In the conventional finance system, the users are bereft of any option to generate interest in the cryptocurrencies sitting stationary in a digital wallet. Owing to aggrandizement in decentralized finance (DeFi), the mechanism of lending and borrowing crypto assets to earn interest is becoming a new normal in the life of crypto investors.

| Very Good Reputation | Visit Website | |

| Very Good Reputation | Visit Website | |

| Very Good Reputation | Visit Website |

Even though being a highly unpredictable commodity, cryptocurrency has turned the world upside down with incredible benefits in a short time. Until now, there was a lack of a decentralized system of finance that could ease the process of monetizing the assets of Cryptography. Compound fills the gap that has recently stepped up as the biggest lending protocol in decentralized finance.

Compound Finance Summary

| Official Website | https://compound.finance/ |

| Headquarters | San Francisco, California |

| Found in | 2018 |

| Native Token | Yes |

| Listed Cryptocurrencies | ETH, WBTC, DAI, USDC, ZRX, USDT, BAT, USDC, LINK, TUSD, UNI |

| Supported Fiat Currencies | USD |

| Minimum Deposit | N/A |

| Deposit Fees | Depends on Cryptocurrency |

| Trading Pairs | N/A |

| Trading Fees | N/A |

| Withdrawal Limit | No |

| Withdrawal Fees | Depends on Cryptocurrency |

| APY | Varies for different Cryptos |

| App | Yes |

| Customer Support | Public Forum & Feedback Options Support |

The Compound was founded in 2018 and has its headquarters in San Francisco, California. It is a mechanical money market protocol that lets users deposit cryptocurrencies and harvest interest or borrow other crypto assets against them. The approach to borrow and lend crypto assets with Compound has been made frictionless and easily accessible to everyone all over the world.

Although, read this Compound Finance review and know all the details of this lending platform.

What is Compound Finance?

To bring revolutionary enhancements in the crypto market, Compound Finance was effectuated by a Californian company Compound Labs Inc. in 2018 with a primary aim of using unoccupied crypto locked in digital wallets to earn unbelievable profits and get a regular passive income.

It is a decentralized cryptocurrency lending platform based completely on Ethereum blockchain protocols. The Platform holds the supported assets count of 11,544,302,975, reaping interests in 18 markets.

In the beginning, Compound was centralized but later grew out of its image after the latest issuance of its native governance token, COMP, marking the commencing step to transform Compound into a community-governed decentralized autonomous organization (DAO).

By using Compound Protocol, customers can lend or borrow at the same time around 12 Ethereum based assets like BAT, ZRX, and WBTC and reap huge benefits from it, negating any official nuisance. The platform launched an advanced crypto-economy known as Yield Farming, recently enhancing the borrowing power of users.

It facilitates users in lending and borrowing crypto assets without the insipid interference of any broker/middleman. The process is beneficial to both lenders and borrowers as each side gets higher profits from their crypto. Lenders can earn interest on their crypto assets; meanwhile, the same crypto-assets can be utilized by the borrowers to gain credit without facing the inconvenience of going to the bank.

By using Compound, the user is emancipated from facing lengthy documentation processes like No Know Your Customer (KYC), Anti Money Laundering (AML), or credit record because no such verification assessments are required to use it. The platform users not only have the potential to procure high-interest rates but are also remunerated with COMP tokens for borrowing or lending crypto assets.

How Does Compound Finance Work?

Compound Finance is the best crypto lending platform that has quite a unique working methodology where being a lender doesn’t mean lending money straight to a borrower but lending assets to a “Liquidity Pool” that may be used by the borrowers to borrow assets from.

The Liquidity Pool is based on a chain of Compound’s smart contracts. A smart contract is an automatic contract containing the conditions of the buyer-seller agreement in the form of digital algorithms that are used to execute an agreement without the involvement of any intermediary. This system is preprogrammed to engage a borrower to preferable cryptocurrency.

As per Compound review, the platform’s smart contracts setup comes in handy for other purposes like to carry out the process of paying interest from borrower to lender automatically and deciding the interest rates with the help of computerized algorithms that calculate supply and demand conditions of Compound Finance protocol at a particular time.

The Compound’s smart contracts generate interest rates in a wholly automated way and follow the rule of thumb, meaning the greater demand for an underlying asset would automatically result in inflated interest rates for both lenders as well as borrowers.

This fluctuation in interest rates as per the demand & supply of assets incentivizes the lenders to lend more meanwhile demotivates the borrowers from over-borrowing. Liquidation of collateral may happen if, due to price drop, a user borrows more than the permitted value. There is no time limit when it comes to Compound. The users have the liberty to relinquish or reimburse their collateral whenever they wish.

Key Features of Compound

- The main feature of Compound Finance is that it gives the user a platform to monetize the cryptocurrency lying dormant in crypto wallets/accounts. The users can lend their assets to a Liquidity Pool which in turn is utilized by the borrowers. Also, it provides the borrowers a hassle-free way to gain access to credit without facing the inconvenience of going to the bank.

