Bitcoin, the OG cryptocurrency is trading above $59,000 and is also showing signs of recovery as the S&P 500 pauses due to Labor Day in the United States.

According to crypto analysis tool Santiment, “Signs of growth in cryptocurrencies that do not rely on stocks indicate that the crypto industry is strong.” As a result, the inherent strength, along with traders’ growing bearish sentiment and FUD sentiment, signs that a rebound is nearing.

📊 Bitcoin has shown signs of life as the S&P 500 is paused for Labor Day. Signs of crypto growth without reliance on equities is a promising hint of the sector’s strength. Combined with growing trader bearishness and FUD, there are promising signs an upcoming rebound is near. pic.twitter.com/d3ykTTSHY0

— Santiment (@santimentfeed) September 2, 2024

Santiment also pointed out in a chart, that around August 4, crowd was the most polarized and dip buyers were vindicated and now it is the first time since mid-July that crypto investors are bearish toward July that increases the chances of a price rise.

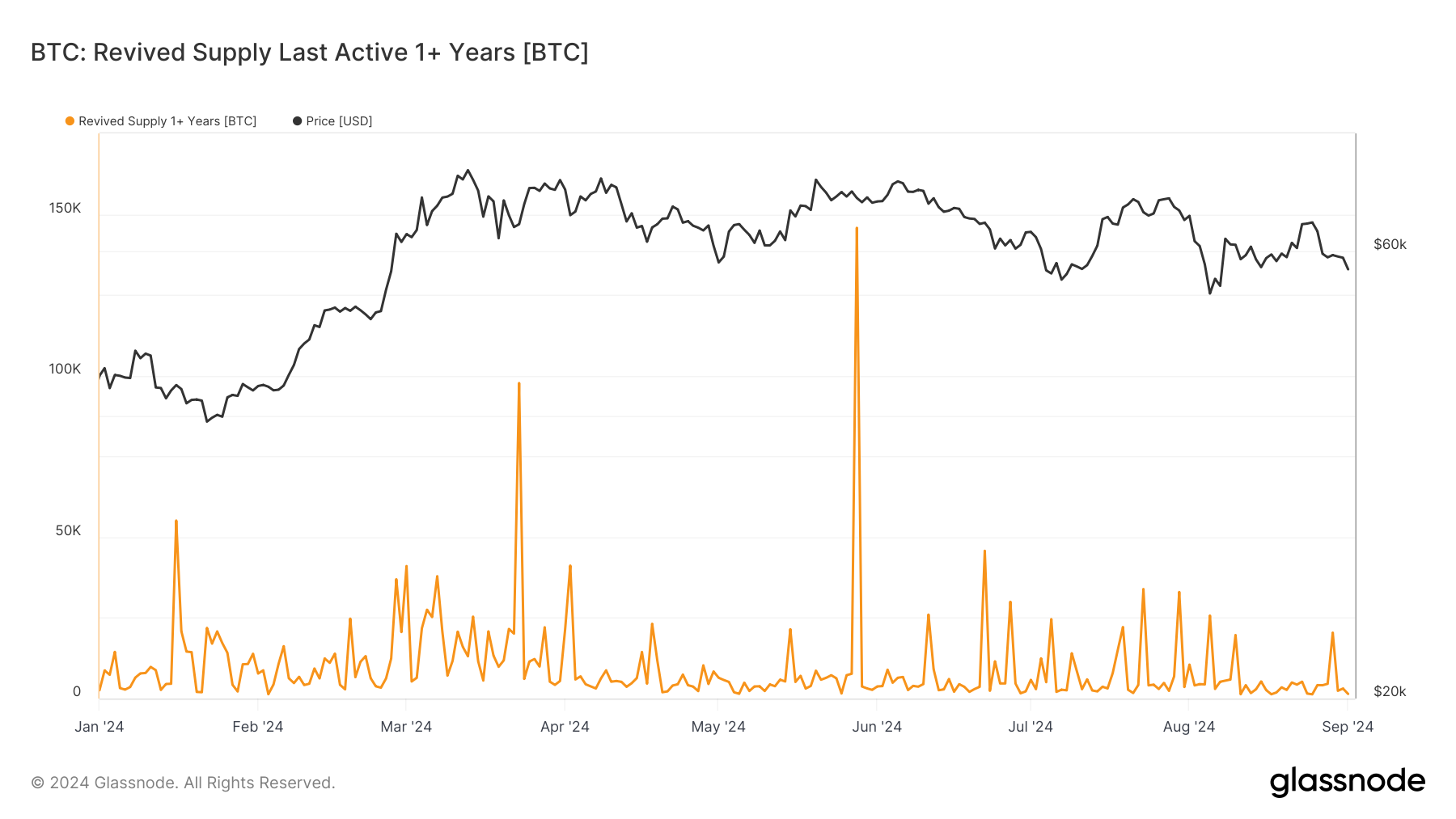

Bitcoin is currently trading at $59,097.73, after witnessing a jump of 3.1%. Apart from market trends, Bitcoin’s revived supply, which tracks the reactivation of coins that are inactive for over a year, has displayed notable fluctuations in 2024.

It showed that around April-June there were periodic spikes and long-term holders wanted to make most of the opportunities presented by market rallies, but at present, many long term holders are clinging on to their bitcoins, which shows that holders have more confidence in holding BTC as it matures as an asset.

However, emphasizing on why crossing $61k mark is crucial for Bitcoin, Market analyst Michael van de Poppe recently added “You’d really need to get a breakout above $61K to get the momentum back in the markets, otherwise, we continue to have this downward trend for a while.”

Also Read: A Whale Withdraws 1,000 BTC Worth $574 Million From Binance