The cryptocurrency market has emerged as a significant focus of the 2024 presidential race, as the Trump campaign stance on digital assets generates considerable attention for investors and industry stakeholders. While the cryptocurrency sector is relatively small in terms of its number of participants, it has exhibited an unprecedented degree of financial influence and political organization during this election cycle.

Donald Trump’s policies, which range from making the US a world crypto hub to reforming regulatory oversight, appeal to the digital asset community. His declared intentions to change the landscape and confirms to bring crypto stricter, particularly regarding the way the SEC views cryptocurrency. This suggests significant changes at the federal government level, as well as a broader regulatory approach to digital assets.

Trump’s Stance on Cryptocurrency and Financial Regulations

Donald Trump’s stance on Bitcoin and other cryptocurrencies has undergone a complete 18–degree turn, transitioning from skepticism in the early stages to becoming one of the most vocal advocates for crypto and decentralized finance. In his presidential speech, he added, “I will ensure that the future of crypto and bitcoin will be made in the USA, not driven overseas. I will support the right to self-custody for the nation’s 50 million crypto holders.”

During his speech at Nashville’s Bitcoin 2024 conference, Trump highlighted several pro-crypto policies, such as the creation of a “strategic national Bitcoin stockpile” and the appointment of a “Bitcoin and crypto presidential advisory council” comprised of industry supporters.

Trump’s regulatory philosophy supports market freedom and minimizes state control, as evidenced thus far. In his stance on crypto at a traditional campaign event in St. Cloud, Minnesota, he added, “If crypto is going to define the future, I want it to be mined, minted, and made in the USA.”

Advertisement

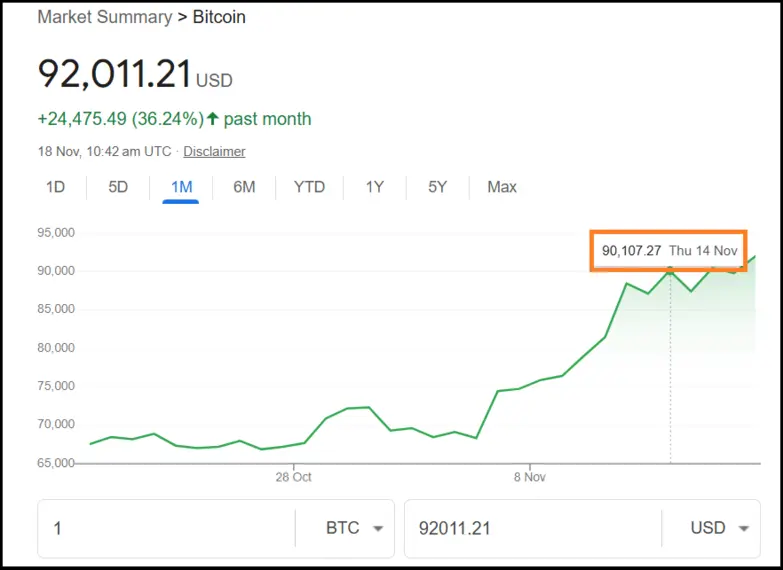

Following Donald Trump’s victory in the elections, Bitcoin has seen a spectacular climb, touching an all-new record high from its previous numbers. Riding on the wave of optimism from investors that see President-elect Donald Trump’s win as a booster dose for the crypto market, Bitcoin has touched a new record high. The cryptocurrency held most of its gains, and the bitcoin value rose to 90,107.27 USD as of November 14.

In addition, this rally has been observed in other cryptocurrencies as well. Ethereum was no exception, having caught the breeze. A promise to make the United States the “crypto capital of the planet” seemed really appealing to investors and industry stakeholders, implying a significant shift in regulatory approach under Trump’s administration.

Expected Changes in Cryptocurrency Tax Policies

Trump’s friendly commitments towards Bitcoin and cryptocurrency indicate a potential shift in the crypto tax rate and policies related to these digital assets. If elected, Trump pledged to “stop Joe Biden’s crusade to crush crypto” and ensure that under his administration, the USA will hold 100% of bitcoin it currently holds or acquires in the future. He also added that he will ensure a conducive crypto tax in the USA for crypto investors and businesses.

The new tax structure could be conceived as a simplified reporting mechanism for tax on crypto gains and losses instead of the convoluted reporting structures currently in place. The new system aims to promote voluntary compliance and essential transparency in cryptocurrency transactions.

Trump revealed that if BTC is mined and minted in the USA, it may indicate crypto tax brackets, possibly in the form of lowered capital gains rates on assets held for the long term by the crypto holders.

Talk of a “strategic national bitcoin stockpile” and Trump’s commitment to self-custody rights may result in regulations that reward patient investors while also promoting market stability. These new policies appear to be based on the same broad promise he made to encourage industrial growth and establish the United States as a global crypto leader.

Conclusion

Advertisement

When discussing Trump’s cryptocurrency policies, it is clear that transparent crypto tax laws, crypto security best practices, and regulatory frameworks are excellent building blocks for a trading environment that people will trust. While deregulation might stimulate growth in the market, strong security procedures and compliance mechanisms must remain in place to nurture the development of a sustainable industry.

The policy change has the potential to propel the United States to the forefront of cryptocurrency innovation, but it must be balanced with universally accepted security protocols and regulations that safeguard investors and prevent market manipulation. The proposed crypto advisory council might play a significant role in developing such standards while encouraging growth in the global digital asset markets.