming anticipation regarding the US presidential elections have investors’ hopes up for further increases in the asset’s price.

The ETH ETF Saga

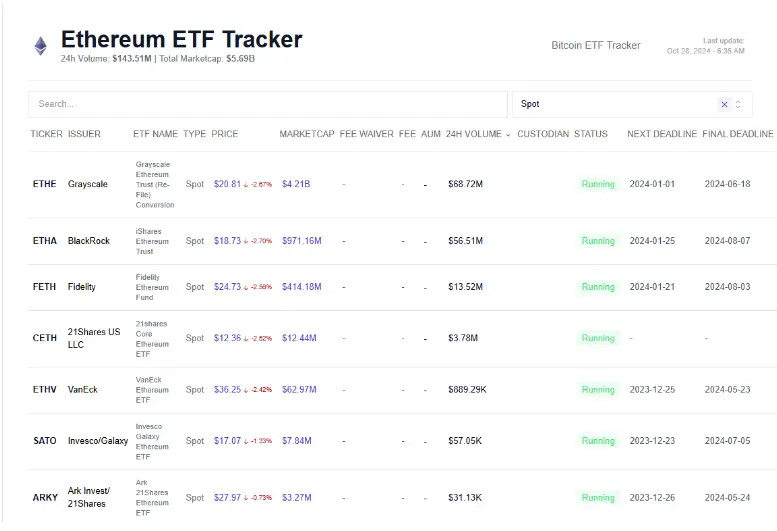

However, the spot ETFs of Ethereum tell a different story! Grayscale’s ETHE is the largest spot ETF for Ethereum, experiencing a daily net outflow of $19.6 million, bringing the cumulative total outflow to a colossal $504.44 million. Meanwhile, other prominent Ethereum ETFs, such as Blackrock’s ETHA, Fidelity’s FETH, and Bitwise’s ETHW, did not see any new inflow on October 25th.

The lack of inflows, along with Grayscale’s enormous outflow, highlights general disinterest in the cryptocurrency’s demand. Despite Ethereum’s strides with its upcoming Pectra upgrade and innovation, it appears that institutional investors aren’t showing the same level of excitement as they are with Bitcoin.

Advertisement

Also Read: Investors’ 5 Secret Weapons to Use Before Applying Any Crypto Presale