The crypto market has been on a wild ride this past week, with Bitcoin plummeting to its lowest value since late February, dipping to $53,550. This represents a stark 13% drop from its weekly opening price of $61,96K.

The downturn coincides with broader market anxieties, particularly regarding sharp Bitcoin sales by the German government and the impending repayments to Mt. Gox creditors. So far, the German government has moved more than 26,200 BTC, valued at $1.5 billion at current prices, to various exchanges and market makers.

According to data from Arkham Intelligence, at the time of writing, it still retains 22,846 BTC, worth approximately $1.31 billion. Adding to the market’s concerns is the potential release of $9 billion in Bitcoin as the defunct Japanese crypto exchange Mt. Gox prepares to reimburse creditors from the infamous 2014 hack.

However, some analysts argue that the fears surrounding the Mt. Gox Bitcoin sales might be exaggerated. Santiment, for instance, suggests that the prevailing fear of sharp Bitcoin sell-offs, stoking the bearish sentiments, might paradoxically set the stage for a surprising price rebound.

😒 Bitcoin sentiment among traders on X, Reddit, Telegram, 4Chan, and BitcoinTalk are showing the most bearish narratives this week in a year. When the crowd shows FUD at this level, the chances of a rebound to catch the majority off guard is at its peak. pic.twitter.com/JLOhNB77n7

— Santiment (@santimentfeed) July 9, 2024

The analytics firm further points out that heightened fear, uncertainty, and doubt (FUD) often precede such reversals, hinting at a possible upswing when least expected.

Possible Bitcoin Recovery

Advertisement

Following the market’s recovery from the $53K zone, the price of BTC has stabilized around the $57.3K mark, indicating a 2% gain compared to the previous day. Moreover, its market cap has seen a similar uptick, now at $1.130 trillion.

This recent surge in Bitcoin prices is driven by a remarkable increase in US-based spot Bitcoin ETFs, which saw $295 million in net inflows on July 8. This marks a positive shift after three weeks of outflows.

Leading the charge, BlackRock’s iShares Bitcoin Trust ETF recorded a $187.2 million inflow, closely followed by Fidelity’s Wise Origin Bitcoin Fund with $61.5 million.

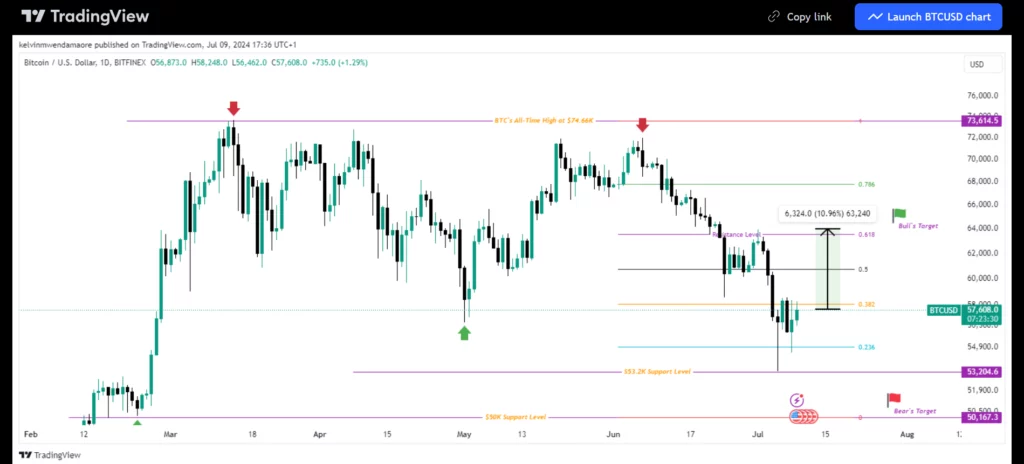

Should this market optimism continue, the BTC token is anticipated to surge in price toward the $64K mark last seen on June 23, marking a 10.96% increase from its current levels.

However, should the FUD take control of the market, BTC prices could retest the $50K mark, a critical support that has held Bitcoin’s price above since late February.

Advertisement

From a technical perspective, the RSI paints an exciting picture as it ascends above the signal line. Positioned at 37.35, the RSI hints at building bullish momentum in the short term that may propel BTC prices to a higher level. Similarly, the CMF index is edging toward the zero mark, signaling an increasing flow of capital into Bitcoin’s domain.

Also Read: Australia’s ASX Approves its Second Spot Bitcoin ETF