As of August 2024, US Bitcoin spot ETFs have witnessed a total net inflow of $64.9072 Million, & ETH ETF saw $874k outflows.

The US Bitcoin spot ETFs’ net inflow of $64.9072 Million continues a net inflow for six consecutive days. Among the key players, Grayscale ETF GBTC had an outflow of $28.362 Million, BlackRock ETF IBIT had an inflow of $75.4907 Million, and Fidelity ETF FBTC had an inflow of $9.2252 Million. Currently, the total net asset value of Bitcoin spot ETFs is $55.131 Billion.

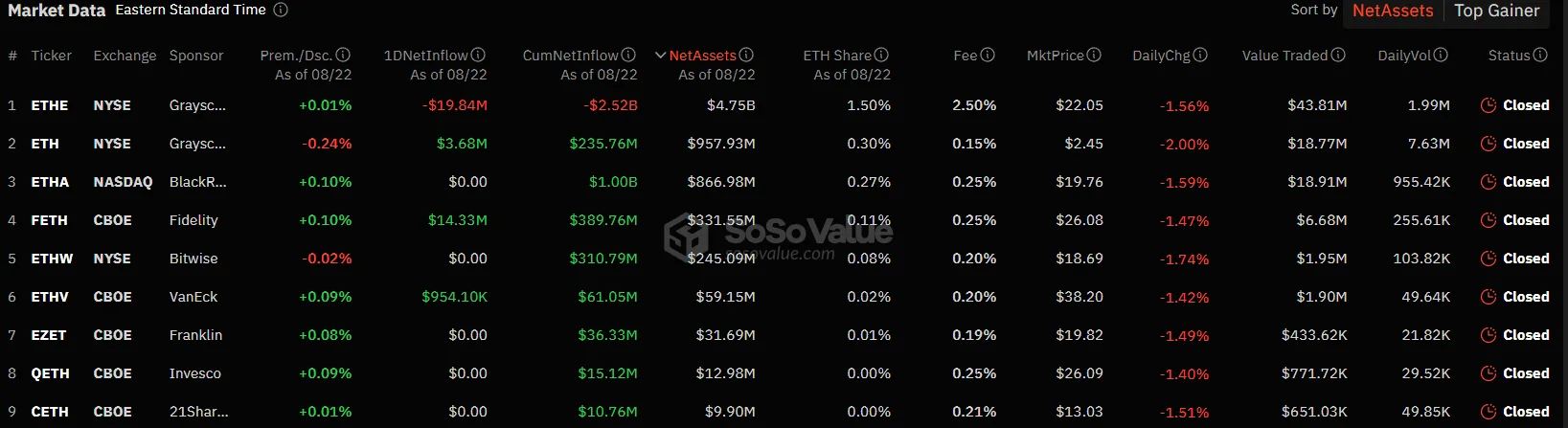

Ethereum spot ETF had a total net outflow of $874,600 on August 22 and continued to have net outflows for 6 days. Grayscale ETF ETHE had an outflow of $19.8427 Million. Grayscale mini ETF ETH had an inflow of $3.6837 Million. Grayscale’s ETF is expected to reach 50% by October. and Fidelity ETF FETH had an inflow of $14.3303 Million. The total net asset value of Ethereum spot ETF is $7.265 Billion.

Advertisement

When it comes to clashes between the titans, BlackRock has more crypto holdings than Grayscale.$61,017.21.

BLACKROCK NOW HAS MORE CRYPTO THAN GRAYSCALE

Blackrock has now overtaken Grayscale in total on-chain holdings. This makes Blackrock the largest ETF-related entity on Arkham.

Blackrock: $22,143,715,559

Grayscale: $21,996,062,828 pic.twitter.com/YrPZdrMObk— Arkham (@ArkhamIntel) August 22, 2024

At the time of writing, bitcoin is trading at $61,012.04 after witnessing a jump of 0.4% in the past day. The rise can also be attributed to investors highly anticipating FED chair Powell’s speech on Friday. Meanwhile, Ethereum is trading at $2,673.30 and also saw a surge of 1.95% in the past day.

Advertisement

Also Read: Q2 2024: $4.7B Institutional Investment in Spot Bitcoin ETF