- Based on Compound review, a unique feature of the platform is that by using smart contracts algorithmically calculated interest rates, the system provides a frictionless and easily manageable platform eliminating unnecessary nuisances one may face in a traditional finance banking system.

- Another exclusive feature of Compound is that to ensure increased participation of lenders and borrowers with the platform, it rewards both lenders and borrowers with COMP tokens. This system’s primary reason is to keep the customer base stable and keep lenders and borrowers engaged with the Compound protocol with amplified enthusiasm.

- Yield farming is another feature of Compound that helps users to maximize their return in COMP tokens by participating in the platform’s ecosystem as both a lender and borrower. This feature can only be accessed with the help of a platform known as InstaDapp that lets a user interact with numerous DeFi platforms from a single reference point.

- It offers a user over 18 markets to lend or borrow cryptocurrencies from. The Gateway and Treasury products offered by the platform help customers by providing premium cash management tools. This leads to simplification in accessing the crypto interest rates, excluding mechanical complexities like cybersecurity, interest rate volatility, and compliance.

Compound Finance Review: Pros and Cons

| Pros | Cons |

| Higher Interest rates in comparison with traditional banking. | Liquidation of collateral due to the unpredictability of Cryptocurrencies sometimes gives a huge setback to users. |

| No KYC, AML, or Credit Score required to use the Platform gives the users a liberating experience. | A highly Volatile algorithm-based smart contract system leads to technical errors in the DeFi system. |

| One of the older and trusted in DeFi space. | There are limited numbers of cryptocurrencies for the users to lend or borrow from. |

| Users are rewarded by the Compound’s native tokens: COMP. It is used as a governance token and profitable asset. | Yield Farming can be extremely risky as the users can trade crypto much larger than the actual value they have put down. |

| No constraint on usage of asset pool multiple times. | |

| The Compound is a Decentralized Autonomous Organization that is governed by Community. |

Registration Process of Compound Finance

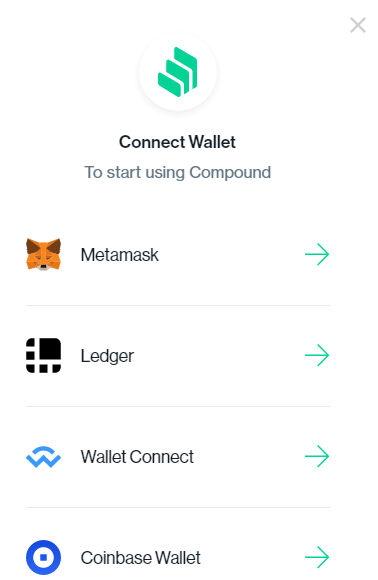

As per our Compound Finance review, the platform offers the user four wallet options using which one can gain access to the Compound application. First, the user has to attach the Compound to any of the four wallets. After completing the connection process, one will reach the landing page that will be divided into three segments:-

- Supply market section: Left side.

- Borrow market section: Right-hand side.

- Supply balance/Borrow balance section: Topside.

- In the far upper corner, one gets a dashboard icon to manage lending/borrowing, and beside it, a vote icon is given to participate in the governance of the Compound.

After completing the registration procedure, one can start lending or lending and borrowing simultaneously as only borrowing is not permitted until there is some balance added to the platform to evaluate the borrowing limit of the customer.

Advertisement

As a transaction completes, the user will get the supply balance on the right-hand side of the dashboard, thereby initiating the earning of interest.

COMP Token Details

The COMP token is an ERC-20 asset that authorizes the governance of the Compound’s protocol. To incentivize users’ engagement with the platform and decentralize the governance process, in 2020, Compound Finance launched the COMP token as its native cryptocurrency.

There are various methods to procure COMP tokens; they can be purchased via an exchange or earned by lending or borrowing on the Compound protocol.

The Users who choose to lend and borrow digital assets are rewarded with a portion of the daily minted COMP token distributed proportionally to them based on the amount invested in the assets and interest rates at the point of time. One can also buy COMP on about a dozen exchanges like Coinbase Pro, Binance, and Poloniex by the process of liquidation.

As already mentioned, Compound is a decentralized protocol that keepers of the native COMP token govern. COMP token holders have special privileges in voting, directing, deciding interest rates, and developing additional protocols. This system helps in keeping the platform uniformly decentralized.

What Cryptocurrencies Does Compound Support?

Following assets are supported by Compound V2:-

- Ether (ETH)

- Wrapped Bitcoin (WBTC)

- Dai (DAI)

- Coinbase’s US Dollar Coin (USDC)

- 0x Token (ZRX)

- Tether (USDT)

- Basic Attention Token (BAT)

- USD coin (USDC)

- Chain link Token (LINK)

- TrueUSD (TUSD)

- Uniswap (UNI)

What Is the Compound Finance Blockchain Lending Interest Rate?

