In a groundbreaking development, BNY Mellon, the world’s largest custodial bank, has secured approval from the U.S. Securities and Exchange Commission (SEC) to offer Bitcoin custody and institutional crypto services. This landmark decision paves the way for widespread adoption of tokenization, with Ripple’s XRP token poised to play a pivotal role.

🚨 BNY Mellon, the first U.S. custody bank, got the green light from the SEC for #Bitcoin custody and institutional crypto services.

This Bank also holds #XRP!

SO IT BEGINS… pic.twitter.com/gPPjVwCgZD— JackTheRippler ©️ (@RippleXrpie) September 23, 2024

Ripple Connection: Strategic Partnership

A recent study conducted by BNY Mellon revealed that 97% of institutional asset managers believe tokenization will revolutionize the asset management industry. Notably, 100% managers with over $1 trillion in assets expressed interest in this space, underscoring the immense potential for growth.

BNY Mellon’s entry into crypto and tokenization is closely related to Ripple. The bank’s head of digital asset product has departed to join Ripple, signaling a strategic partnership that will drive innovation and adoption.

Implication for XRP

Advertisement

This partnership is expected to unlock new cases for XRP, solidifying its position as a leading token in the cryptocurrency market. XRP’s liquidity, scalability, and security make it an attractive choice for transacting tokenized assets.

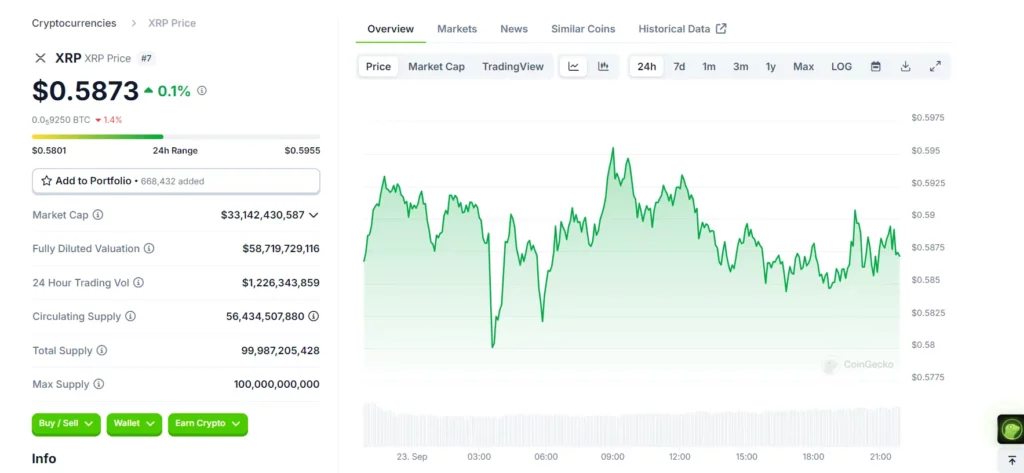

XRP prices are expected to surge following the news as investors anticipate increased adoption and demand. At press time, the price of XRP is at $0.5873 with a surge of 0.1% in the last 24 hours as per CoinGecko.

As BNY Mellon and XRP continue to drive innovation, the tokenization market is expected to experience exponential growth. With XRP at the forefront, this partnership will have far-fetched implications for the crypto market.

Advertisement

Also Read: Ripple Chartist Sees 300% XRP Rally; RCO Finance Presale Token Follows