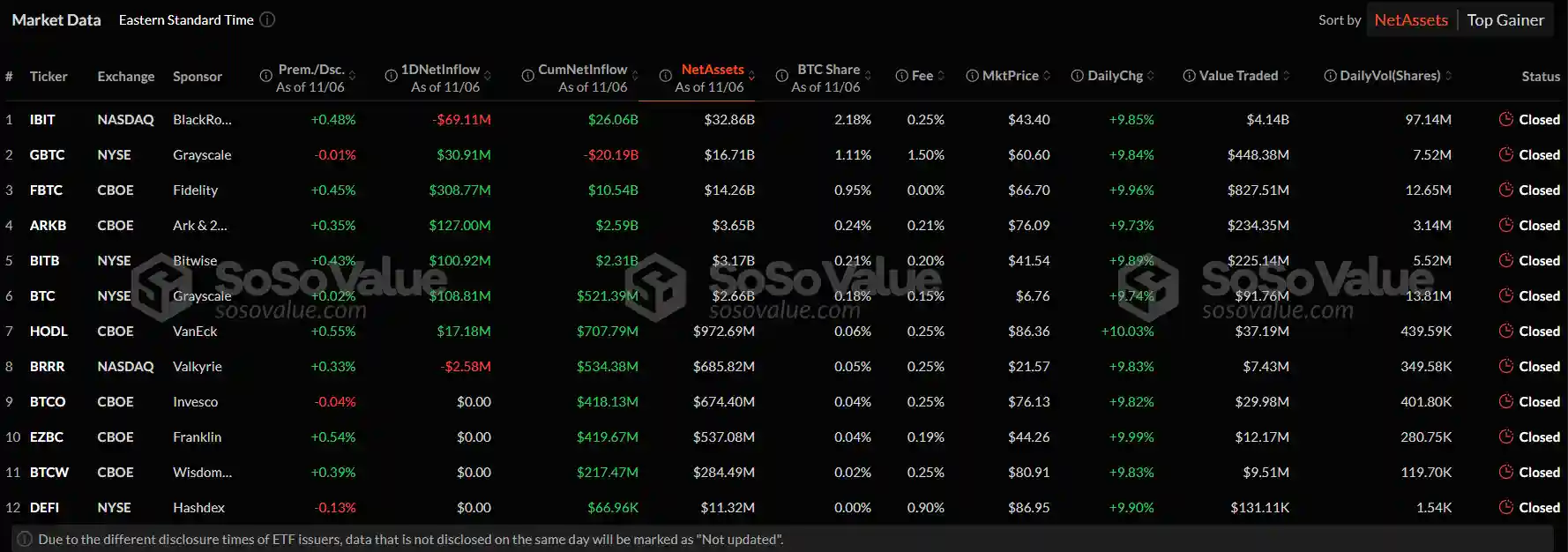

As of November 6th, Bitcoin ETFs recorded a cumulative net inflow of $24.12 billion, as Donald Trump won the US Presidential election a second time, and Ethereum ETFs, too saw $52.29M in daily net inflow (total). This is a pivotal achievement for the crypto market, as this growth indicates that investors’ confidence is rising as more institutions get involved with Bitcoin-related products.

BlackRock Records Outflows:

One of the top asset managers, Blackrock has seen significant activity in its iShares Bitcoin Trust or IBIT with daily net outflows worth $69.11 million, bringing its net cumulative inflow to nearly $20.06 billion. Despite this outflow, the overall asset under management for Blackrock’s Bitcoin ETF remains high showing that the market still has interest in its financial product. As of November 6, Blackrock announced a trading volume of $4.10 billion which reinforces its status as a leading player in the Bitcoin ETF sector.

Fidelity and Grayscale Show Strong Performance:

FBTC, Fidelity’s Bitcoin ETF, has seen $308.77 million inflows. This positions Fidelity as a well-regarded asset manager, drawing more investors to its crypto-related products. At the same time, Grayscale’s Bitcoin Trust GBTC brought in $30.91 million, while Grayscale’s Bitcoin Cash Trust (BTC) added $108.81 million.

Bitwise and ARK Account Gains:

Advertisement

Likewise, Bitwise and ARK Invest have also seen impressive gains, bringing an inflow of $100.92 million and $127 million, respectively. Both firms seem to be well-positioned and are enjoying investors’ attention.

VanEck and Invesco Also Account Inflows:

VanEck’s HODL ETF attracted an extra $17.18 million, revealing the asset manager’s presence in the digital asset domain. Meanwhile, Invesco’s BTCO ETF did not see any net inflow on November 6, but it remains a favorite option for investors looking for stable long-term exposure to Bitcoin.

Ethereum ETF Records Highest One-Day Inflow:

Ethereum ETFs are saying notable investor interest with a daily net inflow of $52.29 million recorded as of November 6th this influx has boosted total net assets in Ethereum spot ETFs to $7.42 billion, signaling a strong market fervor for Ethereum ETF products. Grayscale’s ETHE, a major player in the Ethereum ETF market saw its market price reach $22.69, marking an impressive daily inflow of 11.17%, which has drawn more attention from investors. In addition, Fidelity’s FETH ETF experienced a substantial gain of $26.9 million. Other asset managers like Blackrock and Bitwise also accounted for significant inflows with Ethereum prices hovering around $2721.87.

Also Read: BlackRock Bitcoin ETF Clocks $1.4B Volume in Just 30 Mins!

Advertisement