Here is a list of Compound Finance blockchain lending interest rate:-

| Asset | Lending Rate (30d Avg) |

|---|---|

| BAT | 1.21% |

| COMP | 0.99% |

| DAI | 2.18% |

| ETH | 0.17% |

| LINK | 0.89% |

| TUSD | 2.29% |

| UNI | 0.38% |

| USDC | 1.63% |

| USDT | 1.58% |

| WBTC | 0.54% |

| ZRX | 0.84% |

Compound App

Some of the benefits of using the Compound app are:-

- The registration process can be easily handled on the app.

- Users can choose any one digital wallet to go with out of four options available on the app.

- Lending and borrowing have never been easier than they can be on the app.

- Loan management also becomes easier and simplified.

- Repayment of due is also an additional feature one gets by using the app.

Compound Finance Loan

To borrow an asset directly from the platform, one would need another supported asset to be presented as collateral. The collateral would be evaluated to determine the maximum limit of an asset a user can borrow. The next step is to get a cryptocurrency loan from Compound protocol is to enter the market specific to the asset deemed as collateral.

Using automated algorithms embedded in the contract, an authentic median price would be calculated by comparing multiple highly volatile exchanges. cToken contract determines the sum of a customer’s present borrowings in addition to the interest levied on it. To know the current interest rate of the borrowed asset, one would have to add the borrowing rate to the account’s borrow balance. Know more about other crypto lending platforms which offer BTC loans as well.

If, in any circumstance, the user borrows over his allowed limit, the account would be deemed insolvent. This process is known as liquidation, and one should abstain from committing such mistakes to avoid unnecessary losses.

To know about Compound Finance pricing details click here.

The Compound Roadmap

Dissimilar to other cryptocurrency initiatives, Compound doesn’t have a roadmap in actual terms. As indicated by the CEO of Compound Labs Inc., Robert Leshner, it was designed as an experiment to overcome the shortcomings of the fiat money market. Its Community will determine the future aspects of Compound.

Also, more assets will be added to it with the passing time. A general idea of the roadmap can be taken from a post that stated three goals expected to be achieved by the Compound, namely:-

- Facilitating multiple asset DeFi systems

- Encouraging each asset to have its collateral factor.

- Achieving the status of smoothly operated Decentralized Autonomous Organization.

Date Wise Roadmap of the Compound

- Compound was launched on the internet: September 2018

- v2 was released: May 2019

- Reduction in administrative privileges: October 2019

- Community governance initiative was undertaken: April 2020

- Token distribution was commenced: June 2020

Compound Customer Support

No Compound review is complete without the platform’s customer support details. The site is operated by the community members and the users themselves by direct participation through a public forum dedicated solely for customer interaction.

If the users face a problem with the handling of work, they can open a new topic in the site feedback category where the discussion will take place. Any critical or urgent issue can be resolved by contacting the administration of Compound Finance through the staff page.

Compound Finance Review: Conclusion

With smart contracts systems, Compound has become a key player in revolutionizing the outdated finance system. It is one of the smooth, highly secure, and easily accessible DeFi protocols out there. Although highly reputed, the smart contract system is a little too volatile, so the risks must be kept in mind while investing in the platform. The limited number of assets available on it may increase with time.

Compound Finance is one of the oldest and tested lending and borrowing platforms in the ecosystem of Decentralized Finance.

The top priority goals of the organization are:-

- To achieve the status of being a fully decentralized system.

- To transfer authority of the fundamental protocol to the Decentralized Autonomous Organization governed by Compound’s community.

One can call it the start of a new era of finance where Compound and other platforms like it are in reality the starting steps on a long journey to a world where finance is completely decentralized and secure with a high level of transparency coming in hands with upgraded privacy meanwhile being available virtually to everyone worldwide.

FAQs

Is Compound Finance Legit?

Advertisement

Compound Finance has proven its authenticity by giving open access to its contract protocol to third-party auditors and consultants. These consultants invest considerable efforts to create a safe and reliable protocol. Also, all contract codes and balances are publicly accessible and verifiable, making Compound Finance safe and legit.

What Does Compound Finance Do?

Compound Finance facilitates users in lending and borrowing crypto assets without insipid interference of any broker/middleman. The process is beneficial to both lenders and borrowers as each side gets higher profits from their crypto. Lenders can earn interest on their crypto assets. Meanwhile, the borrowers can utilize the same crypto-assets to gain access to credit without facing the inconvenience of going to the bank.

How Does Compound Finance Make Money?

Compound Finance lets a user lend and borrow cryptocurrencies abstracting any broker/middleman. Both sides get a higher value for their initial crypto holdings. The lenders get a return on investment, and borrowers get hassle-free access to credit without approaching the bank.

Is Compound Finance Safe?

Since its inception, Compound smart contracts have not faced any security threat to date. The platform has withstood various security audits done by renowned firms like Open Zeppelin and Trail of Bits in a publicly exposed way.

Also, the users get insurance covers from products like Nexus Mutual and Opyn. As one can see, numerous products are relying on Compound smart contracts for security, so the conclusion is that it is a reliable, tested and trusted lending and borrowing platform.